Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gary and Vanessa are 51 and expect to work until they are 65. Combined, they have $205,000 in their RRSP and expect to be

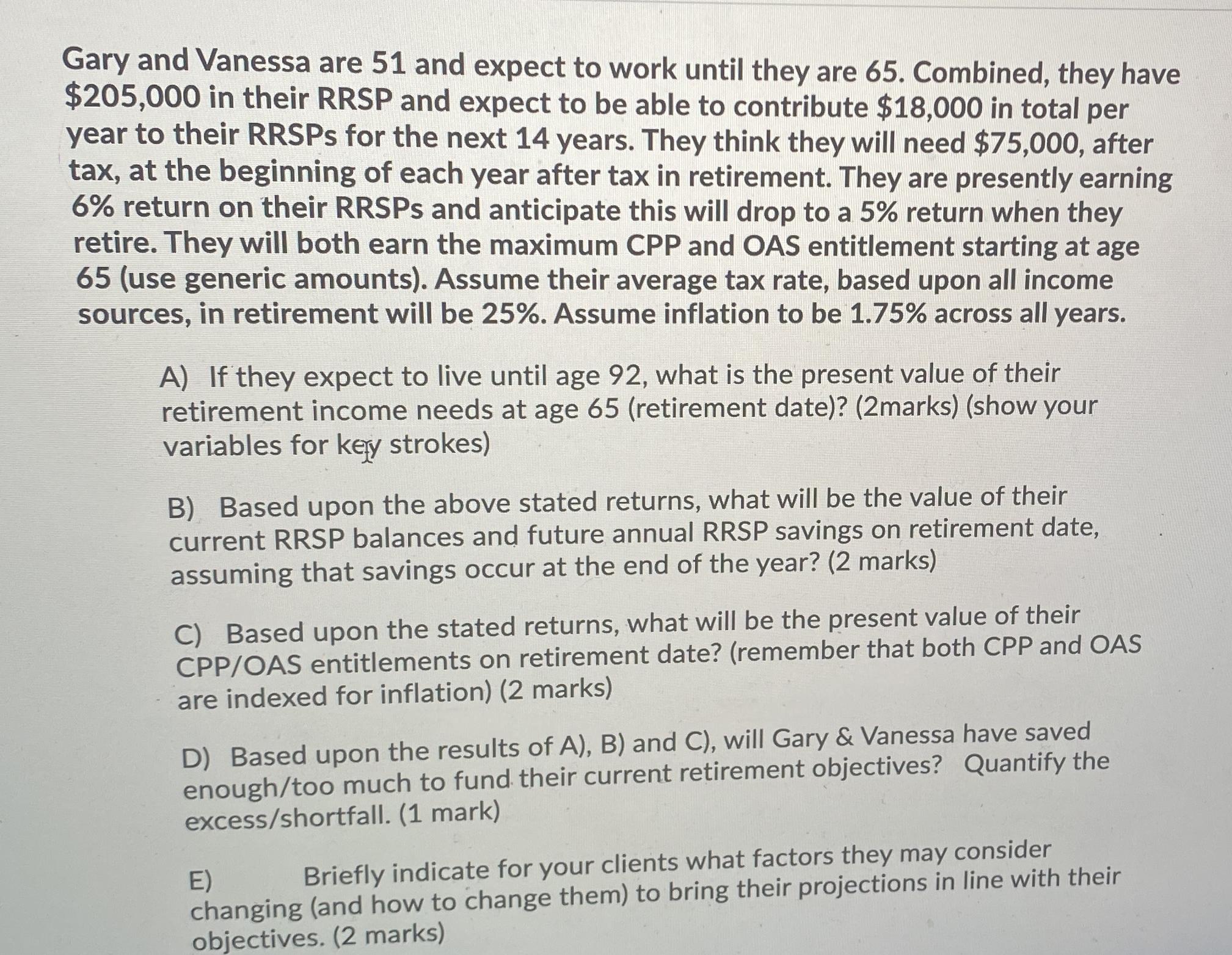

Gary and Vanessa are 51 and expect to work until they are 65. Combined, they have $205,000 in their RRSP and expect to be able to contribute $18,000 in total per year to their RRSPs for the next 14 years. They think they will need $75,000, after tax, at the beginning of each year after tax in retirement. They are presently earning 6% return on their RRSPs and anticipate this will drop to a 5% return when they retire. They will both earn the maximum CPP and OAS entitlement starting at age 65 (use generic amounts). Assume their average tax rate, based upon all income sources, in retirement will be 25%. Assume inflation to be 1.75% across all years. A) If they expect to live until age 92, what is the present value of their retirement income needs at age 65 (retirement date)? (2marks) (show your variables for key strokes) B) Based upon the above stated returns, what will be the value of their current RRSP balances and future annual RRSP savings on retirement date, assuming that savings occur at the end of the year? (2 marks) C) Based upon the stated returns, what will be the present value of their CPP/OAS entitlements on retirement date? (remember that both CPP and OAS are indexed for inflation) (2 marks) D) Based upon the results of A), B) and C), will Gary & Vanessa have saved enough/too much to fund their current retirement objectives? Quantify the excess/shortfall. (1 mark) E) Briefly indicate for your clients what factors they may consider changing (and how to change them) to bring their projections in line with their objectives. (2 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A To determine the present value of their retirement income needs we can use the present value formula PV C 1 rn Where PV is the present value C is the future cash flow r is the discount rate and n is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started