Answered step by step

Verified Expert Solution

Question

1 Approved Answer

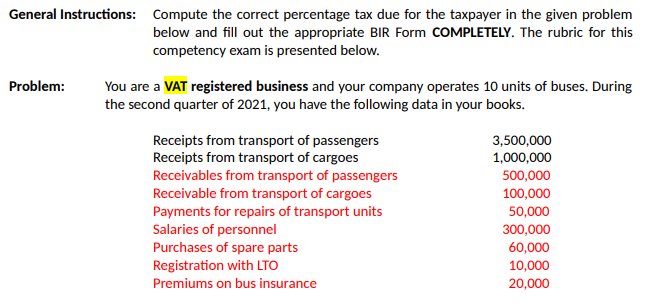

General Instructions: Compute the correct percentage tax due for the taxpayer in the given problem below and fill out the appropriate BIIR Form COMPLETELY.

General Instructions: Compute the correct percentage tax due for the taxpayer in the given problem below and fill out the appropriate BIIR Form COMPLETELY. The rubric for this competency exam is presented below. Problem: You are a VAT registered business and your company operates 10 units of buses. During the second quarter of 2021, you have the following data in your books. Receipts from transport of passengers Receipts from transport of cargoes Receivables from transport of passengers Receivable from transport of cargoes 3,500,000 1,000,000 500,000 100,000 50,000 Payments for repairs of transport units Salaries of personnel Purchases of spare parts Registration with LTO 300,000 60,000 10,000 20,000 Premiums on bus insurance

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Ans Computation of Correct Taxable Income Receipt from transportation of passangers 3500000 R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started