Question

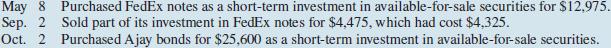

Gard Company completes the following transactions related to its short-term debt investments. Required Prepare journal entries for the transactions. Prepare a year-end adjusting journal entry

Gard Company completes the following transactions related to its short-term debt investments.

Required

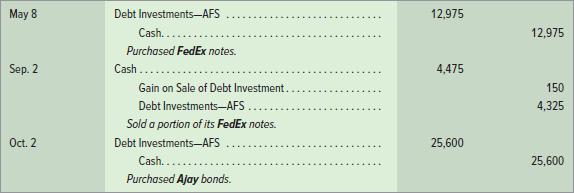

Prepare journal entries for the transactions.

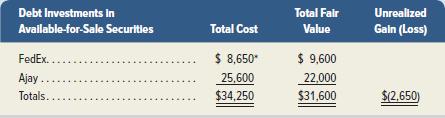

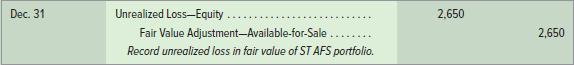

Prepare a year-end adjusting journal entry as of December 31 if the fair values of the debt securities held by Gard are $9,600 for FedEx and $22,000 for Ajay. (This year is the first year Gard Company acquired short-term debt investments.)

Computation of unrealized gain or loss, along with the adjusting entry, follows.

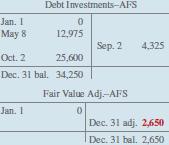

Debt Investments-AFS Jan. I May 8 12,975 Sep. 2 4,325 Oct. 2 25,600 Dec. 31 bal. 34,250 Fair Value Adj.-AFS Jan. I Dec. 31 adj. 2,650 Dec. 31 bal. 2,650

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App