Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gaewelyn is considering opening a new business for a long - term care facility. The initial investment for the business is $ 6 5 0

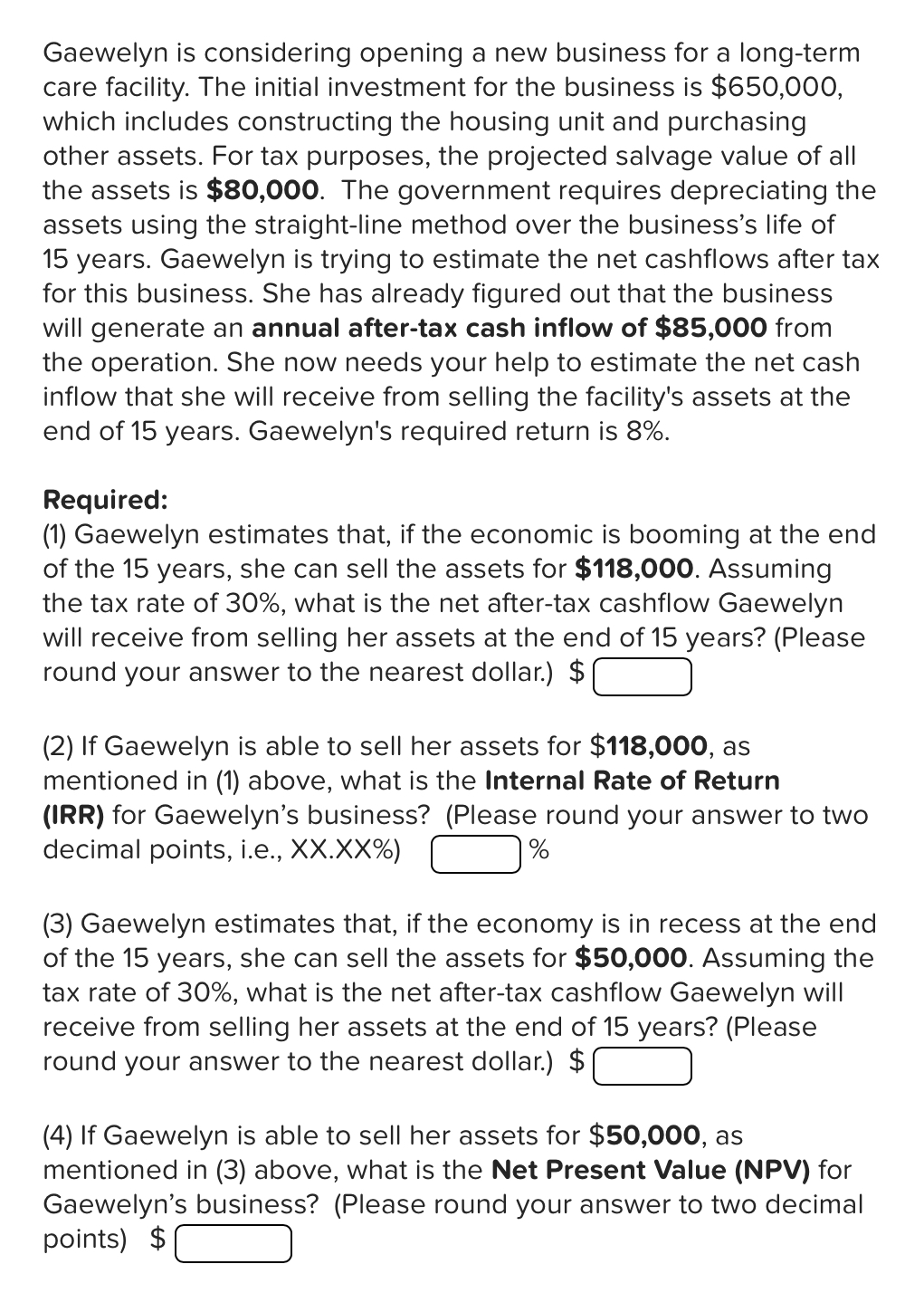

Gaewelyn is considering opening a new business for a longterm

care facility. The initial investment for the business is $

which includes constructing the housing unit and purchasing

other assets. For tax purposes, the projected salvage value of all

the assets is $ The government requires depreciating the

assets using the straightline method over the business's life of

years. Gaewelyn is trying to estimate the net cashflows after tax

for this business. She has already figured out that the business

will generate an annual aftertax cash inflow of $ from

the operation. She now needs your help to estimate the net cash

inflow that she will receive from selling the facility's assets at the

end of years. Gaewelyn's required return is

Required:

Gaewelyn estimates that, if the economic is booming at the end

of the years, she can sell the assets for $ Assuming

the tax rate of what is the net aftertax cashflow Gaewelyn

will receive from selling her assets at the end of years? Please

round your answer to the nearest dollar. $

If Gaewelyn is able to sell her assets for $$ as

mentioned in above, what is the Internal Rate of Return

IRR for Gaewelyn's business? Please round your answer to two

decimal points, ie XXXX

Gaewelyn estimates that, if the economy is in recess at the end

of the years, she can sell the assets for $ Assuming the

tax rate of what is the net aftertax cashflow Gaewelyn will

receive from selling her assets at the end of years? Please

round your answer to the nearest dollar. $

If Gaewelyn is able to sell her assets for $ as

mentioned in above, what is the Net Present Value NPV for

Gaewelyn's business? Please round your answer to two decimal

points $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started