Answered step by step

Verified Expert Solution

Question

1 Approved Answer

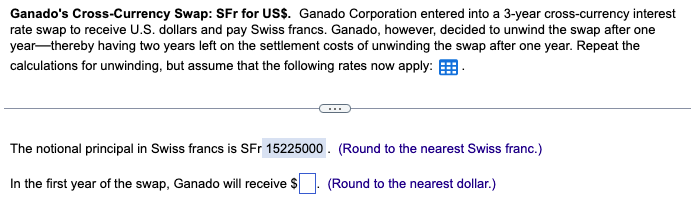

Ganado's Cross - Currency Swap: SFr for US$ . Ganado Corporation entered into a 3 - year cross - currency interest rate swap to receive

Ganado's CrossCurrency Swap: SFr for US$ Ganado Corporation entered into a year crosscurrency interest

rate swap to receive US dollars and pay Swiss francs. Ganado, however, decided to unwind the swap after one

yearthereby having two years left on the settlement costs of unwinding the swap after one year. Repeat the

calculations for unwinding, but assume that the following rates now apply:

The notional principal in Swiss francs is SFr Round to the nearest Swiss franc.

In the first year of the swap, Ganado will receive $ Round to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started