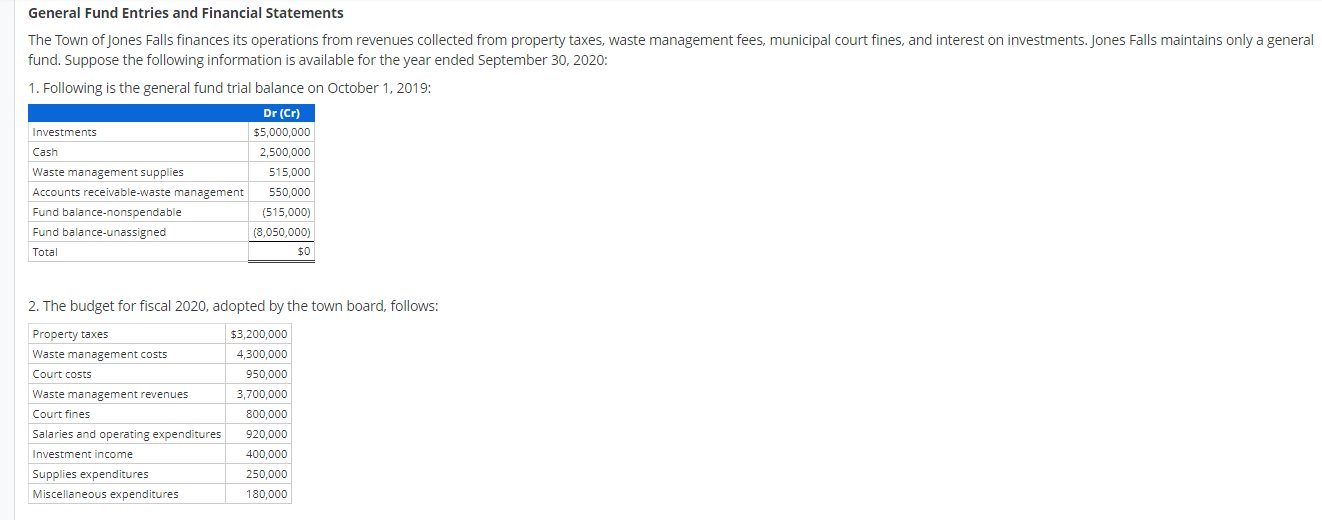

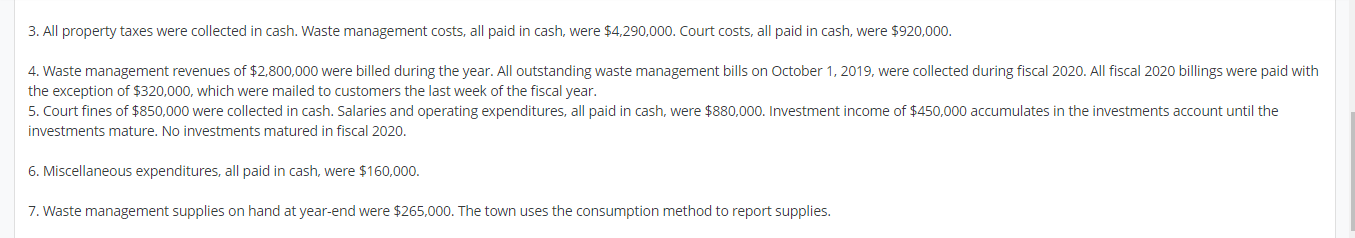

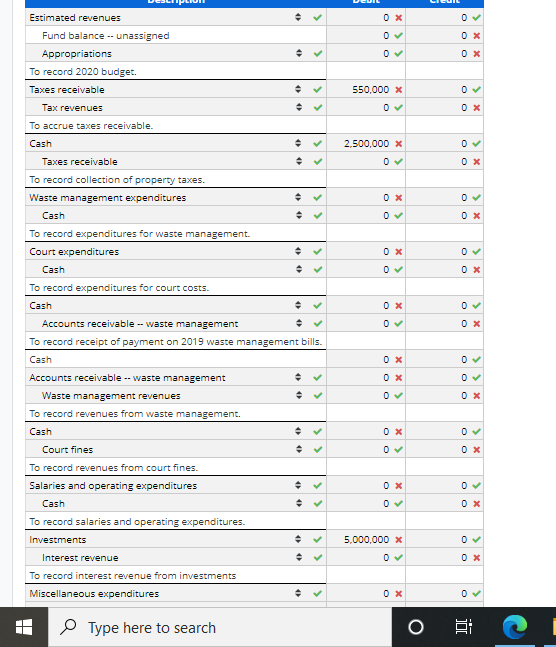

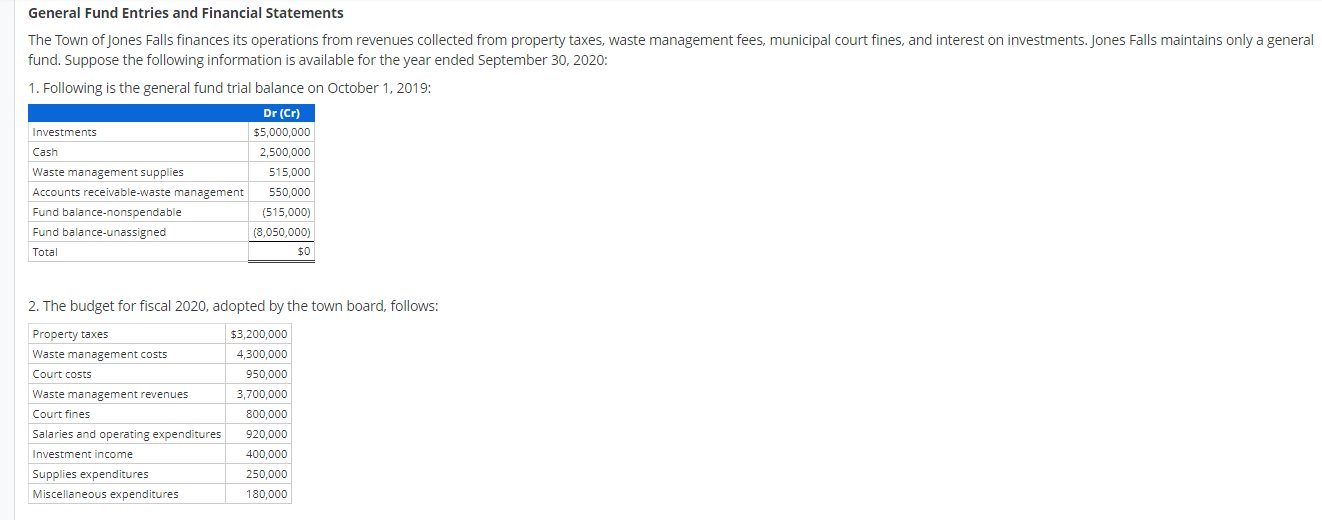

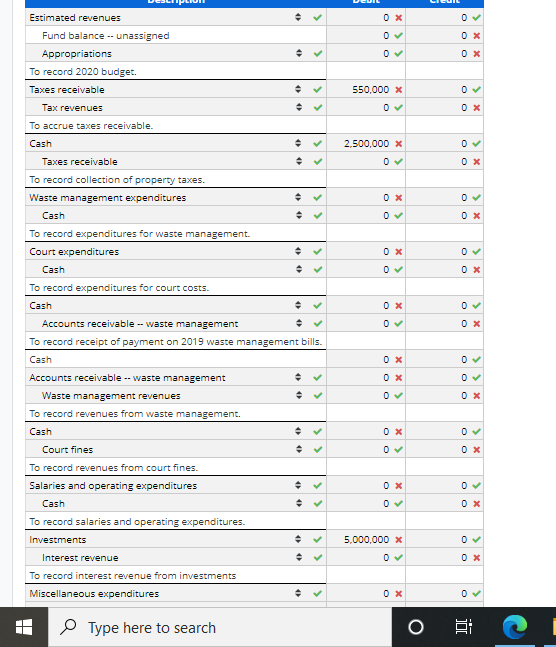

General Fund Entries and Financial Statements The Town of Jones Falls finances its operations from revenues collected from property taxes, waste management fees, municipal court fines, and interest on investments. Jones Falls maintains only a general fund. Suppose the following information is available for the year ended September 30, 2020: 1. Following is the general fund trial balance on October 1, 2019: Dr (Cr) Investments Cash Waste management supplies Accounts receivable-waste management Fund balance-nonspendable Fund balance unassigned Total $5,000,000 2,500,000 515,000 550,000 (515,000) (8,050,000) $0 2. The budget for fiscal 2020, adopted by the town board, follows: Property taxes Waste management costs Court costs Waste management revenues Court fines Salaries and operating expenditures Investment income Supplies expenditures Miscellaneous expenditures $3,200,000 4,300,000 950,000 3,700,000 800,000 920,000 400,000 250,000 180,000 3. All property taxes were collected in cash. Waste management costs, all paid in cash, were $4,290,000. Court costs, all paid in cash, were $920,000. 4. Waste management revenues of $2,800,000 were billed during the year. All outstanding waste management bills on October 1, 2019, were collected during fiscal 2020. All fiscal 2020 billings were paid with the exception of $320,000, which were mailed to customers the last week of the fiscal year. 5. Court fines of $850,000 were collected in cash. Salaries and operating expenditures, all paid in cash, were $880,000. Investment income of $450,000 accumulates in the investments account until the investments mature. No investments matured in fiscal 2020. 6. Miscellaneous expenditures, all paid in cash, were $160,000. 