Answered step by step

Verified Expert Solution

Question

1 Approved Answer

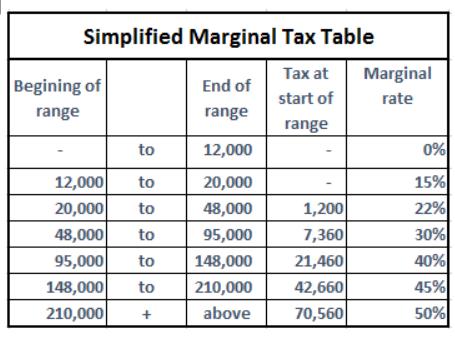

Use the Marginal Tax Table below to answer the following: Belinda just received a financial gift from her grandmother of $20,000 and is wondering what

Use the Marginal Tax Table below to answer the following:

Belinda just received a financial gift from her grandmother of $20,000 and is wondering what is the best way to invest it. She has in a steady job and wants to save it for the long term.

Her annual income is $90,000 and she has $84,000 RRSP carry forward room. How much tax will she save if she contributes it to her RRSP? Input your answer to the nearest dollar.

Simplified Marginal Tax Table Tax at start of range Begining of range to 12,000 to 20,000 to 48,000 to 95,000 to 148,000 to 210,000 + End of range 12,000 20,000 48,000 95,000 148,000 210,000 above 1,200 7,360 21,460 42,660 70,560 Marginal rate 0% 15% 22% 30% 40% 45% 50%

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Annual income 90000 Check the table above 90000 falls in the range 48000 to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started