Answered step by step

Verified Expert Solution

Question

1 Approved Answer

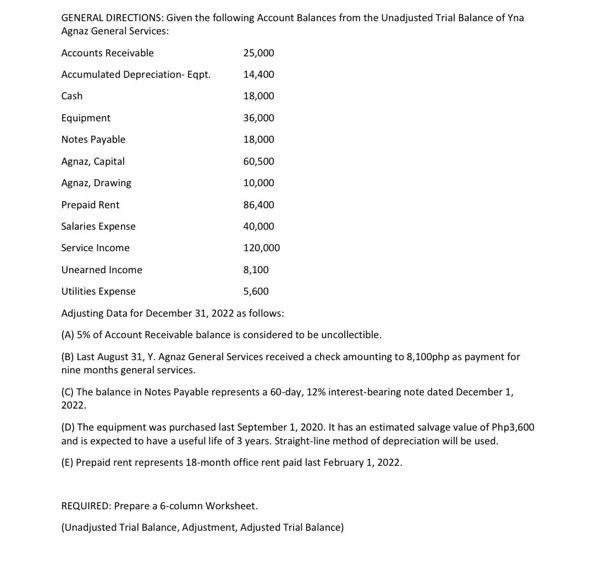

GENERAL DIRECTIONS: Given the following Account Balances from the Unadjusted Trial Balance of Yna Agnaz General Services: Accounts Receivable Accumulated Depreciation- Eqpt. Cash Equipment

GENERAL DIRECTIONS: Given the following Account Balances from the Unadjusted Trial Balance of Yna Agnaz General Services: Accounts Receivable Accumulated Depreciation- Eqpt. Cash Equipment Notes Payable Agnaz, Capital Agnaz, Drawing Prepaid Rent Salaries Expense Service Income 25,000 14,400 18,000 36,000 18,000 60,500 10,000 86,400 40,000 120,000 Unearned Income 8,100 Utilities Expense 5,600 Adjusting Data for December 31, 2022 as follows: (A) 5% of Account Receivable balance is considered to be uncollectible. (B) Last August 31, Y. Agnaz General Services received a check amounting to 8,100php as payment for nine months general services. (C) The balance in Notes Payable represents a 60-day, 12% interest-bearing note dated December 1, 2022. (D) The equipment was purchased last September 1, 2020. It has an estimated salvage value of Php3,600 and is expected to have a useful life of 3 years. Straight-line method of depreciation will be used. (E) Prepaid rent represents 18-month office rent paid last February 1, 2022. REQUIRED: Prepare a 6-column Worksheet. (Unadjusted Trial Balance, Adjustment, Adjusted Trial Balance)

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Worksheet for Yna Agnaz General Services Account Title Debit Credit Adjustment Adjusted Debit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started