Answered step by step

Verified Expert Solution

Question

1 Approved Answer

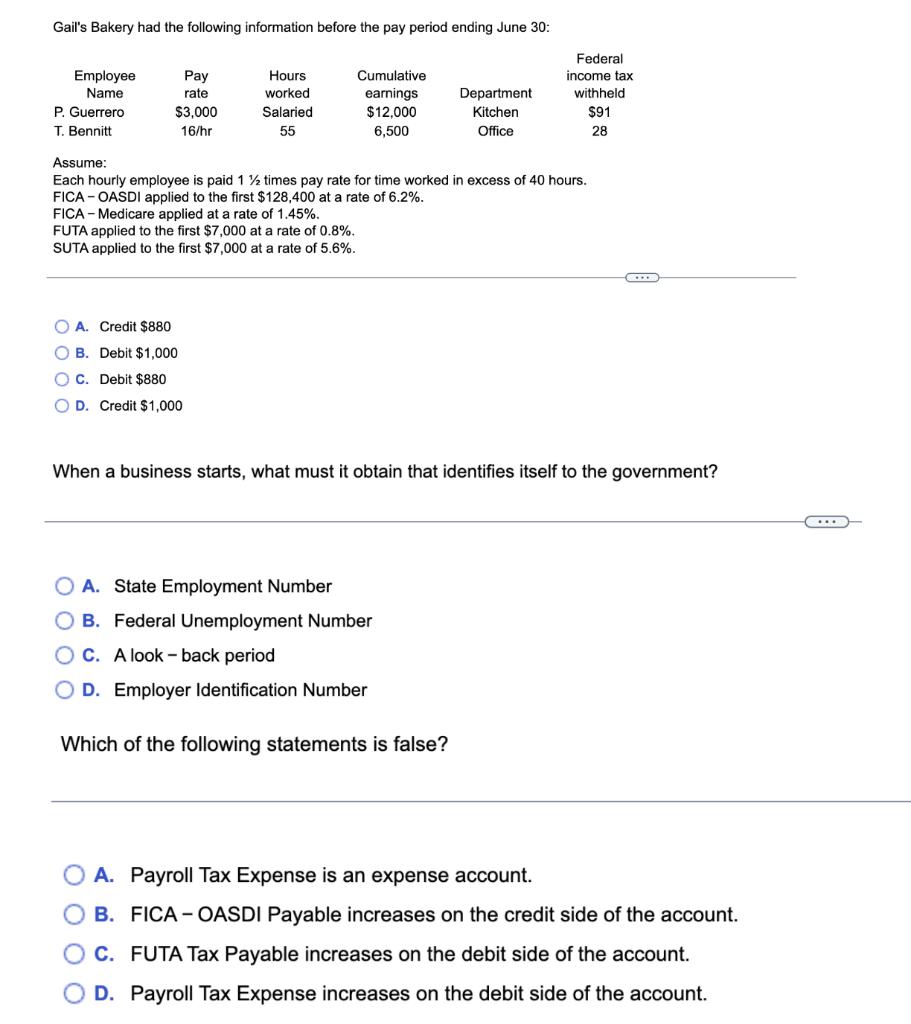

Gail's Bakery had the following information before the pay period ending June 30: Employee Name P. Guerrero T. Bennitt Pay rate $3,000 16/hr OA.

Gail's Bakery had the following information before the pay period ending June 30: Employee Name P. Guerrero T. Bennitt Pay rate $3,000 16/hr OA. Credit $880 OB. Debit $1,000 OC. Debit $880 O D. Credit $1,000 Hours worked Salaried 55 Cumulative earnings $12,000 6,500 Assume: Each hourly employee is paid 1 times pay rate for time worked in excess of 40 hours. FICA-OASDI applied to the first $128,400 at a rate of 6.2%. FICA-Medicare applied at a rate of 1.45%. FUTA applied to the first $7,000 at a rate of 0.8%. SUTA applied to the first $7,000 at a rate of 5.6%. Department Kitchen Office A. State Employment Number B. Federal Unemployment Number C. A look back period D. Employer Identification Number Federal income tax withheld $91 28 When a business starts, what must it obtain that identifies itself to the government? Which of the following statements is false? A. Payroll Tax Expense is an expense account. O B. FICA - OASDI Payable increases on the credit side of the account. O C. FUTA Tax Payable increases on the debit side of the account. O D. Payroll Tax Expense increases on the debit side of the account.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answers a Option D is correct Current earning for TBennitt 500 5001000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started