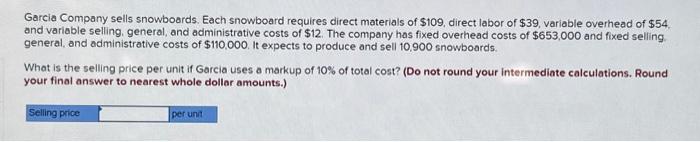

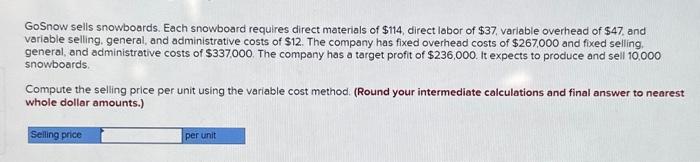

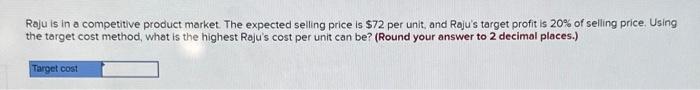

Garcia Company sells snowboards. Each snowboard requires direct materials of $109, direct labor of $39, variable overhead of $54. and variable selling. general, and administrative costs of $12. The company has fixed overhead costs of $653,000 and fixed selling general, and administrative costs of $110,000. It expects to produce and sell 10,900 snowboards. What is the selling price per unit if Garcia uses a markup of 10% of total cost? (Do not round your intermediate calculations. Round your final answer to nearest whole dollar amounts.) GoSnow sells snowboards. Each snowboard requires direct materials of $114, direct labor of $37, variable overhead of $47, and variable selling. general, and administrative costs of $12. The company has fixed overhead costs of $267,000 and fixed selling. general, and administrative costs of $337,000. The company has a target profit of $236,000. It expects to produce and sell 10,000 snowboards. Compute the selling price per unit using the variable cost method. (Round your intermediate calculations and final answer to nearest whole dollar amounts.) Raju is in a competitive product market. The expected selling price is $72 per unit, and Raju's target profit is 20% of selling price. Using the target cost method, what is the highest Roju's cost per unit can be? (Round your answer to 2 decimal places.) Garcia Company sells snowboards. Each snowboard requires direct materials of $109, direct labor of $39, variable overhead of $54. and variable selling. general, and administrative costs of $12. The company has fixed overhead costs of $653,000 and fixed selling general, and administrative costs of $110,000. It expects to produce and sell 10,900 snowboards. What is the selling price per unit if Garcia uses a markup of 10% of total cost? (Do not round your intermediate calculations. Round your final answer to nearest whole dollar amounts.) GoSnow sells snowboards. Each snowboard requires direct materials of $114, direct labor of $37, variable overhead of $47, and variable selling. general, and administrative costs of $12. The company has fixed overhead costs of $267,000 and fixed selling. general, and administrative costs of $337,000. The company has a target profit of $236,000. It expects to produce and sell 10,000 snowboards. Compute the selling price per unit using the variable cost method. (Round your intermediate calculations and final answer to nearest whole dollar amounts.) Raju is in a competitive product market. The expected selling price is $72 per unit, and Raju's target profit is 20% of selling price. Using the target cost method, what is the highest Roju's cost per unit can be? (Round your answer to 2 decimal places.)