Question

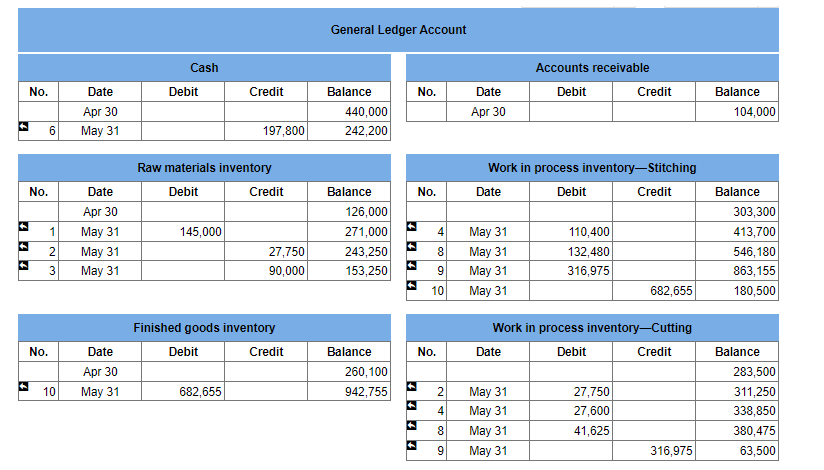

General Journal Record the purchase of materials (on credit). Record direct materials used in production. Record the usage of indirect materials. Record the cost of

General Journal

Record the purchase of materials (on credit).

Record direct materials used in production.

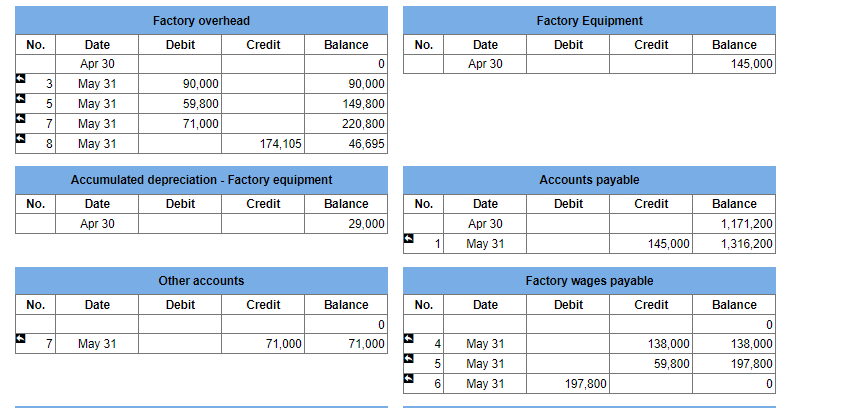

Record the usage of indirect materials.

Record the cost of direct labor incurred but not yet paid. (Use "Factory wages payable" account).

Record the cost of indirect labor incurred but not yet paid. (Use "Factory wages payable" account).

Record overhead costs paid in cash.

Record the application of overhead at a rate of 150% of direct materials costs (Cutting) and 120% of direct labor cost (Stitching).

Record the transferred costs of partially completed goods.

Record the transfer of production to finished goods, as calculated on the Cost of Goods Manufactured tab.

Record the sale of goods on account.

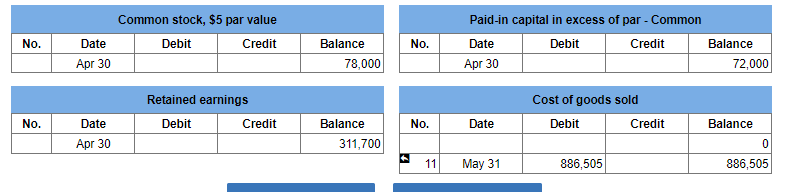

Record the cost of goods sold, as calculated on the cost of goods sold tab.

Please solve the fill in the blanks from each table and solve asap to get an upvote.

