Question: General Instructions: Compute the correct VAT due for the taxpayer in the given problem below and fill out the appropriate BIR Form COMPLETELY. The

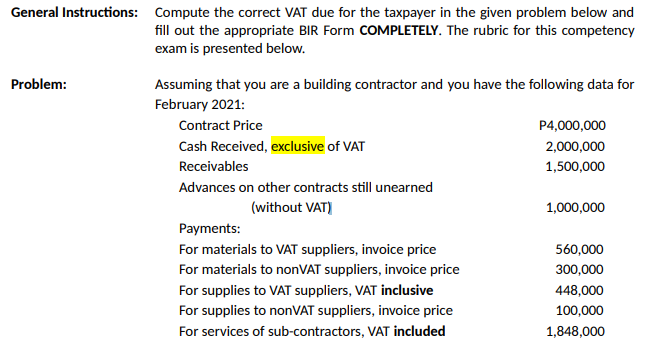

General Instructions: Compute the correct VAT due for the taxpayer in the given problem below and fill out the appropriate BIR Form COMPLETELY. The rubric for this competency exam is presented below. Problem: Assuming that you are a building contractor and you have the following data for February 2021: Contract Price Cash Received, exclusive of VAT Receivables Advances on other contracts still unearned (without VAT) Payments: For materials to VAT suppliers, invoice price For materials to nonVAT suppliers, invoice price For supplies to VAT suppliers, VAT inclusive For supplies to non VAT suppliers, invoice price For services of sub-contractors, VAT included P4,000,000 2,000,000 1,500,000 1,000,000 560,000 300,000 448,000 100,000 1,848,000

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

To compute the correct VAT due for the taxpayer and fill out the appropriate BIR Form completely we ... View full answer

Get step-by-step solutions from verified subject matter experts