General Journal options

-accounts receivable

-cash

-depreciation expense

-insurance exp

-prepaid exp

-rev

-unearned rev

-wages exp

-wages payable

\

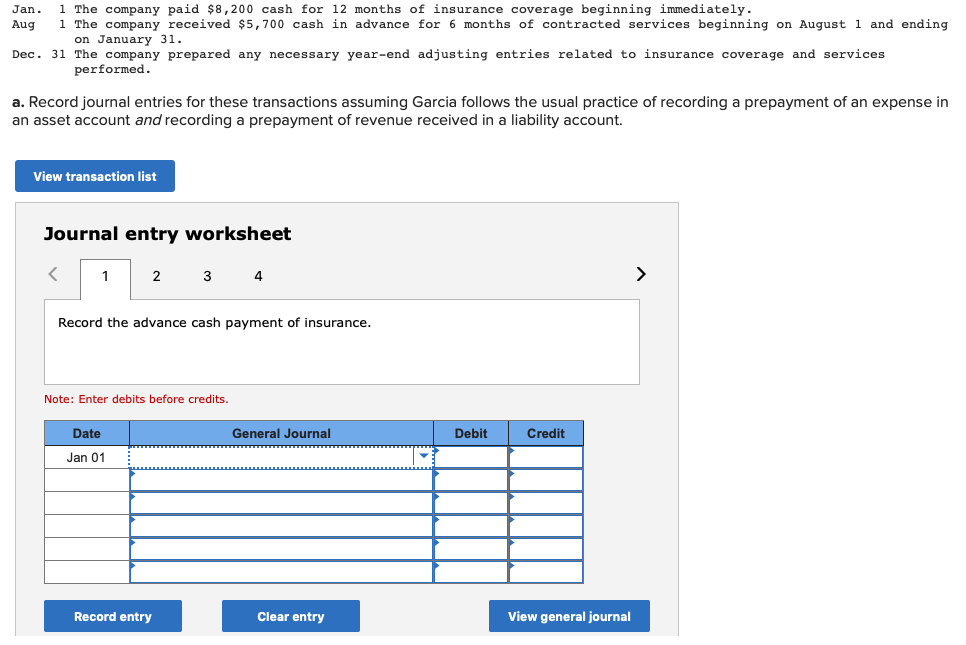

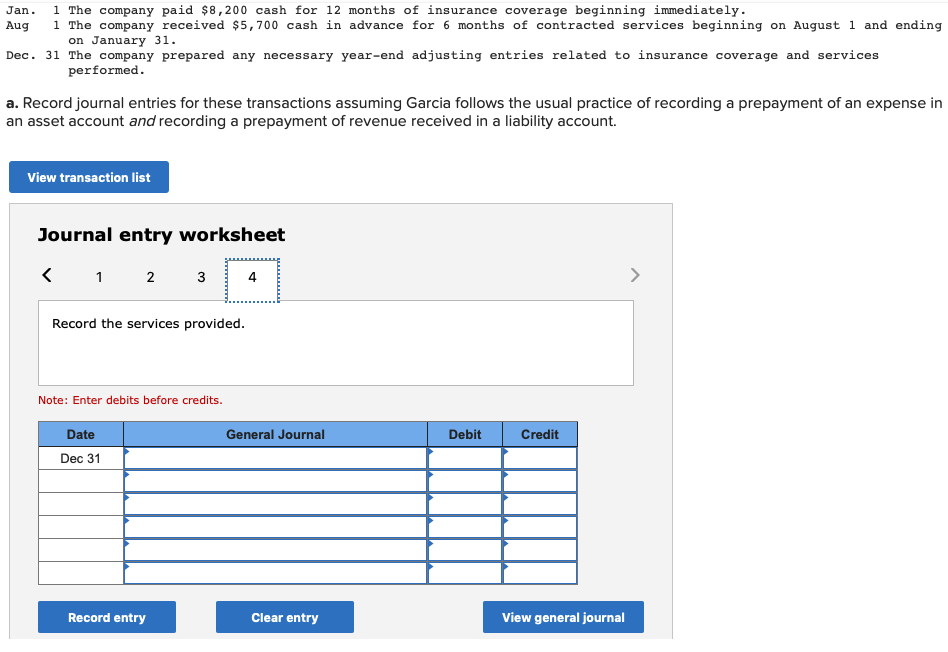

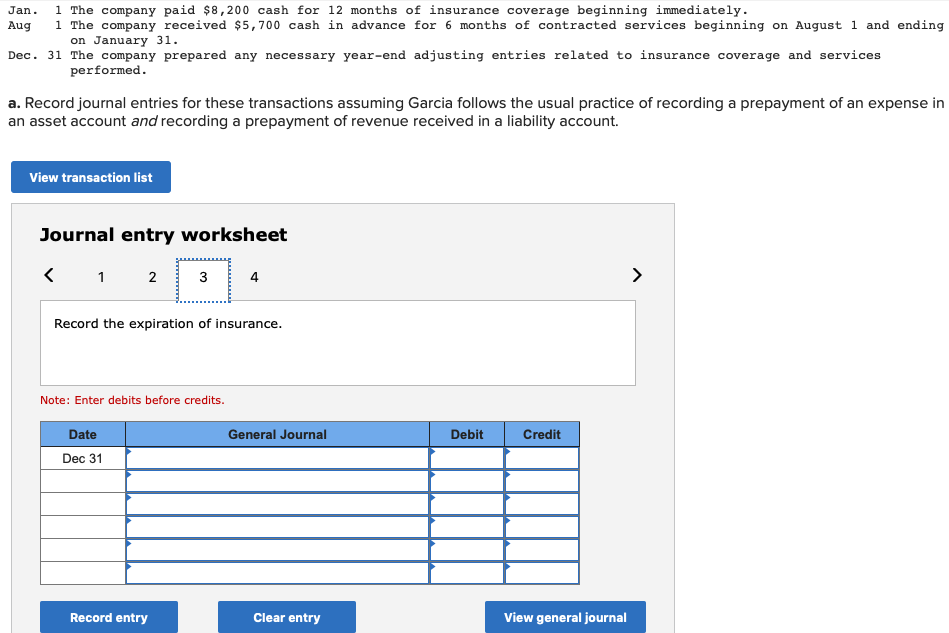

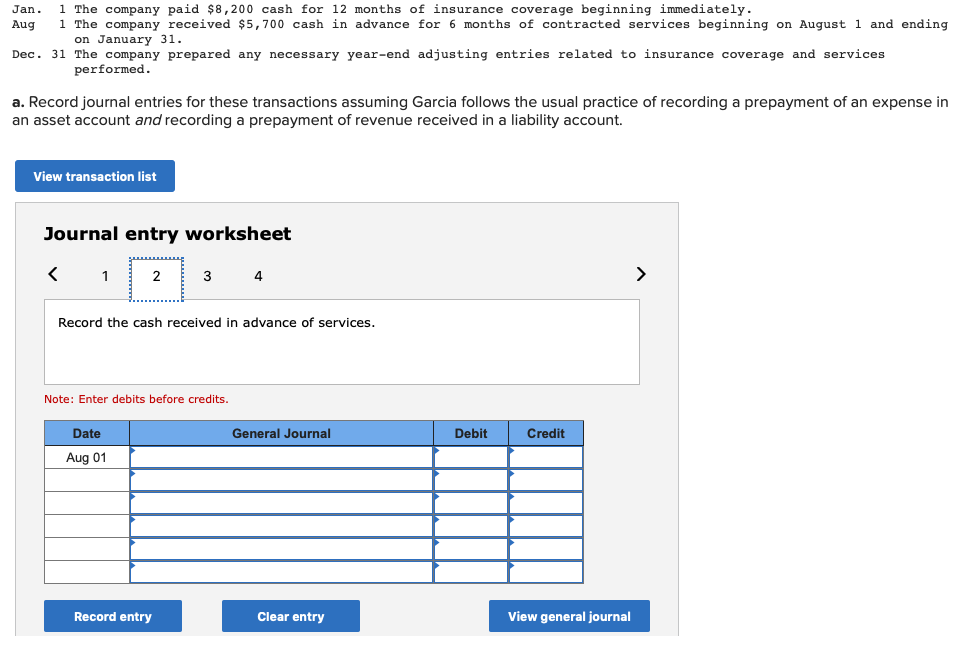

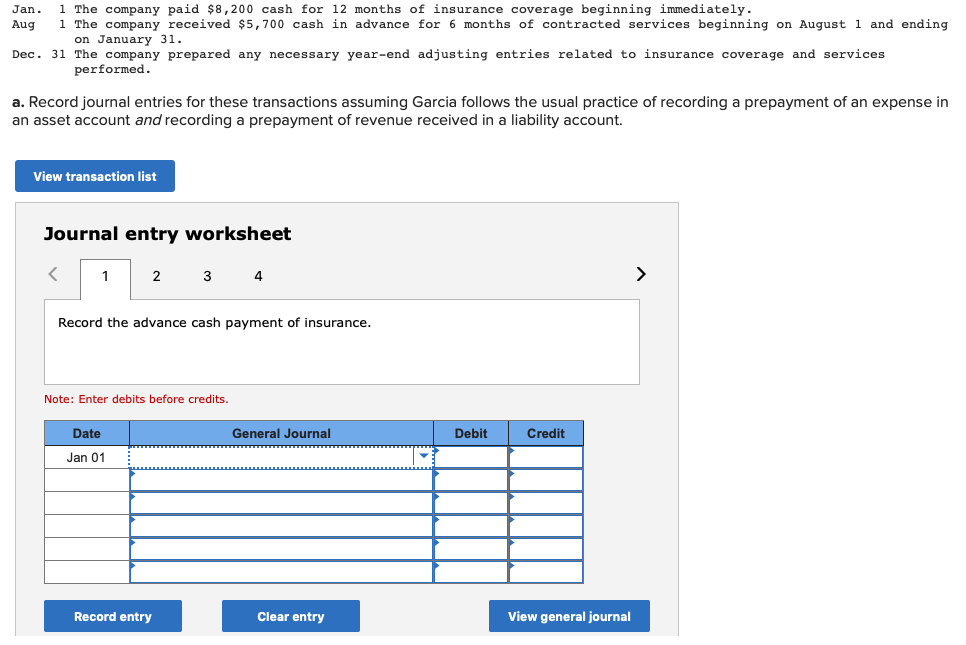

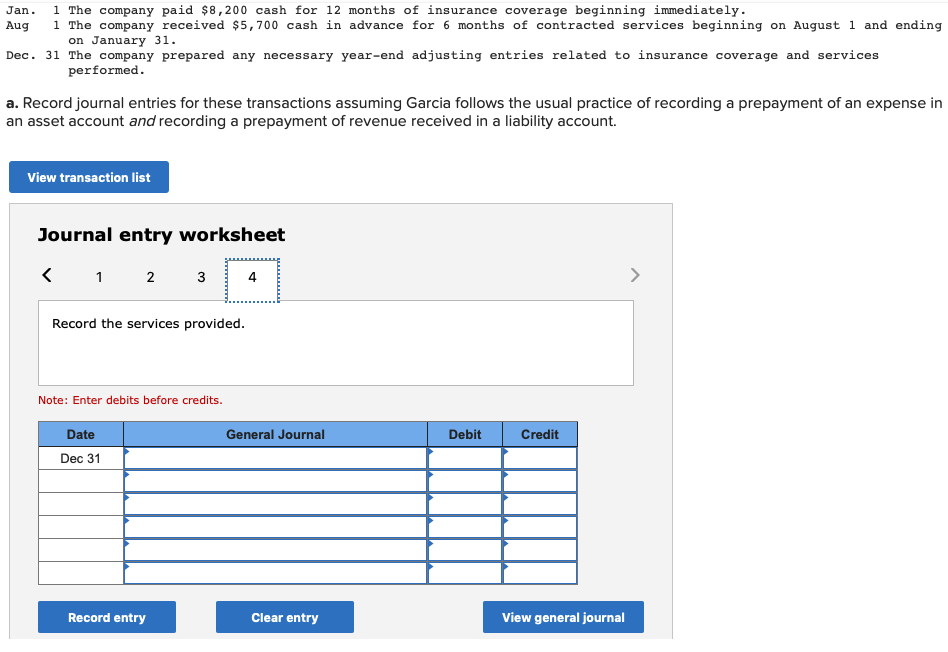

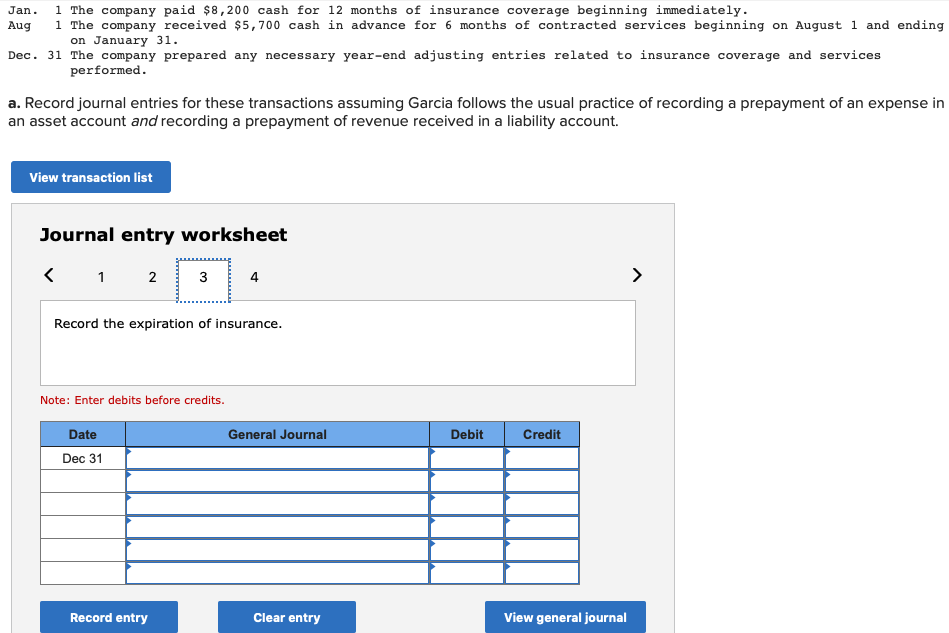

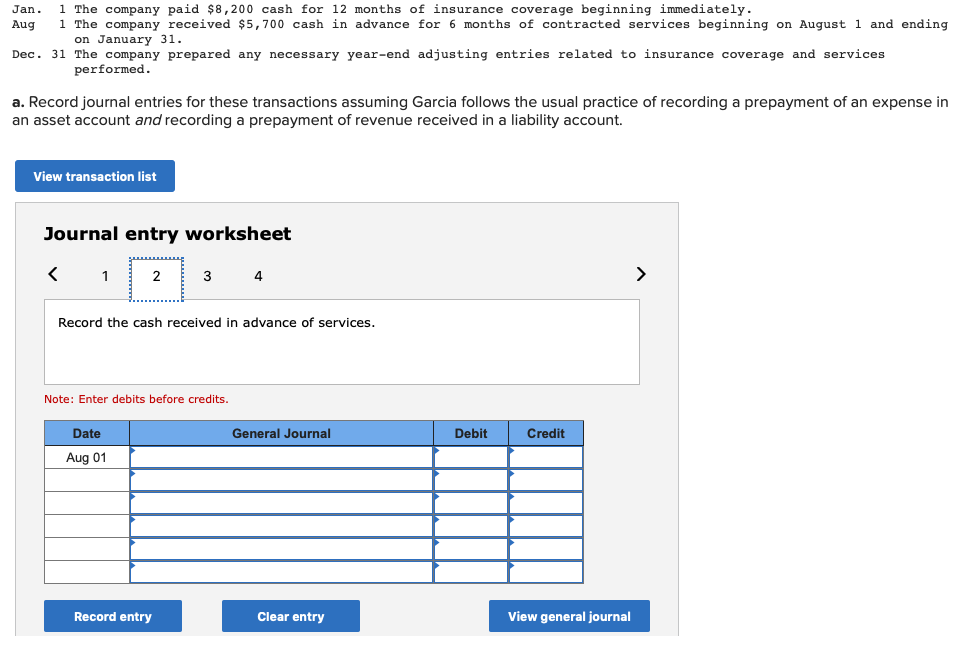

Jan. 1 The company paid $8,200 cash for 12 months of insurance coverage beginning immediately. Aug 1 The company received $5,700 cash in advance for 6 months of contracted services beginning on August 1 