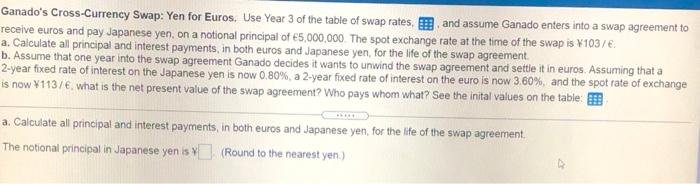

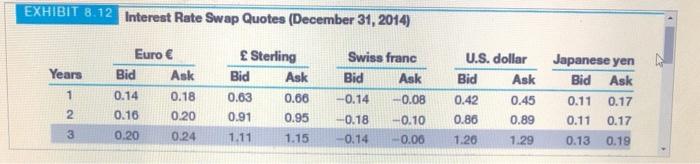

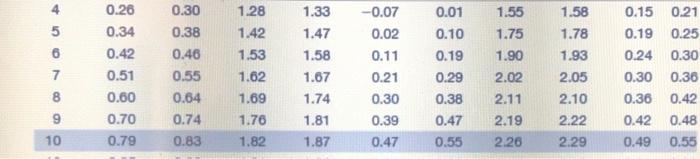

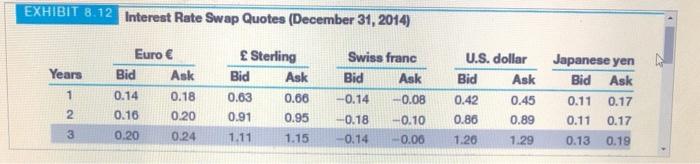

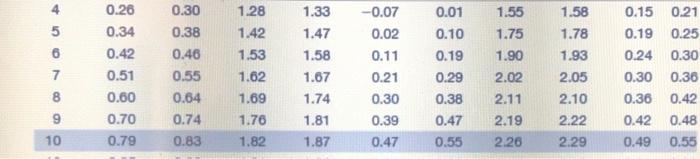

Ganado's Cross-Currency Swap: Yen for Euros. Use Year 3 of the table of swap rates, and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 5,000,000. The spot exchange rate at the time of the swap is 1037 a. Calculate all principal and interest payments in both euros and Japanese yen, for the life of the swap agreement b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year fixed rate of interest on the Japanese yen is now 0.80%, a 2-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 113/, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table a. Calculate all principal and interest payments in both euros and Japanese yen for the life of the swap agreement. The notional principal in Japanese yen is (Round to the nearestyen.) EXHIBIT 8.12 Interest Rate Swap Quotes (December 31, 2014) Years Euro Bid Ask 0.14 0.18 0.16 0.20 0.20 0.24 1 Sterling Bid Ask 0.03 0.66 0.91 0.95 Swiss franc Bid Ask -0.14 -0.08 -0.18 -0.10 -0.14 -0.00 U.S. dollar Bid Ask 0.42 0.45 0.86 0.89 1.26 1.29 Japanese yen Bid Ask 0.11 0.17 0.11 0.17 0.13 0.19 2 3 1.11 1.15 5 6 0.26 0.34 0.42 0.51 0.60 0.70 0.79 0.30 0.38 0.46 0.55 0.64 0.74 7 8 1.28 1.42 1.53 1.62 1.69 1.76 1.82 1.33 1.47 1.58 1.67 1.74 1.81 1.87 -0.07 0.02 0.11 0.21 0.30 0.39 0.47 0.01 0.10 0.19 0.29 0.38 0.47 0.55 1.55 1.75 1.90 2.02 2.11 2.19 2.26 1.58 1.78 1.93 2.05 2.10 2.22 2.29 0.15 0.21 0.19 0.25 0.24 0.30 0.30 0.36 0.36 0.42 0.42 0.48 0.49 0.55 9 10 0.83 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 20 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR Typical presentation by the Financial Times. Bid and ank spreads as of close of London business. US$ is quoted against 3-month LIBOR: Japanese yen against 6-month UBOR Euro and Swiss franc against 6-month UBOR (Click on the icon to import the table into a spreadsheet.) Assumptioms Values Swap Rates Notional principal 5,000,000 Original: Euro Original spot rate (Y/C) 103 Original: Yen 3-Year Bid 0.20% 0.13% 3-Year Ask 0.24% 0.19% Ganado's Cross-Currency Swap: Yen for Euros. Use Year 3 of the table of swap rates, and assume Ganado enters into a swap agreement to receive euros and pay Japanese yen, on a notional principal of 5,000,000. The spot exchange rate at the time of the swap is 1037 a. Calculate all principal and interest payments in both euros and Japanese yen, for the life of the swap agreement b. Assume that one year into the swap agreement Ganado decides it wants to unwind the swap agreement and settle it in euros. Assuming that a 2-year fixed rate of interest on the Japanese yen is now 0.80%, a 2-year fixed rate of interest on the euro is now 3.60%, and the spot rate of exchange is now 113/, what is the net present value of the swap agreement? Who pays whom what? See the inital values on the table a. Calculate all principal and interest payments in both euros and Japanese yen for the life of the swap agreement. The notional principal in Japanese yen is (Round to the nearestyen.) EXHIBIT 8.12 Interest Rate Swap Quotes (December 31, 2014) Years Euro Bid Ask 0.14 0.18 0.16 0.20 0.20 0.24 1 Sterling Bid Ask 0.03 0.66 0.91 0.95 Swiss franc Bid Ask -0.14 -0.08 -0.18 -0.10 -0.14 -0.00 U.S. dollar Bid Ask 0.42 0.45 0.86 0.89 1.26 1.29 Japanese yen Bid Ask 0.11 0.17 0.11 0.17 0.13 0.19 2 3 1.11 1.15 5 6 0.26 0.34 0.42 0.51 0.60 0.70 0.79 0.30 0.38 0.46 0.55 0.64 0.74 7 8 1.28 1.42 1.53 1.62 1.69 1.76 1.82 1.33 1.47 1.58 1.67 1.74 1.81 1.87 -0.07 0.02 0.11 0.21 0.30 0.39 0.47 0.01 0.10 0.19 0.29 0.38 0.47 0.55 1.55 1.75 1.90 2.02 2.11 2.19 2.26 1.58 1.78 1.93 2.05 2.10 2.22 2.29 0.15 0.21 0.19 0.25 0.24 0.30 0.30 0.36 0.36 0.42 0.42 0.48 0.49 0.55 9 10 0.83 12 0.95 0.99 1.91 1.98 0.59 0.69 2.37 2.40 0.61 0.69 15 1.12 1.16 2.02 2.11 0.75 0.85 2.48 2.51 0.82 0.90 20 1.30 1.34 2.12 2.25 0.95 1.05 2.59 2.62 1.09 1.17 25 1.39 1.43 2.15 2.28 1.06 1.16 2.64 2.67 1.22 1.30 30 1.44 1.48 2.17 2.30 1.11 1.21 2.67 2.70 1.29 1.37 LIBOR Typical presentation by the Financial Times. Bid and ank spreads as of close of London business. US$ is quoted against 3-month LIBOR: Japanese yen against 6-month UBOR Euro and Swiss franc against 6-month UBOR (Click on the icon to import the table into a spreadsheet.) Assumptioms Values Swap Rates Notional principal 5,000,000 Original: Euro Original spot rate (Y/C) 103 Original: Yen 3-Year Bid 0.20% 0.13% 3-Year Ask 0.24% 0.19%