Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ge.com/staticb/ui/evo/index.html?eISBN=9780357114537&snapshotid=2568853&id=1277743559 WGAGE MINDTAP Assignment - Corporate Valuation and Financial Planning Blue Elk Manufacturing Balance Sheet For the Year Ended on December 31 Assets Liabilities Current

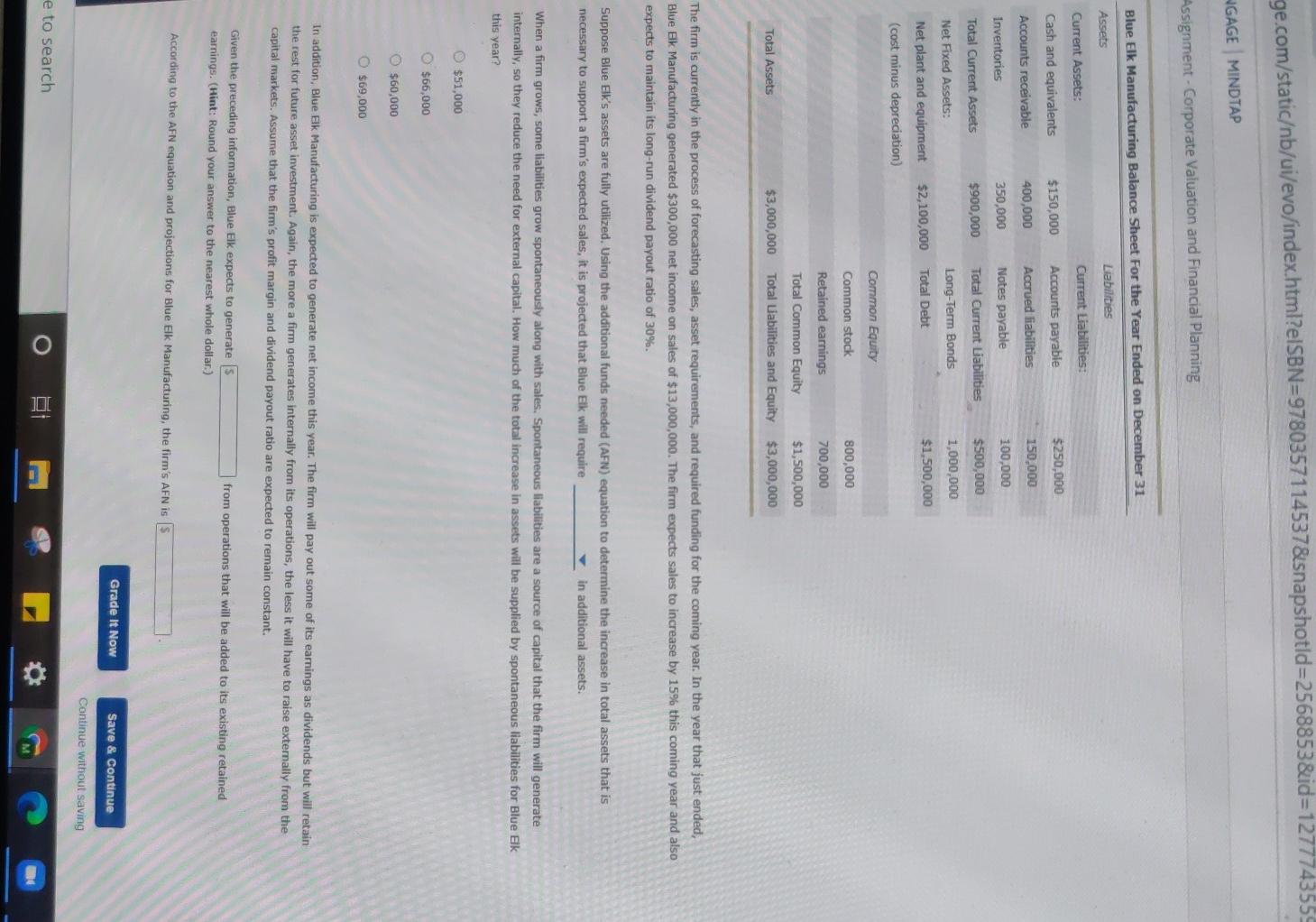

ge.com/staticb/ui/evo/index.html?eISBN=9780357114537&snapshotid=2568853&id=1277743559 WGAGE MINDTAP Assignment - Corporate Valuation and Financial Planning Blue Elk Manufacturing Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: $150,000 Cash and equivalents Current Liabilities: Accounts payable Accrued liabilities $250,000 400,000 Accounts receivable 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 $1,500,000 $2,100,000 Total Debt Net plant and equipment (cost minus depreciation) Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Liabilities and Equity $3,000,000 Total Assets $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Blue Elk Manufacturing generated $300,000 net income on sales of $13,000,000. The firm expects sales to increase by 15% this coming year and also expects to maintain its long-run dividend payout ratio of 30%. Suppose Blue Ek's assets are fully utilized. Using the additional funds needed (AFN) equation to determine the increase in total assets that is necessary to support a firm's expected sales, it is projected that Blue Elk will require in additional assets. When a firm grows, some liabilities grow spontaneously along with sales. Spontaneous liabilities are a source of capital that the firm will generate internally, so they reduce the need for external capital. How much of the total increase in assets will be supplied by spontaneous liabilities for Blue Elk this year? $51,000 $66,000 O $60,000 $69,000 In addition, Blue Elk Manufacturing is expected to generate net income this year. The firm will pay out some of its earnings as dividends but will retain the rest for future asset investment. Again, the more a firm generates internally from its operations, the less it will have to raise externally from the capital markets. Assume that the firm's profit margin and dividend payout ratio are expected to remain constant. Given the preceding information, Blue Elk expects to generates earnings. (Hint: Round your answer to the nearest whole dollar.) from operations that will be added to its existing retained According to the AFN equation and projections for Blue Elk Manufacturing, the firm's AFN is Grade It Now Save & Continue Continue without saving e to search