Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gadget Ltd. is considering to go under liquidation procedures after the global effects of corona virus on the industry. It just announced today will

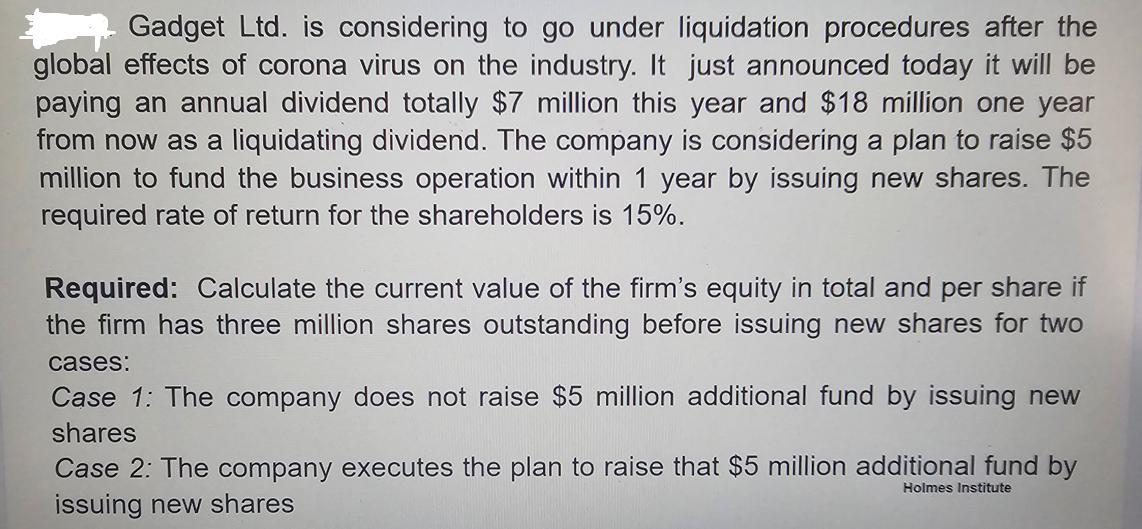

Gadget Ltd. is considering to go under liquidation procedures after the global effects of corona virus on the industry. It just announced today will be paying an annual dividend totally $7 million this year and $18 million one year from now as a liquidating dividend. The company is considering a plan to raise $5 million to fund the business operation within 1 year by issuing new shares. The required rate of return for the shareholders is 15%. Required: Calculate the current value of the firm's equity in total and per share if the firm has three million shares outstanding before issuing new shares for two cases: Case 1: The company does not raise $5 million additional fund by issuing new shares Case 2: The company executes the plan to raise that $5 million additional fund by issuing new shares Holmes Institute

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Case 1 In this case where the company does not raise 5 million by issuing new shares the current val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started