Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GENERAL INFORMATION You are a junior tax consultant at Tax Easy, a tax consultancy firm. Your manager has assigned tax-related work to you which you

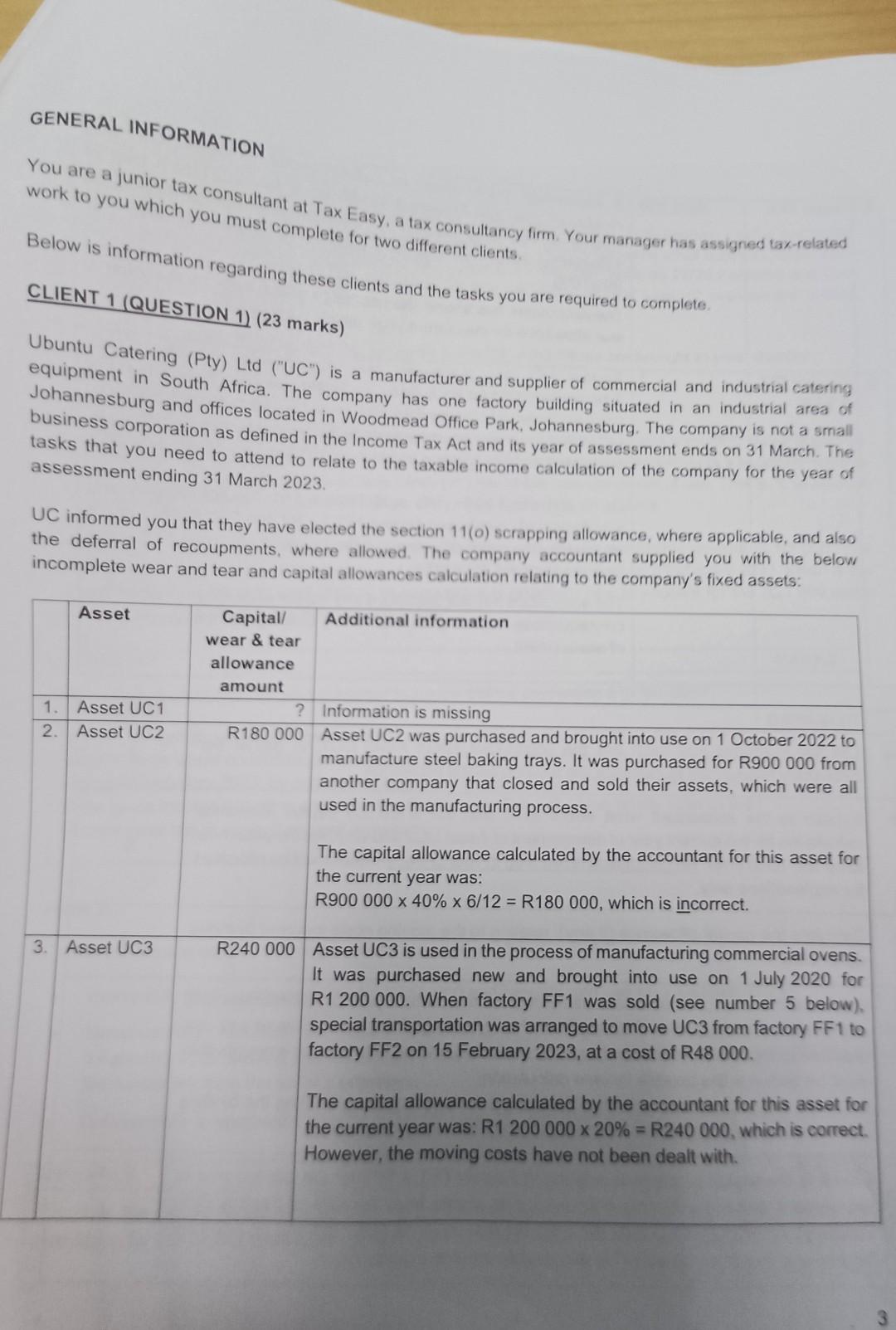

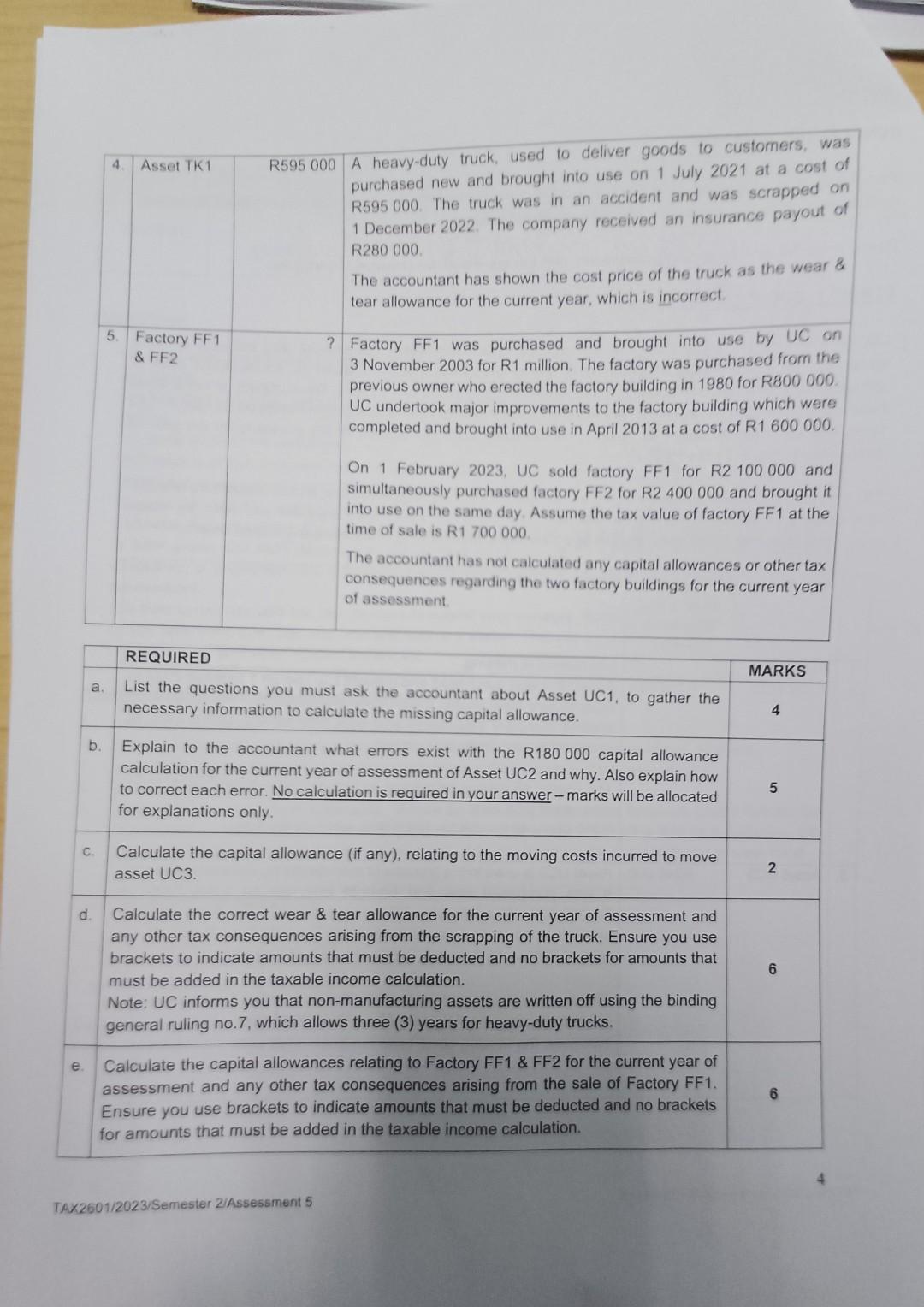

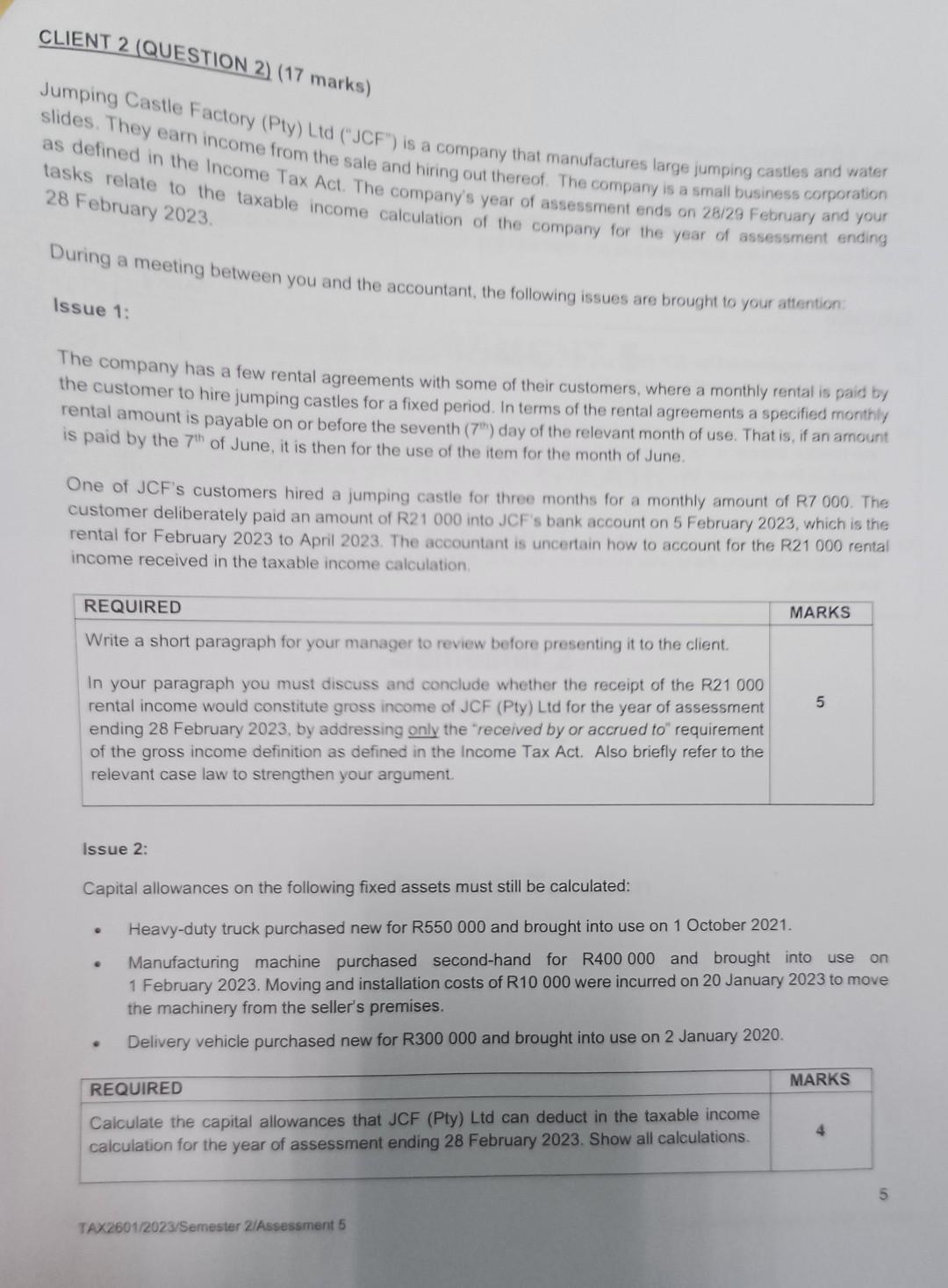

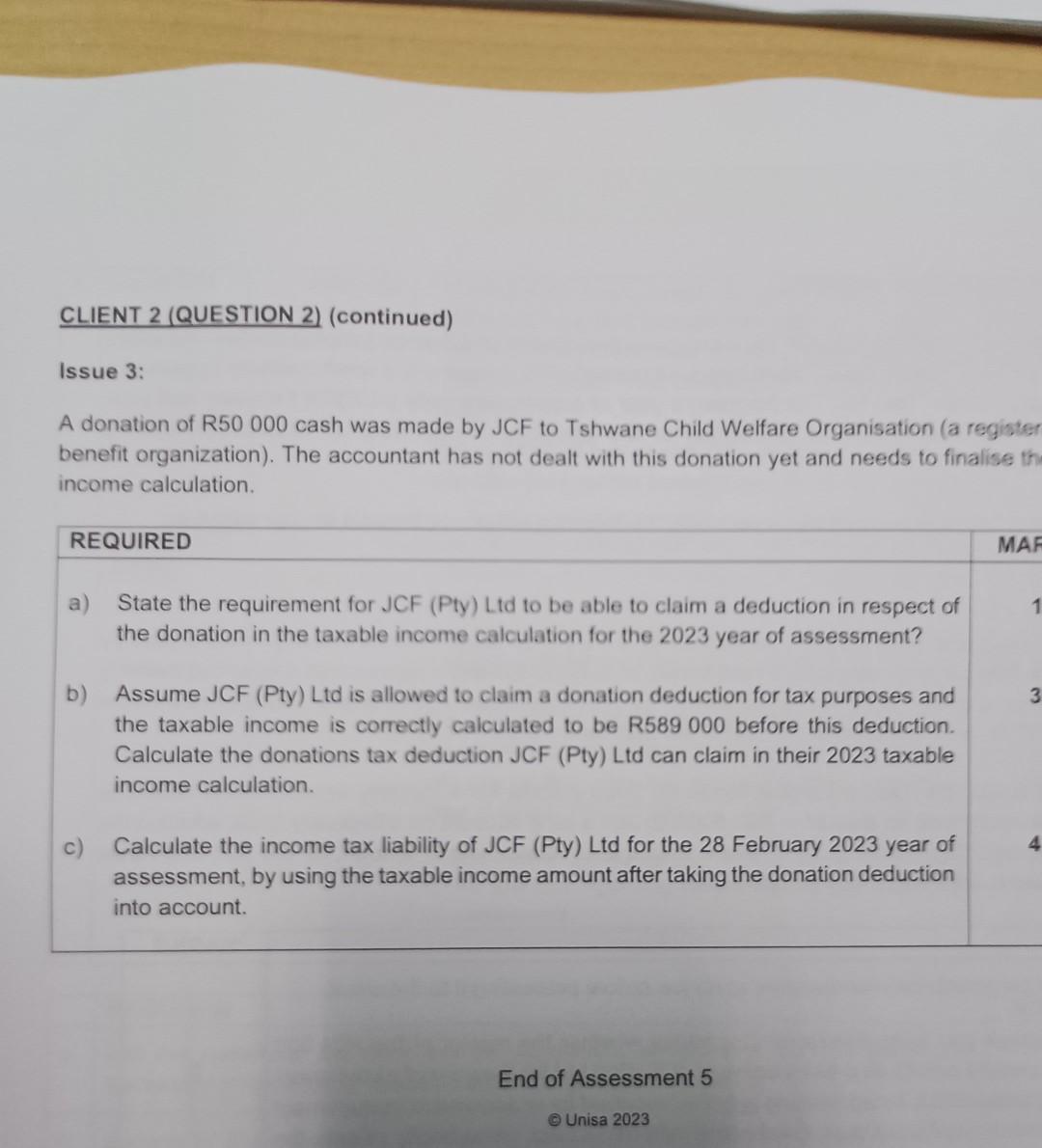

GENERAL INFORMATION You are a junior tax consultant at Tax Easy, a tax consultancy firm. Your manager has assigned tax-related work to you which you must complete for two different clients. Below is information regarding these clients and the tasks you are required to complete. CLIENT 1 (QUESTION 1 ) (23 marks) Ubuntu Catering (Pty) Ltd ("UC") is a manufacturer and supplier of commercial and industrial catering equipment in South Africa. The company has one factory building situated in an industrial area of