Question

Gabry Ponte has a contract in which he will receive the following payments for the next five years: $20,000, $21,000, $22,000, $23,000, $24,000. Gabry

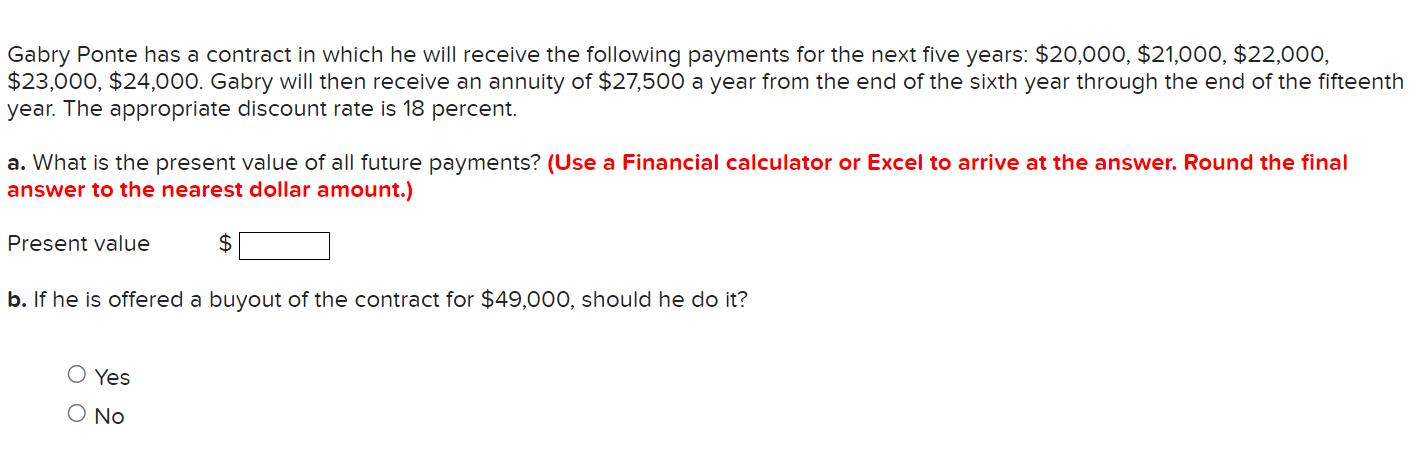

Gabry Ponte has a contract in which he will receive the following payments for the next five years: $20,000, $21,000, $22,000, $23,000, $24,000. Gabry will then receive an annuity of $27,500 a year from the end of the sixth year through the end of the fifteenth year. The appropriate discount rate is 18 percent. a. What is the present value of all future payments? (Use a Financial calculator or Excel to arrive at the answer. Round the final answer to the nearest dollar amount.) Present value $ b. If he is offered a buyout of the contract for $49,000, should he do it? O Yes O No

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value of all future payments and determine whether Gabry should accept the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App