and ending on January 31. Dec. 31 The company prepared any necessary year-end adjusting entries related to insurance coverage and services performed a. Record journal entries for these transactions assuming Garcia follows the usual practice of recording a prepayment of an expense in an asset account and recording a prepayment of revenue received in a liability account. View transaction list Journal entry worksheet Record the advance cash payment of insurance. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journal Jan. 1 The company paid $8,200 cash for 12 months of insurance coverage beginning immediately. Aug 1 The company received $5,700 cash in advance for 6 months of contracted services beginning on August 1 and ending on January 31. Dec. 31 The company prepared any necessary year-end adjusting entries related to insurance coverage and services performed. a. Record journal entries for these transactions assuming Garcia follows the usual practice of recording a prepayment of an expense in an asset account and recording a prepayment of revenue received in a liability account. View transaction list Journal entry worksheet Record the expiration of insurance. Note: Enter debits before credits. General Journal Debit Date Dec 31 Credit Record entry Clear entry View general journal Jan. 1 The company paid $8,200 cash for 12 months of insurance coverage beginning immediately. Aug 1 The company received $5,700 cash in advance for 6 months of contracted services beginning on August 1 and ending on January 31. Dec. 31 The company prepared any necessary year-end adjusting entries related to insurance coverage and services performed. a. Record journal entries for these transactions assuming Garcia follows the usual practice of recording a prepayment of an expense in an asset account and recording a prepayment of revenue received in a liability account. View transaction list Journal entry worksheet Record the cash received in advance of services. Note: Enter debits before credits. Date General Journal Debit Credit Aug 01 Record entry Clear entry View general journal