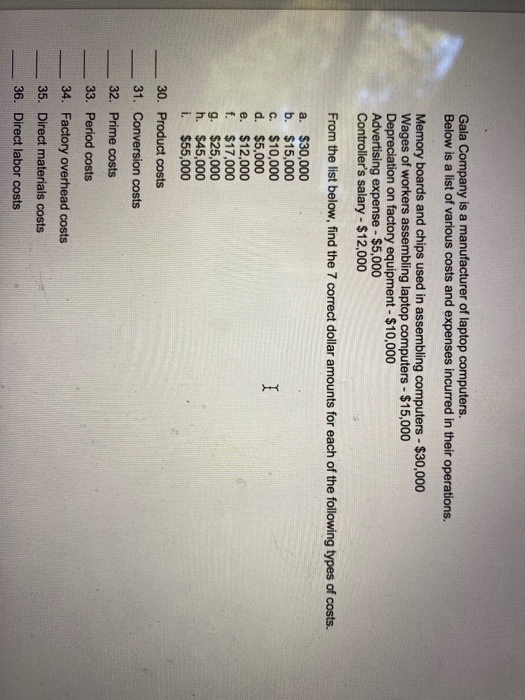

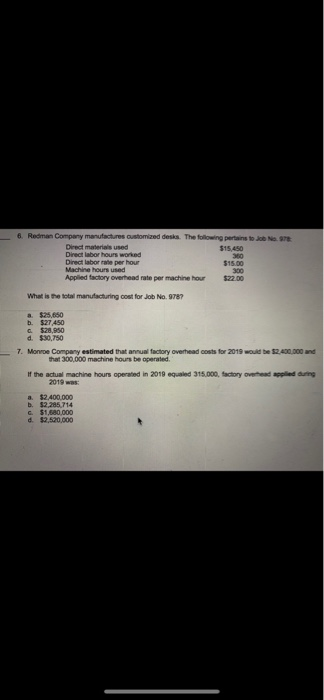

Gala Company is a manufacturer of laptop computers. Below is a list of various costs and expenses incurred in their operations. Memory boards and chips used in assembling computers - $30,000 Wages of workers assembling laptop computers - $15,000 Depreciation on factory equipment - $10,000 Advertising expense - $5,000 Controller's salary - $12,000 From the list below, find the 7 correct dollar amounts for each of the following types of costs. 1 I a. $30,000 b. $15,000 c. $10,000 d. $5,000 e. $12,000 f. $17,000 g. $25,000 h. $45,000 i. $55,000 30. Product costs 31. Conversion costs 32. Prime costs 33. Period costs 34. Factory overhead costs 35. Direct materials costs 36. Direct labor costs 6. Redman Company manufactures customized desks. The following pertains to Job Ne Direct materials used $15,450 Direct labor hours worked 360 Direct laborate per hour $15.00 Machine hours used 300 Applied factory overhead rate per machine hour $22.00 What is the total manufacturing cost for Job No. 9787 b. $27450 c$28,950 d. $30,750 7. Monroe Company estimated that annual factory overhead costs for 2019 would be 52.400.000 and that 300,000 machine hours be operated If the actual machine hours operated in 2019 equaled 315.000, factory red plied during 2019 was: a $2.400.000 b. $2,285,714 $1,680.000 $2,520.000 Gala Company is a manufacturer of laptop computers. Below is a list of various costs and expenses incurred in their operations. Memory boards and chips used in assembling computers - $30,000 Wages of workers assembling laptop computers - $15,000 Depreciation on factory equipment - $10,000 Advertising expense - $5,000 Controller's salary - $12,000 From the list below, find the 7 correct dollar amounts for each of the following types of costs. 1 I a. $30,000 b. $15,000 c. $10,000 d. $5,000 e. $12,000 f. $17,000 g. $25,000 h. $45,000 i. $55,000 30. Product costs 31. Conversion costs 32. Prime costs 33. Period costs 34. Factory overhead costs 35. Direct materials costs 36. Direct labor costs 6. Redman Company manufactures customized desks. The following pertains to Job Ne Direct materials used $15,450 Direct labor hours worked 360 Direct laborate per hour $15.00 Machine hours used 300 Applied factory overhead rate per machine hour $22.00 What is the total manufacturing cost for Job No. 9787 b. $27450 c$28,950 d. $30,750 7. Monroe Company estimated that annual factory overhead costs for 2019 would be 52.400.000 and that 300,000 machine hours be operated If the actual machine hours operated in 2019 equaled 315.000, factory red plied during 2019 was: a $2.400.000 b. $2,285,714 $1,680.000 $2,520.000