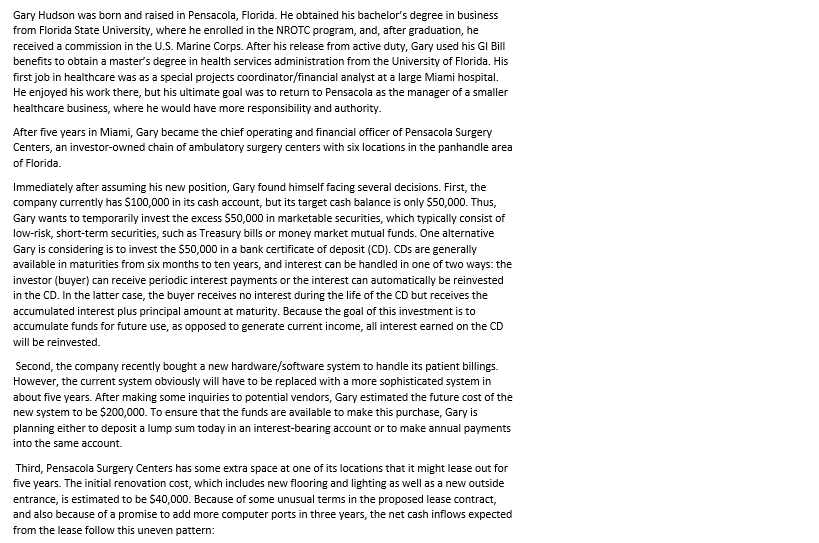

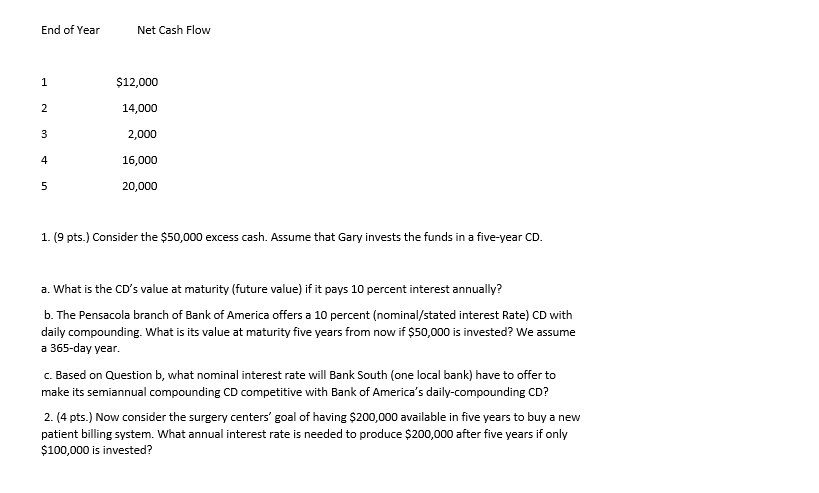

Gary Hudson was born and raised in Pensacola, Florida. He obtained his bachelor's degree in business from Florida State University, where he enrolled in the NROTC program, and, after graduation, he received a commission in the U.S. Marine Corps. After his release from active duty, Gary used his Gl Bill benefits to obtain a master's degree in health services administration from the University of Florida. His first job in healthcare was as a special projects coordinator/financial analyst at a large Miami hospital He enjoyed his work there, but his ultimate goal was to return to Pensacola as the manager of a smaller healthcare business, where he would have more responsibility and authority After five years in Miami, Gary became the chief operating and financial officer of Pensacola Surgery Centers, an investor-owned chain of ambulatory surgery centers with six locations in the panhandle area of Florida Immediately after assuming his new position, Gary found himself facing several decisions. First, the company currently has $100,000 in its cash account, but its target cash balance is only S50,000. Thus, Gary wants to temporarily invest the excess $50,000 in marketable securities, which typically consist of low-risk, short-term securities, such as Treasury bills or money market mutual funds. One alternative Gary is considering is to invest the S50,000 in a bank certificate of deposit (CD). CDs are generally available in maturities from six months to ten years, and interest can be handled in one of two ways: the investor (buyer) can receive periodic interest payments or the interest can automatically be reinvested in the CD. In the latter case, the buyer receives no interest during the life of the CD but receives the accumulated interest plus principal amount at maturity. Because the goal of this investment is to accumulate funds for future use, as opposed to generate current income, all interest earned on the CD will be reinvested. Second, the company recently bought a new hardware/software system to handle its patient billings. However, the current system obviously will have to be replaced with a more sophisticated system in about five years. After making some inquiries to potential vendors, Gary estimated the future cost of the new system to be $200,000. To ensure that the funds are available to make this purchase, Gary is planning either to deposit a lump sum today in an interest-bearing account or to make annual payments into the same account. Third, Pensacola Surgery Centers has some extra space at one of its locations that it might lease out for five years. The initial renovation cost, which includes new flooring and lighting as well as a new outside entrance, is estimated to be S40,000. Because of some unusual terms in the proposed lease contract, and also because of a promise to add more computer ports in three years, the net cash inflows expected from the lease follow this uneven pattern