Question

Gardo and Gordo formed a partnership on July 1, 2015 to operate two stores to be managed by each of them. They invested P30,000

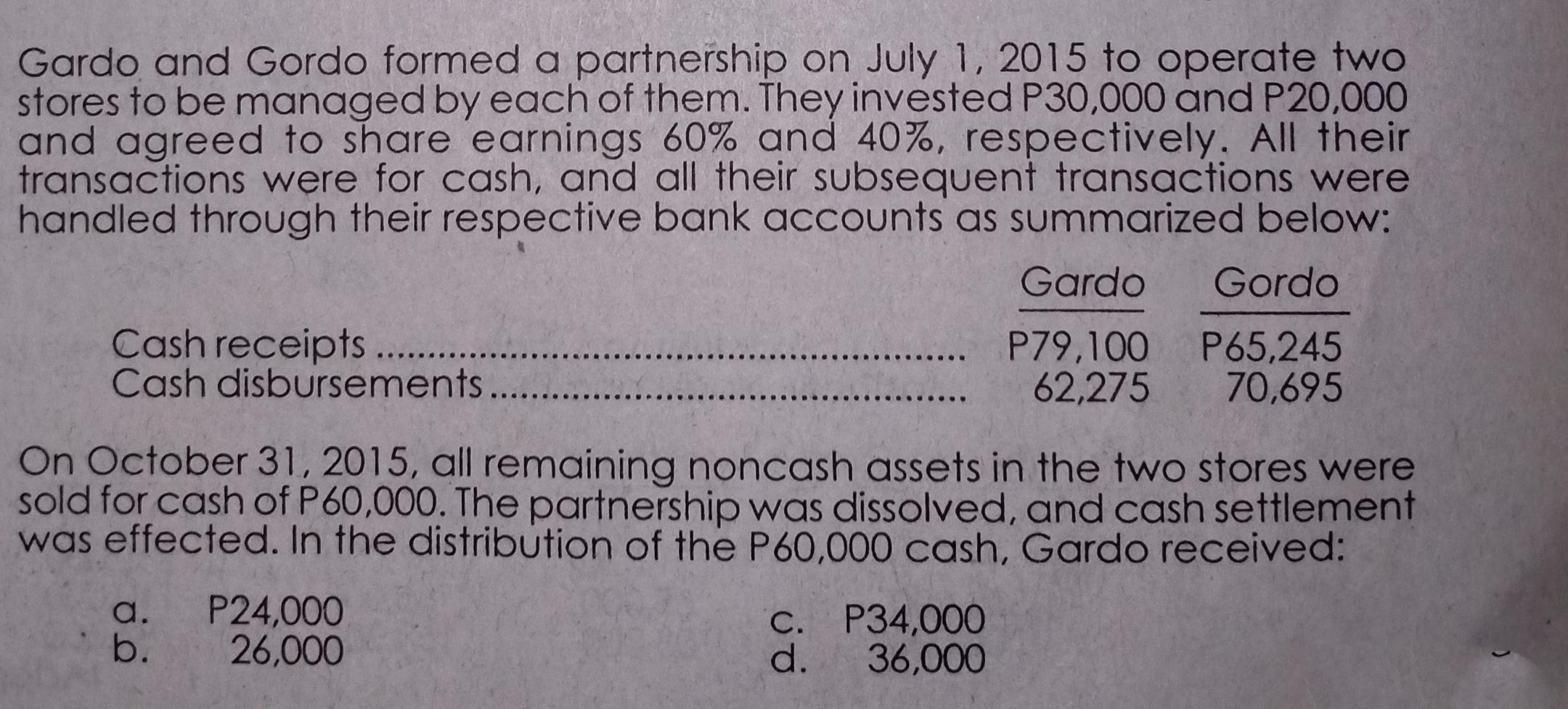

Gardo and Gordo formed a partnership on July 1, 2015 to operate two stores to be managed by each of them. They invested P30,000 and P20,000 and agreed to share earnings 60% and 40%, respectively. All their transactions were for cash, and all their subsequent transactions were handled through their respective bank accounts as summarized below: Cash receipts ........ Cash disbursements On October 31, 2015, all remaining noncash assets in the two stores were sold for cash of P60,000. The partnership was dissolved, and cash settlement was effected. In the distribution of the P60,000 cash, Gardo received: a. b. P24,000 26,000 Gardo Gordo P79,100 P65,245 62,275 70,695 c. P34,000 d. 36,000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Accounting

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood

11th Canadian Edition Volume 2

0135359783, 978-0135359785

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App