Answered step by step

Verified Expert Solution

Question

1 Approved Answer

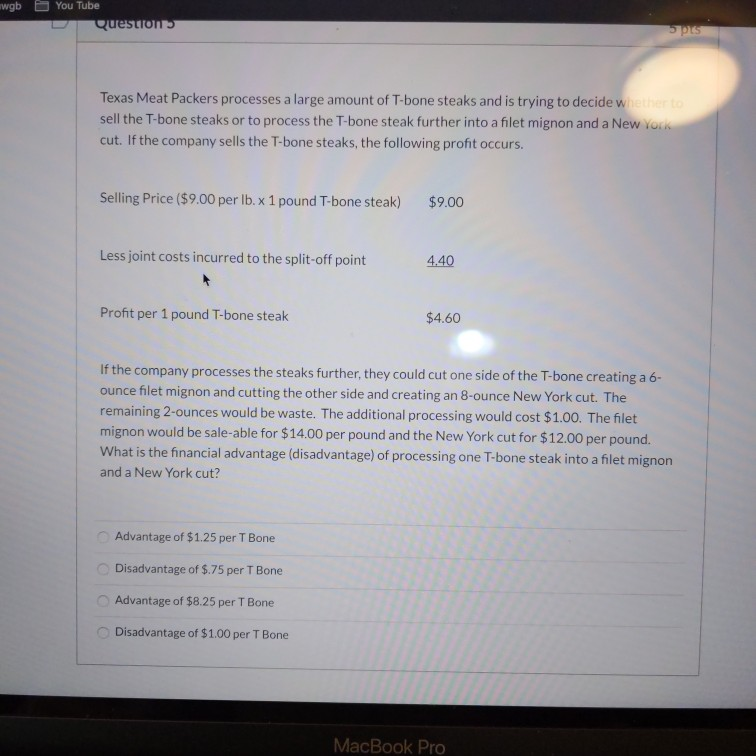

gb You Tube Questions 0155 Texas Meat Packers processes a large amount of T-bone steaks and is trying to decide we sell the T-bone steaks

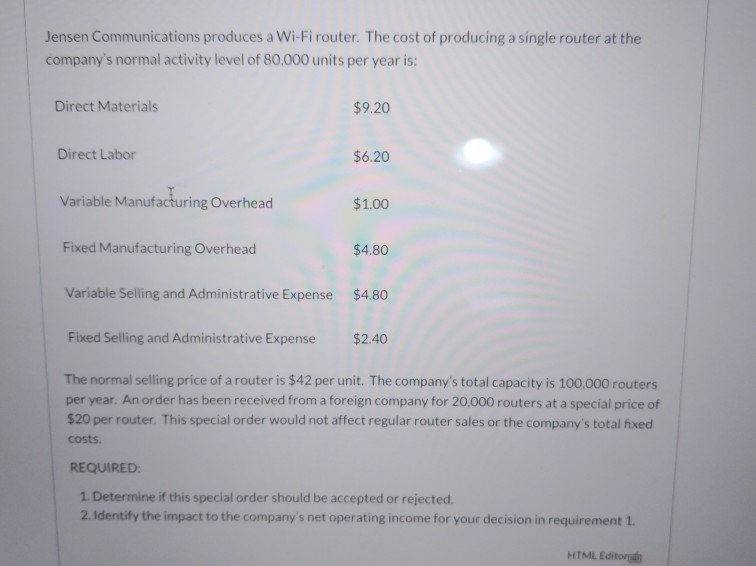

gb You Tube Questions 0155 Texas Meat Packers processes a large amount of T-bone steaks and is trying to decide we sell the T-bone steaks or to process the T-bone steak further into a filet mignon and a New York cut. If the company sells the T-bone steaks, the following profit occurs. Selling Price ($9.00 per lb. x 1 pound T-bone steak) $9.00 Less joint costs incurred to the split-off point 4.40 Profit per 1 pound T-bone steak $4.60 If the company processes the steaks further, they could cut one side of the T-bone creating a 6- ounce filet mignon and cutting the other side and creating an 8-ounce New York cut. The remaining 2-ounces would be waste. The additional processing would cost $1.00. The filet mignon would be sale-able for $14.00 per pound and the New York cut for $12.00 per pound. What is the financial advantage (disadvantage) of processing one T-bone steak into a filet mignon and a New York cut? Advantage of $1.25 per T Bone Disadvantage of $.75 per T Bone Advantage of $8.25 per T Bone Disadvantage of $1.00 per T Bone MacBook Pro Jensen Communications produces a Wi-Fi router. The cost of producing a single router at the company's normal activity level of 80,000 units per year is: Direct Materials $9.20 Direct Labor $6.20 Variable Manufacturing Overhead $1.00 Fixed Manufacturing Overhead $4.80 Variable Selling and Administrative Expense $4.80 Fixed Selling and Administrative Expense $2.40 The normal selling price of a router is $42 per unit. The company's total capacity is 100,000 routers per year. An order has been received from a foreign company for 20,000 routers at a special price of $20 per router. This special order would not affect regular router sales or the company's total fixed costs. REQUIRED 1. Determine if this special order should be accepted or rejected. 2. Identify the impact to the company's net operating income for your decision in requirement 1. HTML Editor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started