Answered step by step

Verified Expert Solution

Question

1 Approved Answer

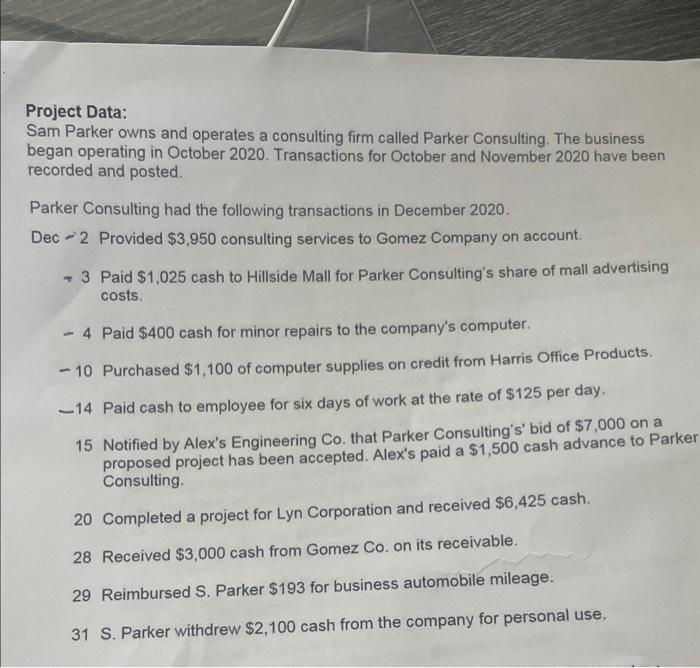

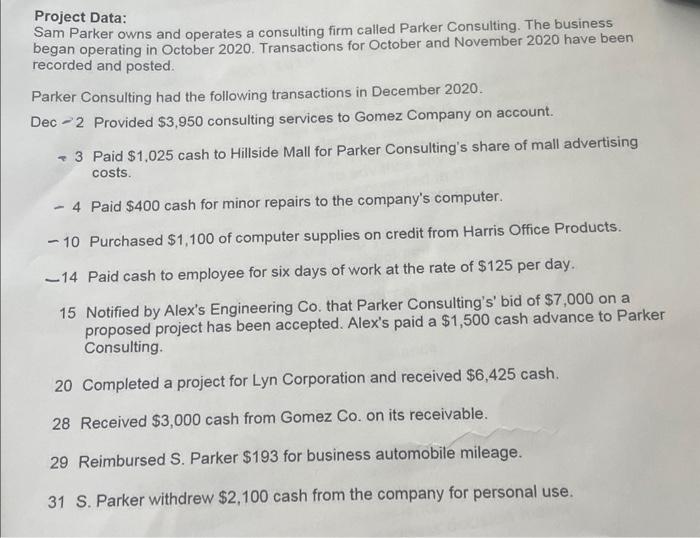

general journal Project Data: Sam Parker owns and operates a consulting firm called Parker Consulting. The business began operating in October 2020. Transactions for October

