Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) The Beck, De Jonghe and Schepens (2013) (BJS hereafter) paper investigates the link between bank financial soundness and market power among other things.

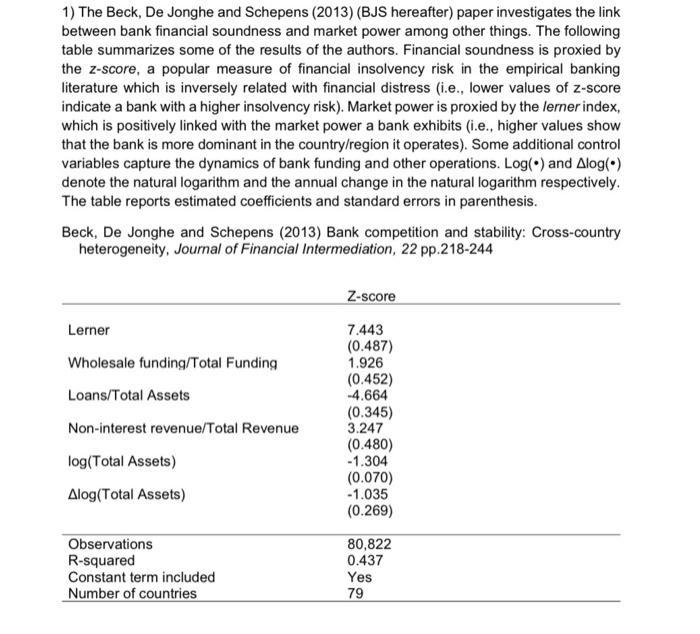

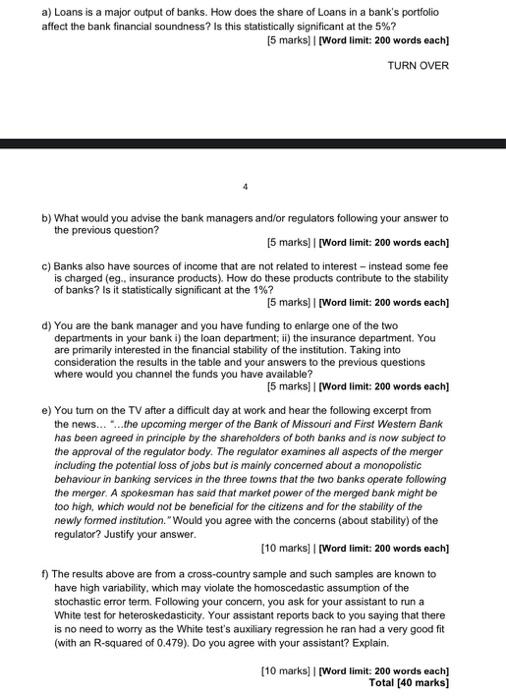

1) The Beck, De Jonghe and Schepens (2013) (BJS hereafter) paper investigates the link between bank financial soundness and market power among other things. The following table summarizes some of the results of the authors. Financial soundness is proxied by the z-score, a popular measure of financial insolvency risk in the empirical banking literature which is inversely related with financial distress (i.e., lower values of z-score indicate a bank with a higher insolvency risk). Market power is proxied by the lerner index, which is positively linked with the market power a bank exhibits (i.e., higher values show that the bank is more dominant in the country/region it operates). Some additional control variables capture the dynamics of bank funding and other operations. Log() and Alog() denote the natural logarithm and the annual change in the natural logarithm respectively. The table reports estimated coefficients and standard errors in parenthesis. Beck, De Jonghe and Schepens (2013) Bank competition and stability: Cross-country heterogeneity, Journal of Financial Intermediation, 22 pp.218-244 Lerner Wholesale funding/Total Funding Loans/Total Assets Non-interest revenue/Total Revenue log(Total Assets) Alog(Total Assets) Observations R-squared Constant term included Number of countries Z-score 7.443 (0.487) 1.926 (0.452) -4.664 (0.345) 3.247 (0.480) -1.304 (0.070) -1.035 (0.269) 80,822 0.437 Yes 79 a) Loans is a major output of banks. How does the share of Loans in a bank's portfolio affect the bank financial soundness? Is this statistically significant at the 5%? [5 marks] | [Word limit: 200 words each] TURN OVER b) What would you advise the bank managers and/or regulators following your answer to the previous question? [5 marks] | [Word limit: 200 words each] c) Banks also have sources of income that are not related to interest - instead some fee is charged (eg., insurance products). How do these products contribute to the stability of banks? Is it statistically significant at the 1%? [5 marks] | [Word limit: 200 words each] d) You are the bank manager and you have funding to enlarge one of the two departments in your bank i) the loan department; ii) the insurance department. You are primarily interested in the financial stability of the institution. Taking into consideration the results in the table and your answers to the previous questions where would you channel the funds you have available? [5 marks] | [Word limit: 200 words each] e) You turn on the TV after a difficult day at work and hear the following excerpt from the news... "...the upcoming merger of the Bank of Missouri and First Western Bank has been agreed in principle by the shareholders of both banks and is now subject to the approval of the regulator body. The regulator examines all aspects of the merger including the potential loss of jobs but is mainly concerned about a monopolistic behaviour in banking services in the three towns that the two banks operate following the merger. A spokesman has said that market power of the merged bank might be too high, which would not be beneficial for the citizens and for the stability of the newly formed institution."Would you agree with the concerns (about stability) of the regulator? Justify your answer. [10 marks] | [Word limit: 200 words each] f) The results above are from a cross-country sample and such samples are known to have high variability, which may violate the homoscedastic assumption of the stochastic error term. Following your concern, you ask for your assistant to run a White test for heteroskedasticity. Your assistant reports back to you saying that there is no need to worry as the White test's auxiliary regression he ran had a very good fit (with an R-squared of 0.479). Do you agree with your assistant? Explain. [10 marks] | [Word limit: 200 words each] Total [40 marks]

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a The table shows that the coefficient for the LoansTotal Assets variable is positive and statistically significant at the 5 level suggesting t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started