Question

Garca and Martinez manufacture widgets and currently have $25 million in taxable income. The company recently spent $750,000 to put together a bid for a

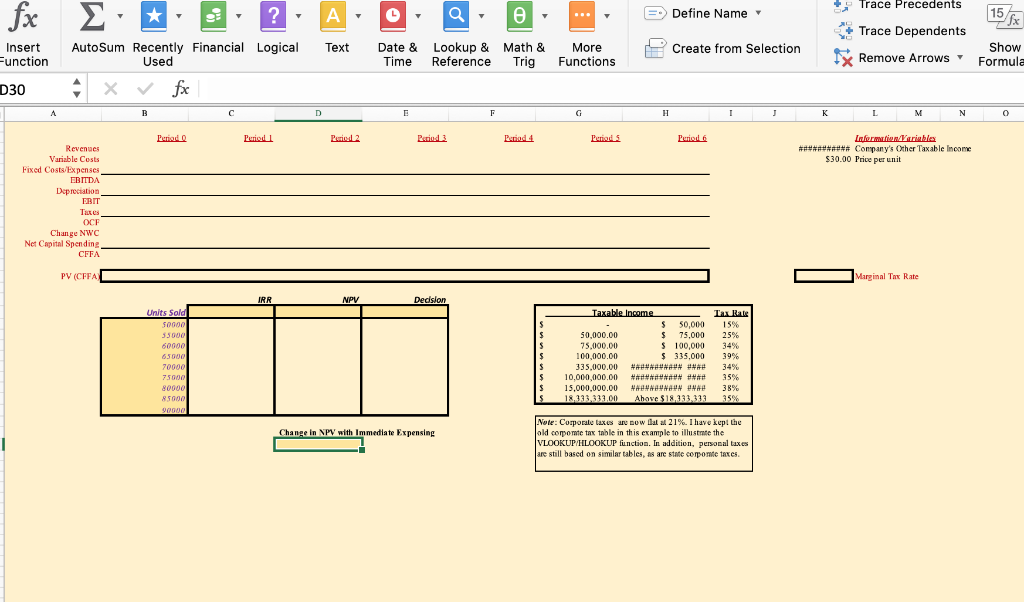

Garca and Martinez manufacture widgets and currently have $25 million in taxable income. The company recently spent $750,000 to put together a bid for a government contract, and this morning they were notified that they won the contract. The contract requires the firm to provide 70,000 widgets a year for 6 years, and the government will pay $30 for each widget. To satisfy the new contract, Garca and Martinez estimate they will need an additional $5,000,000 worth of machinery. The machinery costs $150,000 a year to operate and maintain. The machinerys depreciable life is 7-years, and the company expects to salvage the machinery for $60,000 at the end of year 6. If the project is accepted, the company will immediately increase inventory by $500,000 and maintain the new inventory level over the projects life. Similarly, the company will immediately add $50,000 to their cash balance and maintain that higher cash balance over the projects life. The investments in cash and inventory will be recovered when the project is completed. The marginal cost of producing a widget is $6.00 and the cost of capital is 14%. Calculate the projects NPV by linking to the information/variable values in Column K.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started