general journal

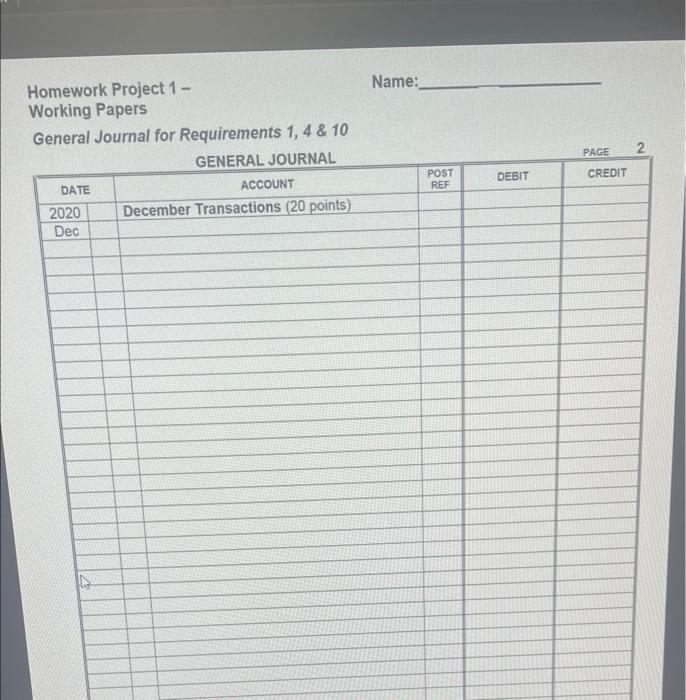

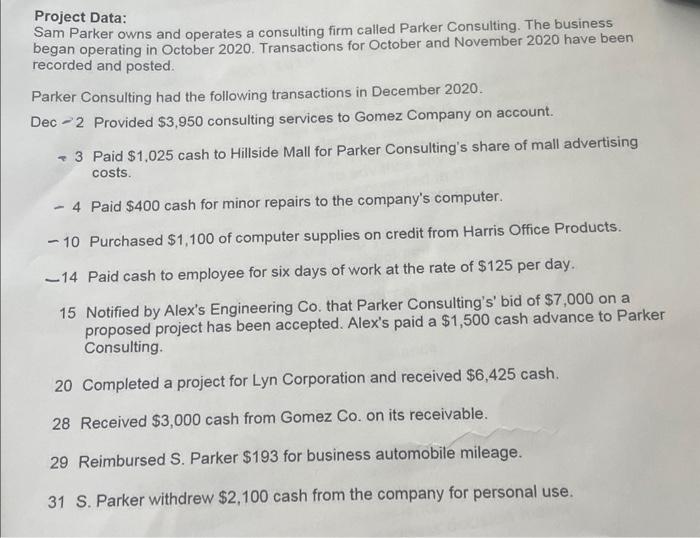

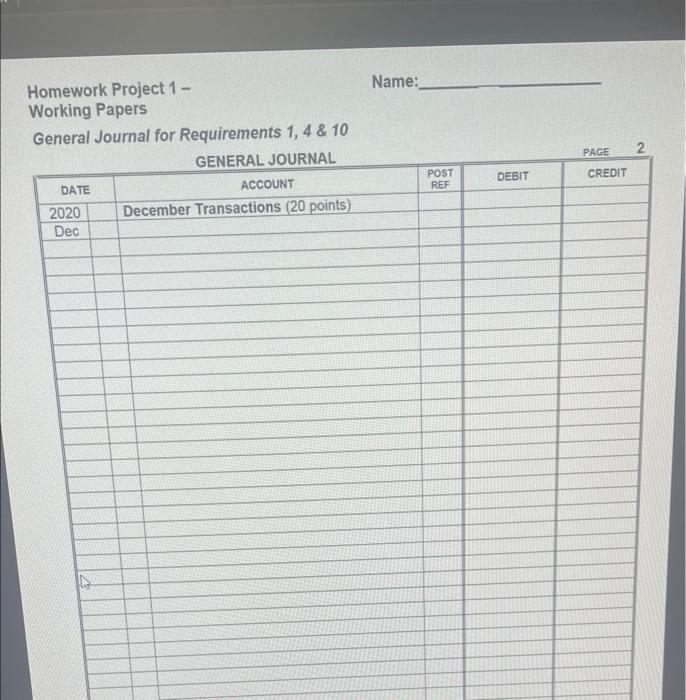

Project Data: Sam Parker owns and operates a consulting firm called Parker Consulting. The business began operating in October 2020. Transactions for October and November 2020 have been recorded and posted. Parker Consulting had the following transactions in December 2020. Dec 2 Provided $3,950 consulting services to Gomez Company on account. - 3 Paid $1,025 cash to Hillside Mall for Parker Consulting's share of mall advertising costs. - 4 Paid $400 cash for minor repairs to the company's computer. - 10 Purchased $1,100 of computer supplies on credit from Harris Office Products. -14 Paid cash to employee for six days of work at the rate of $125 per day. 15 Notified by Alex's Engineering Co. that Parker Consulting's' bid of $7,000 on a proposed project has been accepted. Alex's paid a $1,500 cash advance to Parker Consulting. 20 Completed a project for Lyn Corporation and received $6,425 cash. 28 Received $3,000 cash from Gomez Co. on its receivable. 29 Reimbursed S. Parker $193 for business automobile mileage. 31 S. Parker withdrew $2,100 cash from the company for personal use. Project Data: Sam Parker owns and operates a consulting firm called Parker Consulting. The business began operating in October 2020. Transactions for October and November 2020 have been recorded and posted. Parker Consulting had the following transactions in December 2020. Dec 2 Provided $3,950 consulting services to Gomez Company on account. - 3 Paid $1,025 cash to Hillside Mall for Parker Consulting's share of mall advertising costs. - 4 Paid $400 cash for minor repairs to the company's computer. - 10 Purchased $1,100 of computer supplies on credit from Harris Office Products. -14 Paid cash to employee for six days of work at the rate of $125 per day. 15 Notified by Alex's Engineering Co. that Parker Consulting's' bid of $7,000 on a proposed project has been accepted. Alex's paid a $1,500 cash advance to Parker Consulting. 20 Completed a project for Lyn Corporation and received $6,425cash. 28 Received $3,000 cash from Gomez Co. on its receivable. 29 Reimbursed S. Parker $193 for business automobile mileage. 31 S. Parker withdrew $2,100 cash from the company for personal use. Homework Project 1 - Working Papers Cawnul Inurnal far Ranuirements 1,4&10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started