Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gaspar Manufacturing produces a single product: a component for commercial agricultural machinery. The company uses absorption costing for external financial reporting purposes and variable

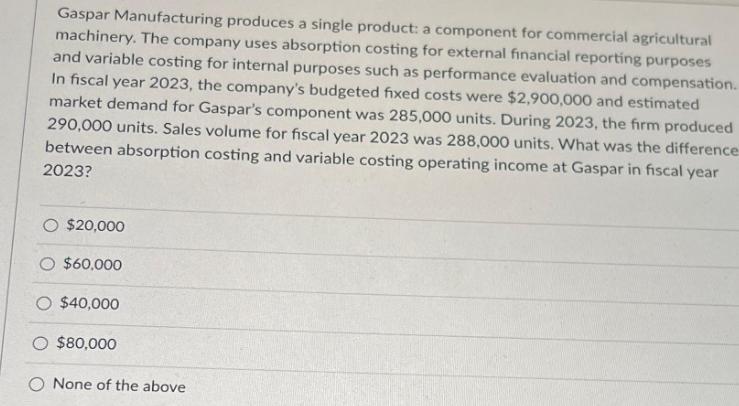

Gaspar Manufacturing produces a single product: a component for commercial agricultural machinery. The company uses absorption costing for external financial reporting purposes and variable costing for internal purposes such as performance evaluation and compensation. In fiscal year 2023, the company's budgeted fixed costs were $2,900,000 and estimated market demand for Gaspar's component was 285,000 units. During 2023, the firm produced 290,000 units. Sales volume for fiscal year 2023 was 288,000 units. What was the difference between absorption costing and variable costing operating income at Gaspar in fiscal year 2023? O $20,000 O $60,000 O $40,000 O $80,000 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image provides the following information Gaspar Manufacturing produces a single product a component for commercial agricultural machinery The comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started