Answered step by step

Verified Expert Solution

Question

1 Approved Answer

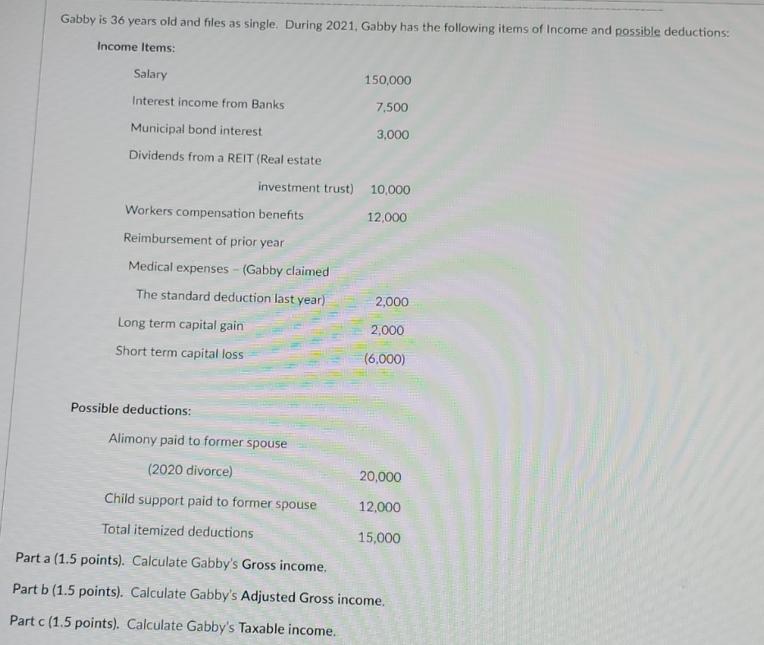

Gabby is 36 years old and files as single. During 2021, Gabby has the following items of Income and possible deductions: Income Items: Salary

Gabby is 36 years old and files as single. During 2021, Gabby has the following items of Income and possible deductions: Income Items: Salary Interest income from Banks Municipal bond interest Dividends from a REIT (Real estate Workers compensation benefits Reimbursement of prior year Medical expenses - (Gabby claimed The standard deduction last year) Long term capital gain Short term capital loss investment trust) Possible deductions: Alimony paid to former spouse (2020 divorce) Child support paid to former spouse Total itemized deductions 150,000 7,500 3,000 10,000 12,000 2,000 2,000 (6,000) 20,000 12,000 15,000 Part a (1.5 points). Calculate Gabby's Gross income. Part b (1.5 points). Calculate Gabby's Adjusted Gross income. Part c (1.5 points). Calculate Gabby's Taxable income.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

PART A Gross Income Salary Interest income from Banks D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started