7. Waste management supplies on hand at year-end were $265,000. The town uses the consumption method to report supplies. OX OX . OX 550,000 x 0 x 2.500,000 X Estimated revenues Fund balance -- unassigned Appropriations To record 2020 budget. Taxes receivable Tax revenues To accrue taxes receivable. Cash Taxes receivable To record collection of property taxes. Waste management expenditures Cash To record expenditures for waste management. Court expenditures Cash To record expenditures for court costs. Cash Accounts receivable -- waste management To record receipt of payment on 2019 waste management bills. Cash 0 x 0 x . OX OX 07 OX OX Accounts receivable -- Waste management OX Waste management revenues To record revenues from waste management. Cash OX > > OX Court fines To record revenues from court fines. Salaries and operating expenditures Cash To record salaries and operating expenditures. Investments 0 x 5,000,000 x Interest revenue OX To record interest revenue from investments Miscellaneous expenditures O Type here to search General Fund Entries and Financial Statements The Town of Jones Falls finances its operations from revenues collected from property taxes, waste management fees, municipal court fines, and interest on investments. Jones Falls maintains only a general fund. Suppose the following information is available for the year ended September 30, 2020: 1. Following is the general fund trial balance on October 1, 2019: Dr (Cr) Investments Cash Waste management supplies Accounts receivable-waste management Fund balance-nonspendable Fund balance unassigned Total $5,000,000 2,500,000 515,000 550,000 (515,000) (8,050,000) $0 2. The budget for fiscal 2020, adopted by the town board, follows: Property taxes Waste management costs Court costs Waste management revenues Court fines Salaries and operating expenditures Investment income Supplies expenditures Miscellaneous expenditures $3,200,000 4,300,000 950,000 3,700,000 800,000 920,000 400,000 250,000 180,000 3. All property taxes were collected in cash. Waste management costs, all paid in cash, were $4,290,000. Court costs, all paid in cash, were $920,000. 