o ge.com/staticb/ui/evo/index.html?eISBN=9780357114537&snapshotid=2568853&id=1277743559 WGAGE MINDTAP Assignment - Corporate Valuation and Financial Planning Blue Elk Manufacturing Balance Sheet For the Year Ended on December 31 Assets Liabilities Current Assets: $150,000 Cash and equivalents Current Liabilities: Accounts payable Accrued liabilities $250,000 400,000 Accounts receivable 150,000 Inventories 350,000 Notes payable 100,000 Total Current Assets $900,000 Total Current Liabilities $500,000 Net Fixed Assets: Long-Term Bonds 1,000,000 $1,500,000 $2,100,000 Total Debt Net plant and equipment (cost minus depreciation) Common Equity Common stock 800,000 Retained earnings 700,000 Total Common Equity $1,500,000 Total Liabilities and Equity $3,000,000 Total Assets $3,000,000 The firm is currently in the process of forecasting sales, asset requirements, and required funding for the coming year. In the year that just ended, Blue Elk Manufacturing generated $300,000 net income on sales of $13,000,000. The firm expects sales to increase by 15% this coming year and also expects to maintain its long-run dividend payout ratio of 30%. Suppose Blue Ek's assets are fully utilized. Using the additional funds needed (AFN) equation to determine the increase in total assets that is necessary to support a firm's expected sales, it is projected that Blue Elk will require in additional assets. When a firm grows, some liabilities grow spontaneously along with sales. Spontaneous liabilities are a source of capital that the firm will generate internally, so they reduce the need for external capital. How much of the total increase in assets will be supplied by spontaneous liabilities for Blue Elk this year? $51,000 $66,000 O $60,000 $69,000 In addition, Blue Elk Manufacturing is expected to generate net income this year. The firm will pay out some of its earnings as dividends but will retain the rest for future asset investment. Again, the more a firm generates internally from its operations, the less it will have to raise externally from the capital markets. Assume that the firm's profit margin and dividend payout ratio are expected to remain constant. Given the preceding information, Blue Elk expects to generates earnings. (Hint: Round your answer to the nearest whole dollar.) from operations that will be added to its existing retained According to the AFN equation and projections for Blue Elk Manufacturing, the firm's AFN is Grade It Now Save & Continue Continue without saving e to search o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started