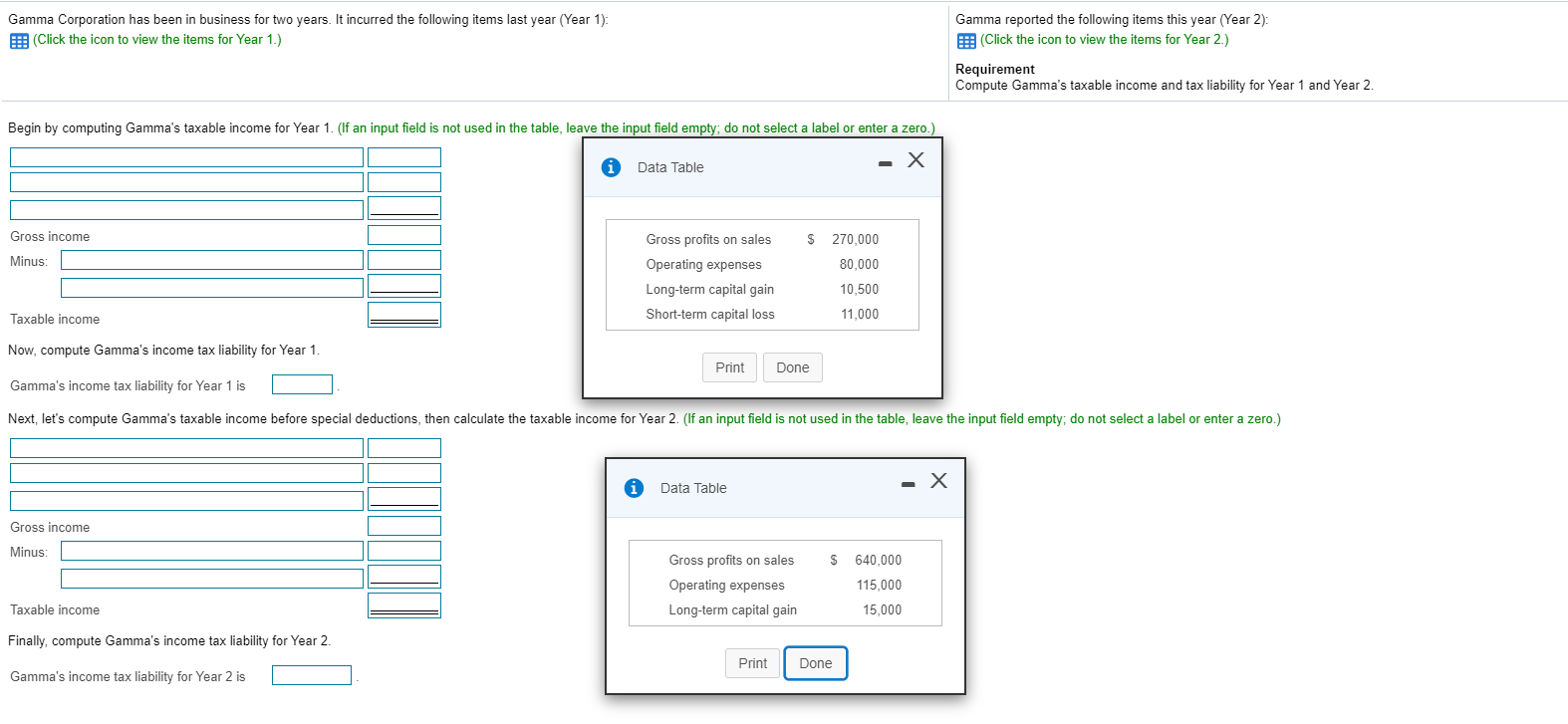

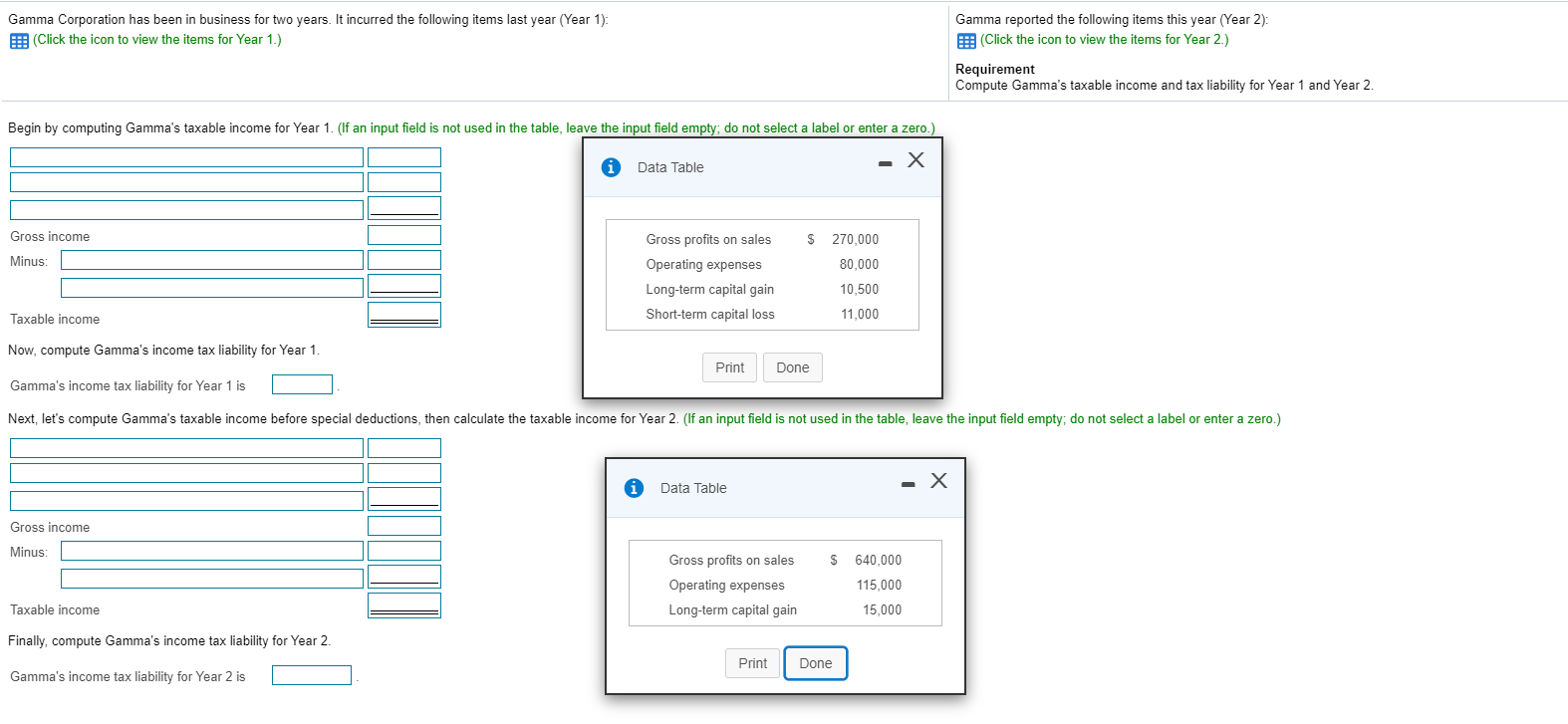

Gamma Corporation has been in business for two years. It incurred the following items last year (Year 1): (Click the icon to view the items for Year 1.) Gamma reported the following items this year (Year 2): (Click the icon to view the items for Year 2.) Requirement Compute Gamma's taxable income and tax liability for Year 1 and Year 2. Begin by computing Gamma's taxable income for Year 1. (lf an input field is not used in the table, leave the input field empty, do not select a label or enter a zero.) X Data Table $ 270,000 Gross income Minus: 80,000 Gross profits on sales Operating expenses Long-term capital gain Short-term capital loss 10,500 11,000 Taxable income Now, compute Gamma's income tax liability for Year 1. Print Done Gamma's income tax liability for Year 1 is Next, let's compute Gamma's taxable income before special deductions, then calculate the taxable income for Year 2. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) A Data Table Gross income Minus: $ Gross profits on sales Operating expenses Long-term capital gain 640,000 115,000 15,000 Taxable income Finally, compute Gamma's income tax liability for Year 2. Print Done Gamma's income tax liability for Year 2 is Gamma Corporation has been in business for two years. It incurred the following items last year (Year 1): (Click the icon to view the items for Year 1.) Gamma reported the following items this year (Year 2): (Click the icon to view the items for Year 2.) Requirement Compute Gamma's taxable income and tax liability for Year 1 and Year 2. Begin by computing Gamma's taxable income for Year 1. (lf an input field is not used in the table, leave the input field empty, do not select a label or enter a zero.) X Data Table $ 270,000 Gross income Minus: 80,000 Gross profits on sales Operating expenses Long-term capital gain Short-term capital loss 10,500 11,000 Taxable income Now, compute Gamma's income tax liability for Year 1. Print Done Gamma's income tax liability for Year 1 is Next, let's compute Gamma's taxable income before special deductions, then calculate the taxable income for Year 2. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) A Data Table Gross income Minus: $ Gross profits on sales Operating expenses Long-term capital gain 640,000 115,000 15,000 Taxable income Finally, compute Gamma's income tax liability for Year 2. Print Done Gamma's income tax liability for Year 2 is