Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gangnam Ltd acquired a shopping mall on 1 January 2017 for $9,000,000 and included it as Property, Plant and Equipment under IAS 16. The

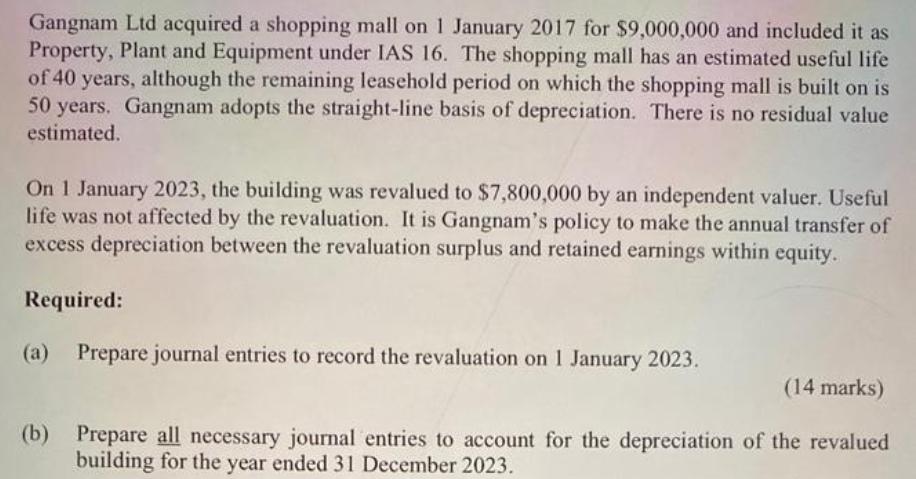

Gangnam Ltd acquired a shopping mall on 1 January 2017 for $9,000,000 and included it as Property, Plant and Equipment under IAS 16. The shopping mall has an estimated useful life of 40 years, although the remaining leasehold period on which the shopping mall is built on is 50 years. Gangnam adopts the straight-line basis of depreciation. There is no residual value estimated. On 1 January 2023, the building was revalued to $7,800,000 by an independent valuer. Useful life was not affected by the revaluation. It is Gangnam's policy to make the annual transfer of excess depreciation between the revaluation surplus and retained earnings within equity. Required: (a) Prepare journal entries to record the revaluation on 1 January 2023. (14 marks) (b) Prepare all necessary journal entries to account for the depreciation of the revalued building for the year ended 31 December 2023.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started