Johannesburg and offices located in Woodmead Office Park. Johannesburg. The company is not a small business corporation as defined in the Income Tax Act and its year of assessment ends on 31 March. The tasks that you need to attend to relate to the taxable income calculation of the company for the year of assessment ending 31 March 2023. UC informed you that they have elected the section 11(0) scrapping allowance, where applicable, and also the deferral of recoupments, where allowed. The company accountant supplied you with the below incomplete wear and tear and capital allowances calculation relating to the company's fixed assets: TAX2601/2023/Semester 2/Assessment 5 CLIENT 2 (QUESTION 2) (17 marks) slides. They earn income from the sale and hiring out thereof. The company is a small business corporation as defined in the Income Tax Act. The company's year of assessment ends on 28129 February and your tasks relate the taxable income calculation of the company for the year of assessment ending 28 February 2023. During a meeting between you and the accountant, the following issues are brought to your attention: Issue 1: The company has a few rental agreements with some of their customers, where a monthly rental is paid by the customer to hire jumping castles for a fixed period. In terms of the rental agreements a specified monthly rental amount is payable on or before the seventh (7bi) day of the relevant month of use. That is, if an amount is paid by the 7th of June, it is then for the use of the item for the month of June. One of JCF's customers hired a jumping castle for three months for a monthly amount of R7 000. The customer deliberately paid an amount of R21 000 into JCF's bank account on 5 February 2023, which is the rental for February 2023 to April 2023. The accountant is uncertain how to account for the R21 000 rental income received in the taxable income calculation. Issue 2: Capital allowances on the following fixed assets must still be calculated: - Heavy-duty truck purchased new for R550 000 and brought into use on 1 October 2021. - Manufacturing machine purchased second-hand for R400000 and brought into use on 1 February 2023. Moving and installation costs of R10 000 were incurred on 20 January 2023 to move the machinery from the seller's premises. - Delivery vehicle purchased new for R300 000 and brought into use on 2 January 2020 . A donation of R50 000 cash was made by JCF to Tshwane Child Welfare Organisation (a registe benefit organization). The accountant has not dealt with this donation yet and needs to finalise income calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started