Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GCC Ltd. includes warranty coverage in the price it charges to customers for its products. For the year ending December 31, 20X2 the company

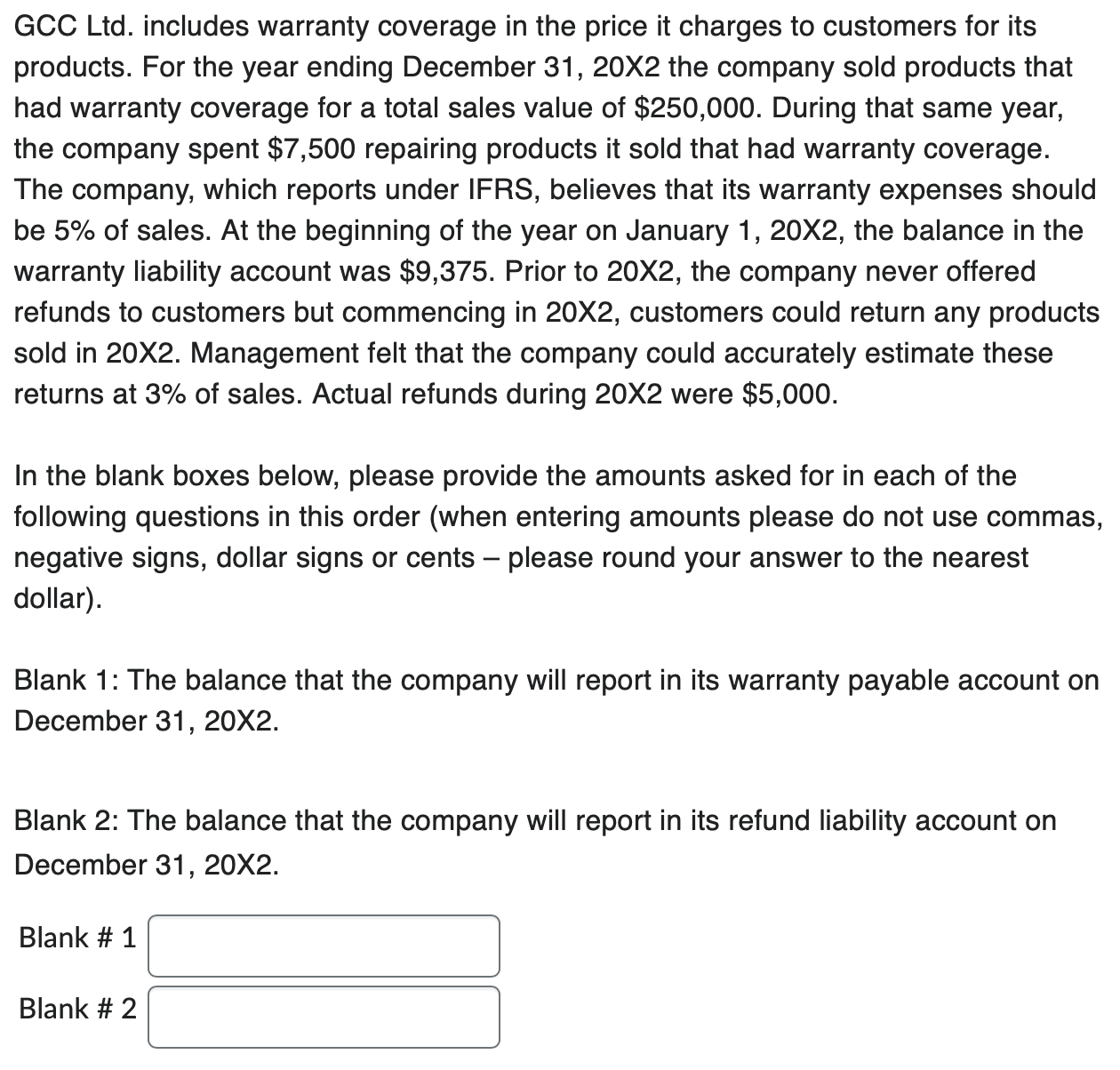

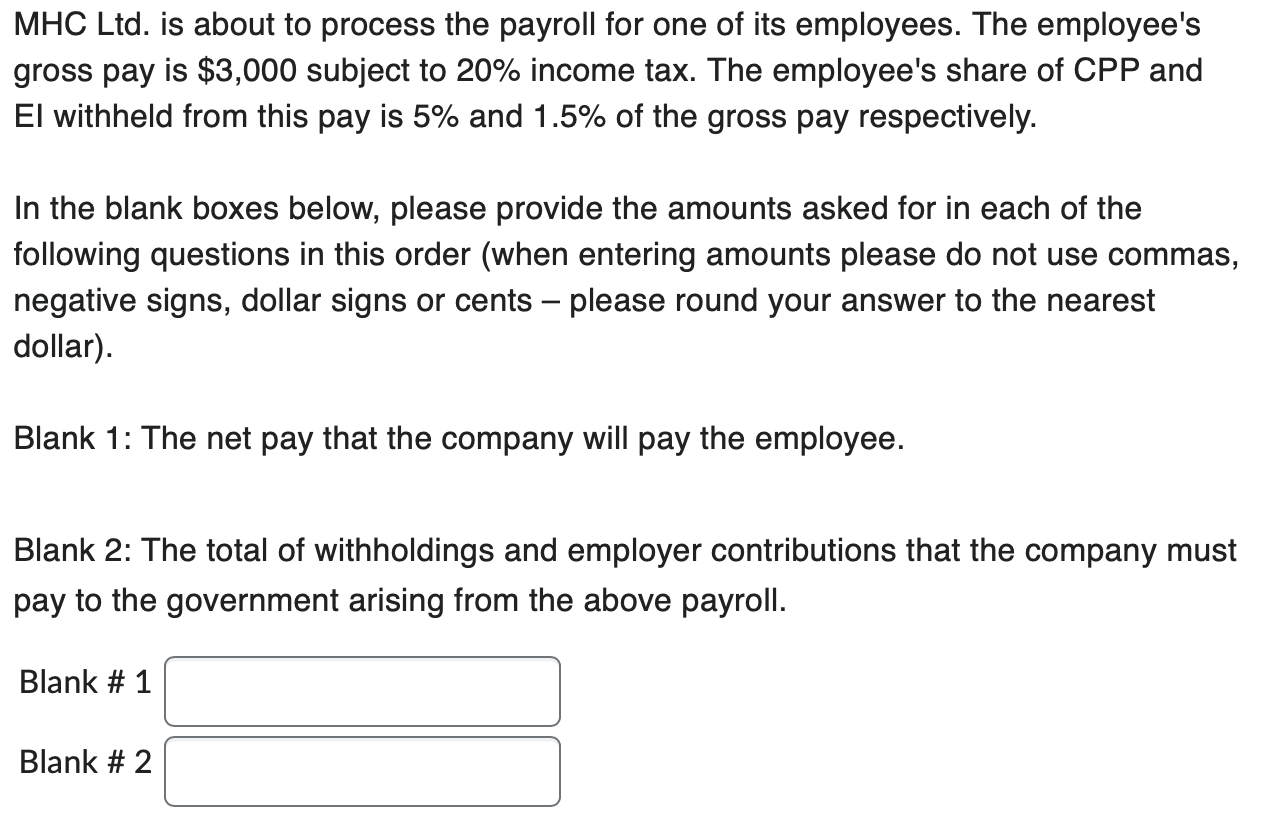

GCC Ltd. includes warranty coverage in the price it charges to customers for its products. For the year ending December 31, 20X2 the company sold products that had warranty coverage for a total sales value of $250,000. During that same year, the company spent $7,500 repairing products it sold that had warranty coverage. The company, which reports under IFRS, believes that its warranty expenses should be 5% of sales. At the beginning of the year on January 1, 20X2, the balance in the warranty liability account was $9,375. Prior to 20X2, the company never offered refunds to customers but commencing in 20X2, customers could return any products sold in 20X2. Management felt that the company could accurately estimate these returns at 3% of sales. Actual refunds during 20X2 were $5,000. In the blank boxes below, please provide the amounts asked for in each of the following questions in this order (when entering amounts please do not use commas, negative signs, dollar signs or cents please round your answer to the nearest dollar). Blank 1: The balance that the company will report in its warranty payable account on December 31, 20X2. Blank 2: The balance that the company will report in its refund liability account on December 31, 20X2. Blank # 1 Blank # 2 MHC Ltd. is about to process the payroll for one of its employees. The employee's gross pay is $3,000 subject to 20% income tax. The employee's share of CPP and El withheld from this pay is 5% and 1.5% of the gross pay respectively. In the blank boxes below, please provide the amounts asked for in each of the following questions in this order (when entering amounts please do not use commas, negative signs, dollar signs or cents - please round your answer to the nearest dollar). Blank 1: The net pay that the company will pay the employee. Blank 2: The total of withholdings and employer contributions that the company must pay to the government arising from the above payroll. Blank # 1 Blank # 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Blank 1 The balance that the company will report in its warranty payable account on December 31 20X2 To calculate the balance in the warranty payable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started