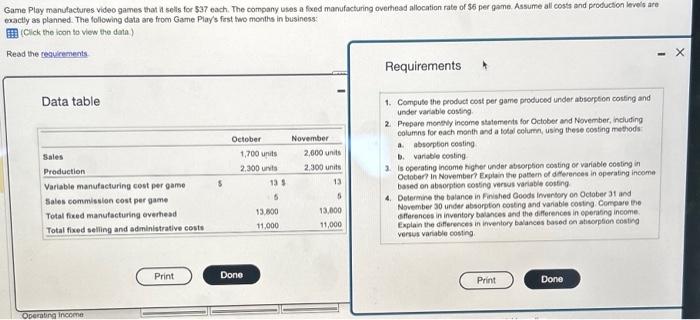

Game Play manufactures video games that it sells for $37 each. The company uses a fixed manufacturing overhead allocation rate of $6 per game. Assume all costs and production levels are exactly as planned. The following data are from Game Play's first two months in business:

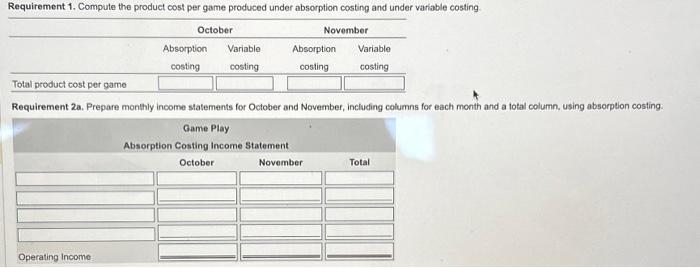

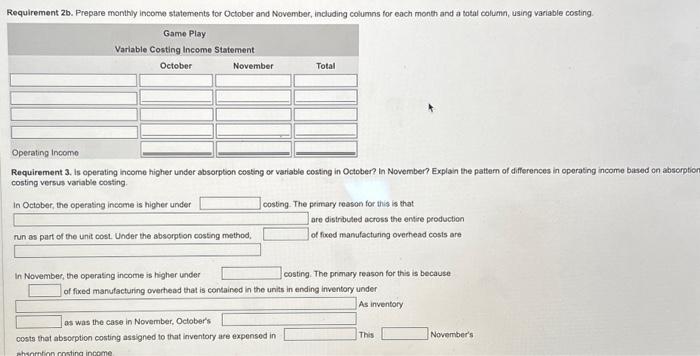

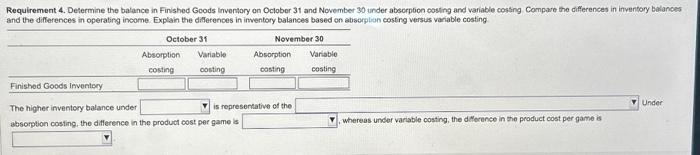

Game Play manufactures video games that i selis for $37 each. The compary usas a fxed mamufacturing overhead allocation rate of $6 per pame. Assume all coss and production levels are wactly as planned. The following data are from Game. Play's fast two months in business: (Click the ion to view the data) Read the requirements. Data table Requirements 1. Compute the product cost per game probuced under absorpeco cosfing and under variable costing. 2. Prepare monely income statements for October and November, including a. absorpton cesting b. variable costing 3. Is operating income higher under absorpbon costing of variable coeting in October? In November? Exptain sie pottem of difevences in operating income. based on absorption costing verus variable costing 4. Determine the balance in Finshed Goods imensary on October 31 and November 30 under absorption costng and variable costry. Compare the deflerences in inventery balances and the differences in cperating income. Explain the differences in inventory balances based en atieorption costry versus variable costing. Requirement 1. Compute the product cost per game produced under absorption costing and under variable costing \begin{tabular}{lccccc} \hline & \multicolumn{2}{c}{ October } & \multicolumn{2}{c}{ November } \\ \hline & Absorption & Variable & Absorption & Variable \\ & costing & costing & costing & costing \\ \hline Total product cost per game & & & & & \\ \hline \end{tabular} Requirement 2a. Prepare monthly income statements for October and November, including columns for each month and a total column, using absorption costing. Game Play Absorption Costing Income Statement October Operating Income Requirement 3. Is operating income higher under absorption cosking or variable costing in October? in November? Explain the pattem of differences in operating income based on absorpt costing versus variable costing. In October, the operating income is higher under costing. The peimary reason for this is that are distributed across the entire production run as part of the unit cost. Under the absorption costing method, of foxod manufacturing overhead cosis are In November, the operating income is higher under costing. The prenary reason for this is because of foxed manulacturing overhead that is contairod in the units in ending inventory under as was the case in Novernber, October's costa that absorption costing assigned to that inventory are expensod in This November's The higher inventery balance under is representative of the Under absorption costing, the diflerence in the product cost per game is Whereas under variable costing, the dilerance in the product cost per game is