Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gamma Corporation sold the following property on March 3 of the current year. Securities Selling price Cost $ 65.000 $100,000 Accumulated depreciation Adjusted basis Gain

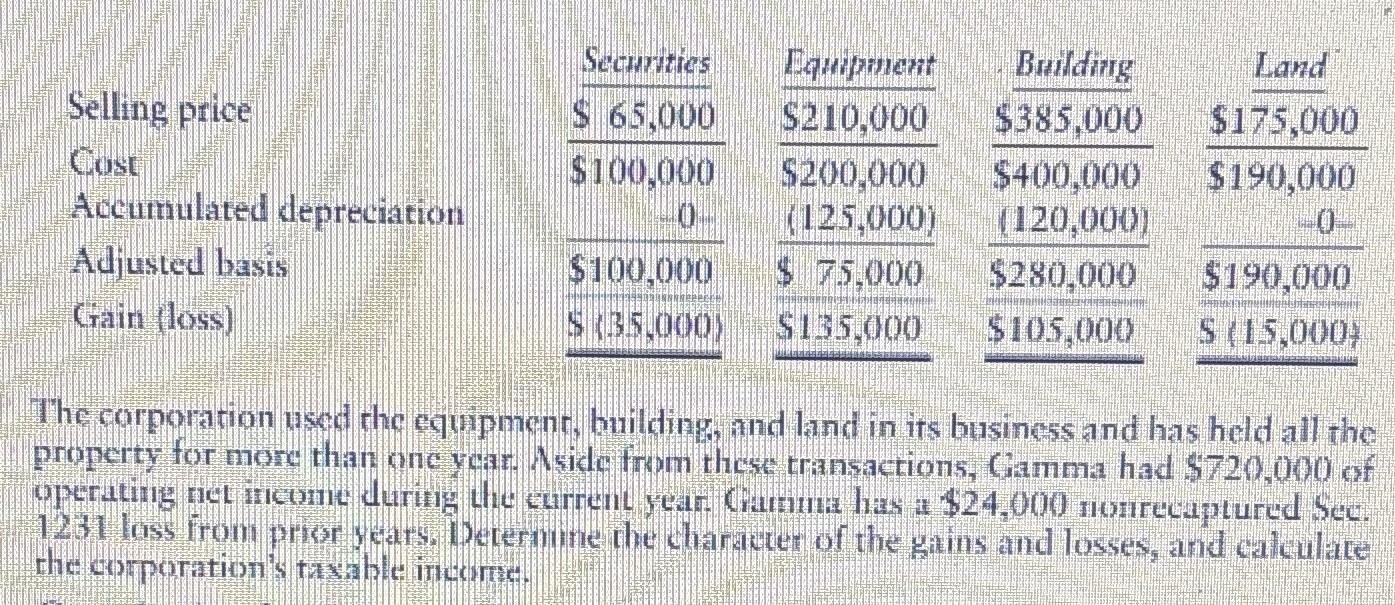

Gamma Corporation sold the following property on March 3 of the current year.

Securities Selling price Cost $ 65.000 $100,000 Accumulated depreciation Adjusted basis Gain (loss) $100,000 S (35.000) $ 75,000 $135,000 Equipment Building $210,000 $385,000 $175,000 $200,000 $400,000 $190,000 (125,000) (120,000) $280,000 $105,000 Land -0- $190,000 S (15,000 The corporation used the equipment, building, and land in its business and has held all the property for more than one year. Aside from these transactions, Gamma had $720,000 of operating net income during the current year. Gamma has a $24,000 nonrecaptured Sec. 1231 loss from prior years. Determine the character of the gains and losses, and calculate the corporation's taxable income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the character of the gain or loss from the sale of the proper...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started