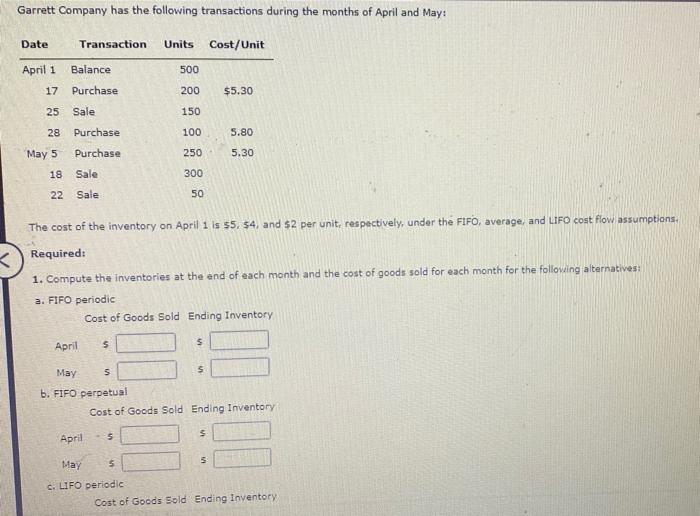

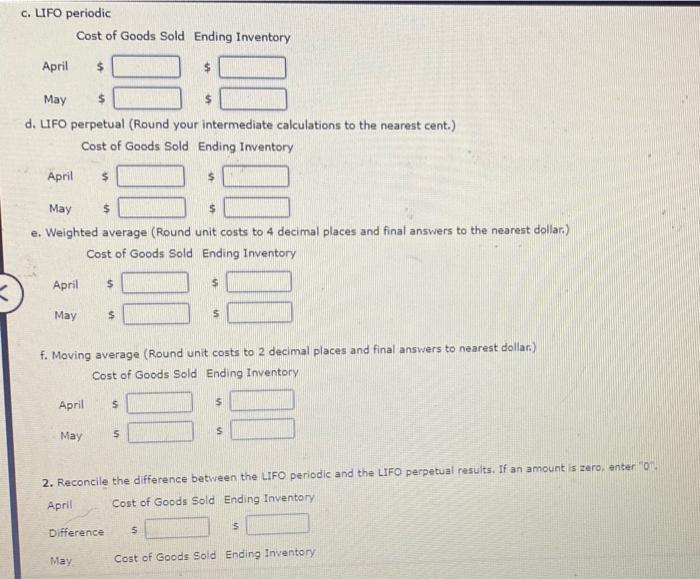

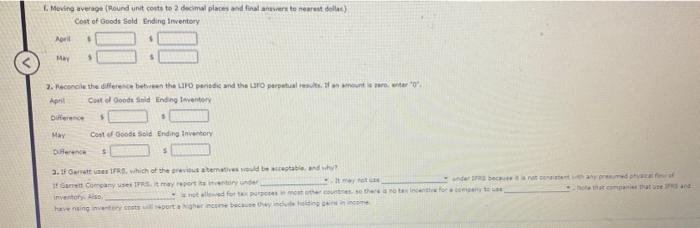

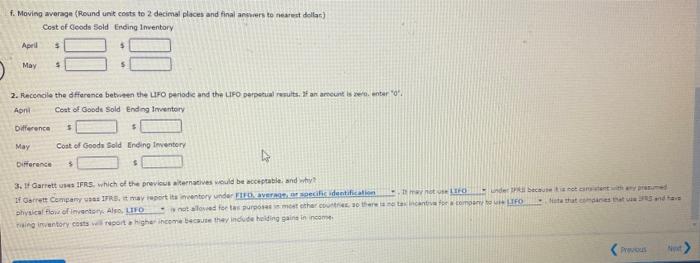

Garrett Company has the following transactions during the months of April and May: The cost of the inventory on April 1 is $5,54, and $2 per unit, respectively, under the FIFO, average, and UFO cost flow assumptians. Required: 1. Compute the inventories at the end of each month and the cost of goods sold for each month for the following alternatives: 3. FIFO periodic d. LIFO perpetual (Round your intermediate calculations to the nearest cent.) Cost of Goods Sold Ending Inventory \begin{tabular}{ll|l|} April $ & $ \\ May & $ & $ \end{tabular} e. Weighted average (Round unit costs to 4 decimal places and final answers to the nearest dollar) Cost of Goods Sold Ending Inventory f. Moving average (Round unit costs to 2 decimal places and final answers to nearest dollar) cost of Goods Sold Ending Inventory 2. Reconcile the difference between the LIFO periodic and the LIFO perpetual results. If an amount is zero, anter " 0 :": April Cost of Goods Sold Ending Inventory Difference 5 May Cost of Goods Sold Ending Inventory 1. Meving average (Round unit conts to 2 decimal plares and firal answers to nearest dellat) Cost of Goods sold Ending Inventary Aphil Cut d Oobds stid Ending tewentery. irvertern 2aso. f. Moving average (Round unit costs to 2 decimal places and final answers to nestest dollar) Cost of Geods sold Ereoing inventory april Cost of Goods Sold End ng Imventery Ditference May Cost of Goodn Sold Ending tewentery 3. If Garrett usat IFrs. which of the previeus akernacives viould be acceptable snd why? Garrett Company has the following transactions during the months of April and May: The cost of the inventory on April 1 is $5,54, and $2 per unit, respectively, under the FIFO, average, and UFO cost flow assumptians. Required: 1. Compute the inventories at the end of each month and the cost of goods sold for each month for the following alternatives: 3. FIFO periodic d. LIFO perpetual (Round your intermediate calculations to the nearest cent.) Cost of Goods Sold Ending Inventory \begin{tabular}{ll|l|} April $ & $ \\ May & $ & $ \end{tabular} e. Weighted average (Round unit costs to 4 decimal places and final answers to the nearest dollar) Cost of Goods Sold Ending Inventory f. Moving average (Round unit costs to 2 decimal places and final answers to nearest dollar) cost of Goods Sold Ending Inventory 2. Reconcile the difference between the LIFO periodic and the LIFO perpetual results. If an amount is zero, anter " 0 :": April Cost of Goods Sold Ending Inventory Difference 5 May Cost of Goods Sold Ending Inventory 1. Meving average (Round unit conts to 2 decimal plares and firal answers to nearest dellat) Cost of Goods sold Ending Inventary Aphil Cut d Oobds stid Ending tewentery. irvertern 2aso. f. Moving average (Round unit costs to 2 decimal places and final answers to nestest dollar) Cost of Geods sold Ereoing inventory april Cost of Goods Sold End ng Imventery Ditference May Cost of Goodn Sold Ending tewentery 3. If Garrett usat IFrs. which of the previeus akernacives viould be acceptable snd why