Answered step by step

Verified Expert Solution

Question

1 Approved Answer

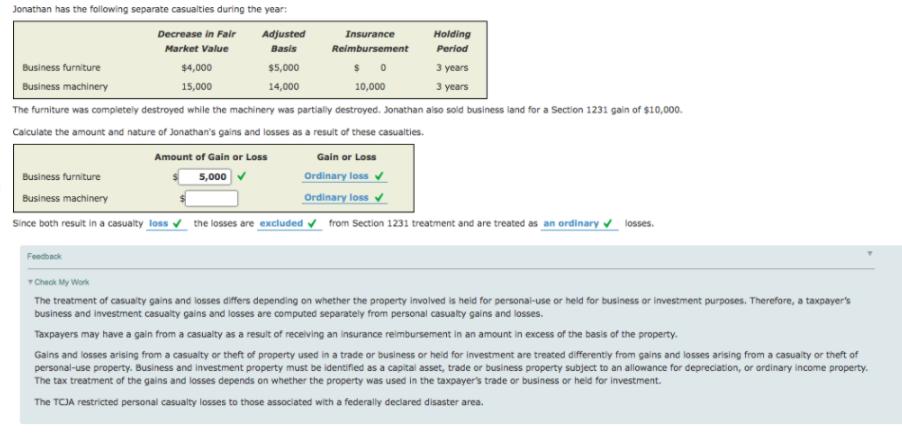

Jonathan has the following separate casualties during the year: Decrease in Fair Market Value Adjusted Basis Business furniture $5,000 3 years $4,000 15,000 Business

Jonathan has the following separate casualties during the year: Decrease in Fair Market Value Adjusted Basis Business furniture $5,000 3 years $4,000 15,000 Business machinery 14,000 3 years The furniture was completely destroyed while the machinery was partially destroyed. Jonathan also sold business land for a Section 1231 gain of $10,000. Calculate the amount and nature of Jonathan's gains and losses as a result of these casualties. Gain or Loss Amount of Gain or Loss 5,000 Ordinary loss Ordinary loss Insurance Reimbursement $0 10,000 Feedback Holding Period Business furniture Business machinery Since both result in a casualty loss the losses are excluded from Section 1231 treatment and are treated as an ordinary losses. Check My Work The treatment of casualty gains and losses differs depending on whether the property involved is held for personal-use or held for business or investment purposes. Therefore, a taxpayer's business and investment casualty gains and losses are computed separately from personal casualty gains and losses. Taxpayers may have a gain from a casualty as a result of receiving an insurance reimbursement in an amount in excess of the basis of the property. Gains and losses arising from a casualty or theft of property used in a trade or business or held for investment are treated differently from gains and losses arising from a casualty or theft of personal-use property. Business and investment property must be identified as a capital asset, trade or business property subject to an allowance for depreciation, or ordinary income property. The tax treatment of the gains and losses depends on whether the property was used in the taxpayer's trade or business or held for investment. The TCJA restricted personal casualty losses to those associated with a federally declared disaster area.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Number of periods on semiannual 6 basis Stated interest rate per period 62 3 Market interest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started