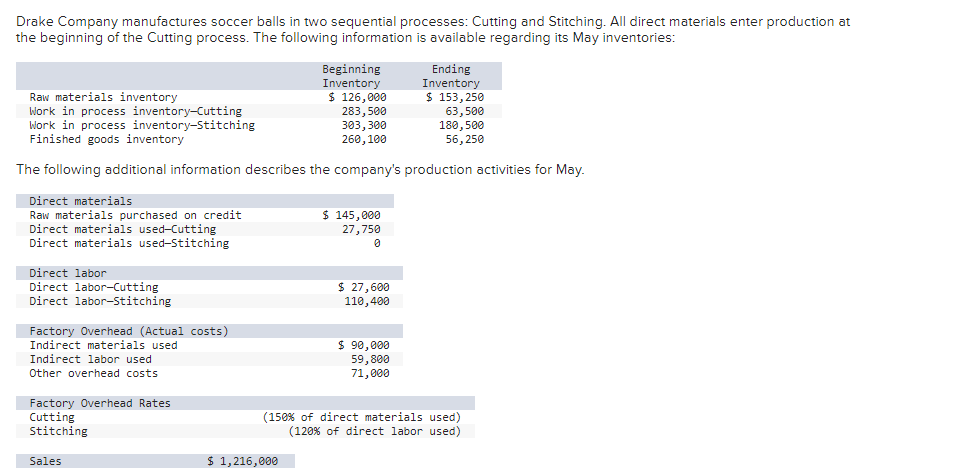

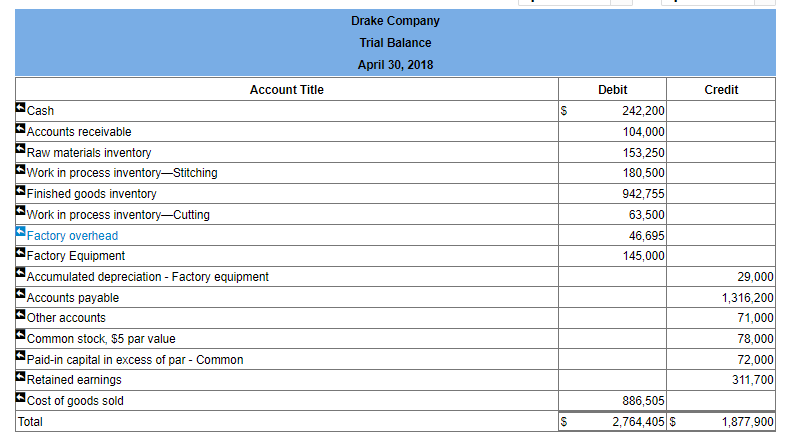

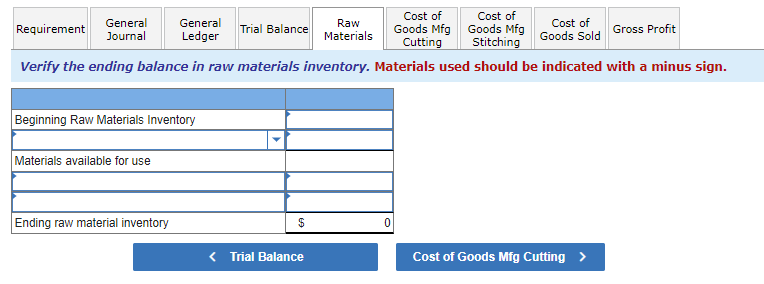

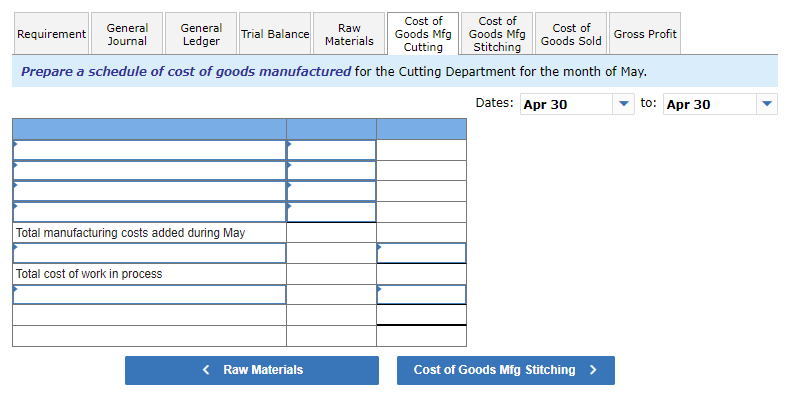

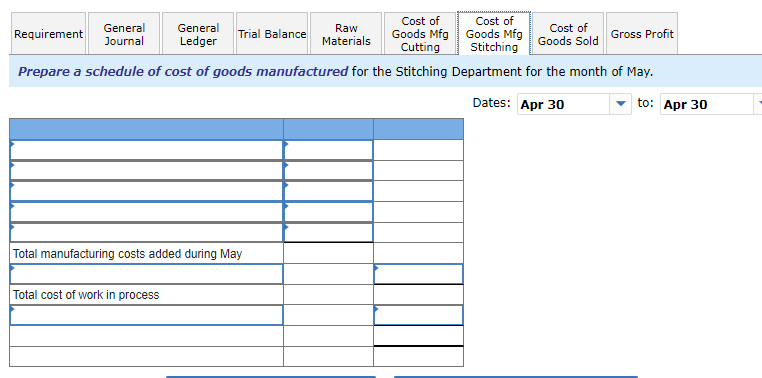

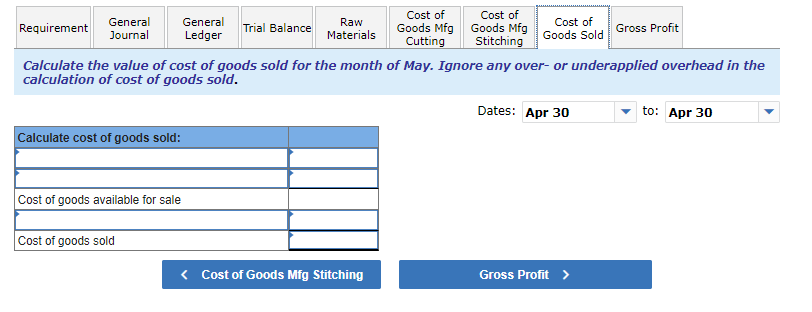

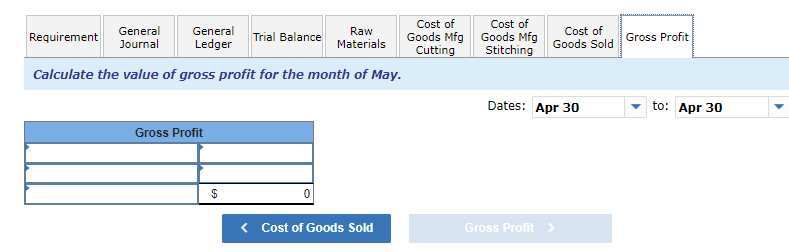

Drake Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the Cutting process. The following information is available regarding its May inventories: The following additional information describes the company's production activities for May. General Ledger Account \begin{tabular}{|r|c|r|c|r|} \hline \multicolumn{5}{|c|}{ Factory overhead } \\ \hline No. & Date & Debit & Credit & \multicolumn{1}{|c|}{ Balance } \\ \hline & Apr 30 & & & 0 \\ \hline 3 & May 31 & 90,000 & & 90,000 \\ \hline 5 & May 31 & 59,800 & & 149,800 \\ \hline 7 & May 31 & 71,000 & & 220,800 \\ \hline 8 & May 31 & & 174,105 & 46,695 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|r|} \hline \multicolumn{6}{|c|}{ Other accounts } \\ \hline No. & Date & Debit & Credit & \multicolumn{1}{c|}{ Balance } \\ \hline & & & & 0 \\ \hline 7 & May 31 & & 71,000 & 71,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Common stock, \$5 par value } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 78,000 \\ \hline \end{tabular} Paid-in capital in excess of par - Common \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Apr 30 & & & 72,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Cost of goods sold } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & & & & 0 \\ \hline \$11 & May 31 & 886,505 & & 886,505 \\ \hline \end{tabular} Verify the ending balance in raw materials inventory. Materials used should be indicated with a minus sign. Prepare a schedule of cost of goods manufactured for the Cutting Department for the month of May. Prepare a schedule of cost of goods manufactured for the Stitching Department for the month of May. Calculate the value of cost of goods sold for the month of May. Ignore any over- or underapplied overhead in the calculation of cost of goods sold. Dates: to: Calculate the value of gross profit for the month of MayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started