Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Galt Motors currently produces 50,000 electric motors a year and expects output levels to remain steady in the future. It buys armatures from an

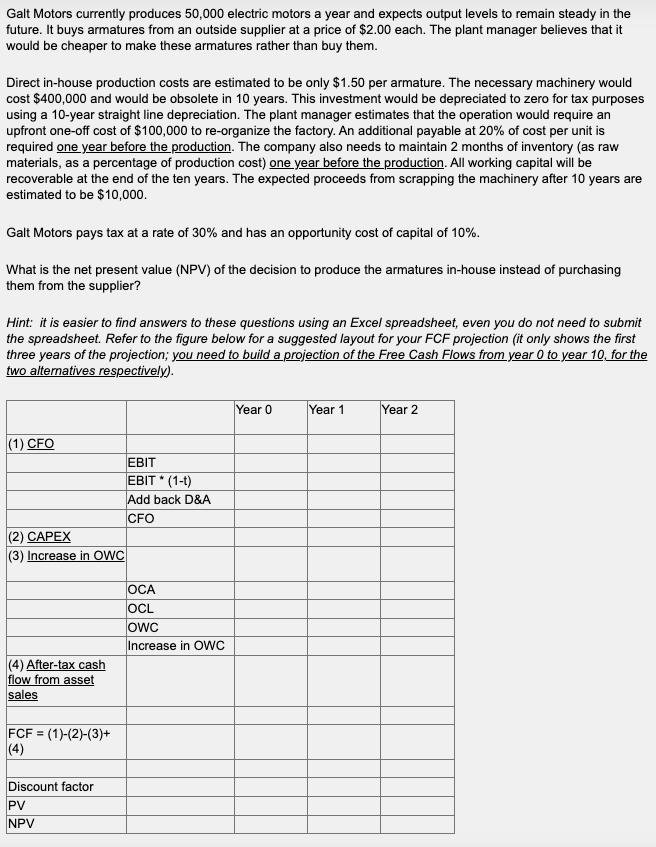

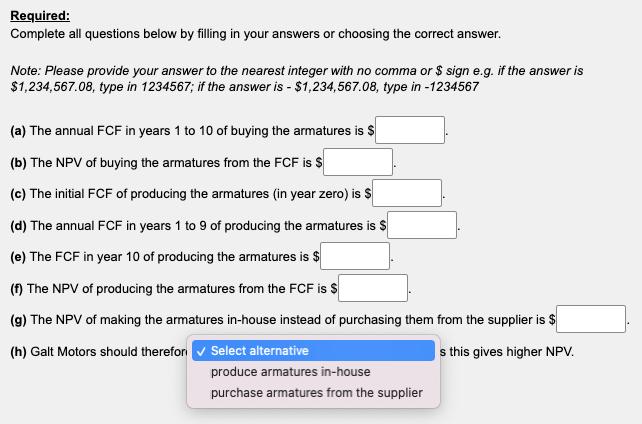

Galt Motors currently produces 50,000 electric motors a year and expects output levels to remain steady in the future. It buys armatures from an outside supplier at a price of $2.00 each. The plant manager believes that it would be cheaper to make these armatures rather than buy them. Direct in-house production costs are estimated to be only $1.50 per armature. The necessary machinery would cost $400,000 and would be obsolete in 10 years. This investment would be depreciated to zero for tax purposes using a 10-year straight line depreciation. The plant manager estimates that the operation would require an upfront one-off cost of $100,000 to re-organize the factory. An additional payable at 20% of cost per unit is required one year before the production. The company also needs to maintain 2 months of inventory (as raw materials, as a percentage of production cost) one year before the production. All working capital will be recoverable at the end of the ten years. The expected proceeds from scrapping the machinery after 10 years are estimated to be $10,000. Galt Motors pays tax at a rate of 30% and has an opportunity cost of capital of 10%. What is the net present value (NPV) of the decision to produce the armatures in-house instead of purchasing them from the supplier? Hint: it is easier to find answers to these questions using an Excel spreadsheet, even you do not need to submit the spreadsheet. Refer to the figure below for a suggested layout for your FCF projection (it only shows the first three years of the projection; you need to build a projection of the Free Cash Flows from year 0 to year 10, for the two alternatives respectively). (1) CFO EBIT EBIT (1-t) Add back D&A CFO (2) CAPEX (3) Increase in OWC OCA OCL OWC (4) After-tax cash flow from asset Increase in OWC sales FCF = (1)-(2)-(3)+ (4) Discount factor PV NPV Year 0 Year 1 Year 2 Required: Complete all questions below by filling in your answers or choosing the correct answer. Note: Please provide your answer to the nearest integer with no comma or $ sign e.g. if the answer is $1,234,567.08, type in 1234567; if the answer is - $1,234,567.08, type in -1234567 (a) The annual FCF in years 1 to 10 of buying the armatures is $ (b) The NPV of buying the armatures from the FCF is $ (c) The initial FCF of producing the armatures (in year zero) is $ (d) The annual FCF in years 1 to 9 of producing the armatures is $ (e) The FCF in year 10 of producing the armatures is $ (f) The NPV of producing the armatures from the FCF is $ (g) The NPV of making the armatures in-house instead of purchasing them from the supplier is $ (h) Galt Motors should therefor Select alternative produce armatures in-house s this gives higher NPV. purchase armatures from the supplier

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started