4. Waste management revenues of $2,800,000 were billed during the year. All outstanding waste management bills on October 1, 2019, were collected during fiscal 2020. All fiscal 2020 billings were paid with the exception of $320,000, which were mailed to customers the last week of the fiscal year. 5. Court fines of $850,000 were collected in cash. Salaries and operating expenditures, all paid in cash, were $880,000. Investment income of $450,000 accumulates in the investments account until the investments mature. No investments matured in fiscal 2020. 6. Miscellaneous expenditures, all paid in cash, were $160,000. 7. Waste management supplies on hand at year-end were $265,000. The town uses the consumption method to report supplies. OX OX . OX 550,000 x 0 x 2.500,000 X Estimated revenues Fund balance -- unassigned Appropriations To record 2020 budget. Taxes receivable Tax revenues To accrue taxes receivable. Cash Taxes receivable To record collection of property taxes. Waste management expenditures Cash To record expenditures for waste management. Court expenditures Cash To record expenditures for court costs. Cash Accounts receivable -- waste management To record receipt of payment on 2019 waste management bills. Cash 0 x 0 x . OX OX 07 OX OX Accounts receivable -- Waste management OX Waste management revenues To record revenues from waste management. Cash OX > > OX Court fines To record revenues from court fines. Salaries and operating expenditures Cash To record salaries and operating expenditures. Investments 0 x 5,000,000 x Interest revenue OX To record interest revenue from investments Miscellaneous expenditures O Type here to search