Answered step by step

Verified Expert Solution

Question

1 Approved Answer

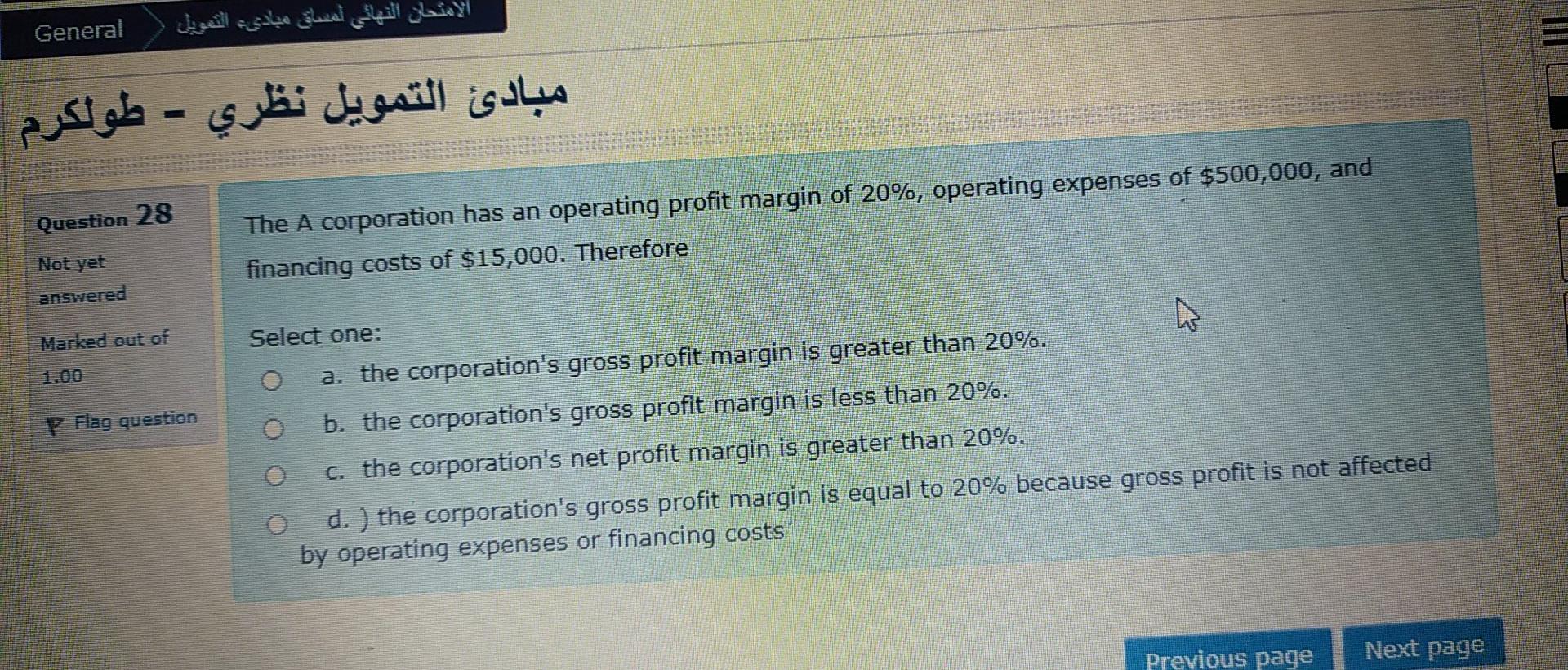

General - Question 28 The A corporation has an operating profit margin of 20%, operating expenses of $500,000, and financing costs of $15,000. Therefore Not

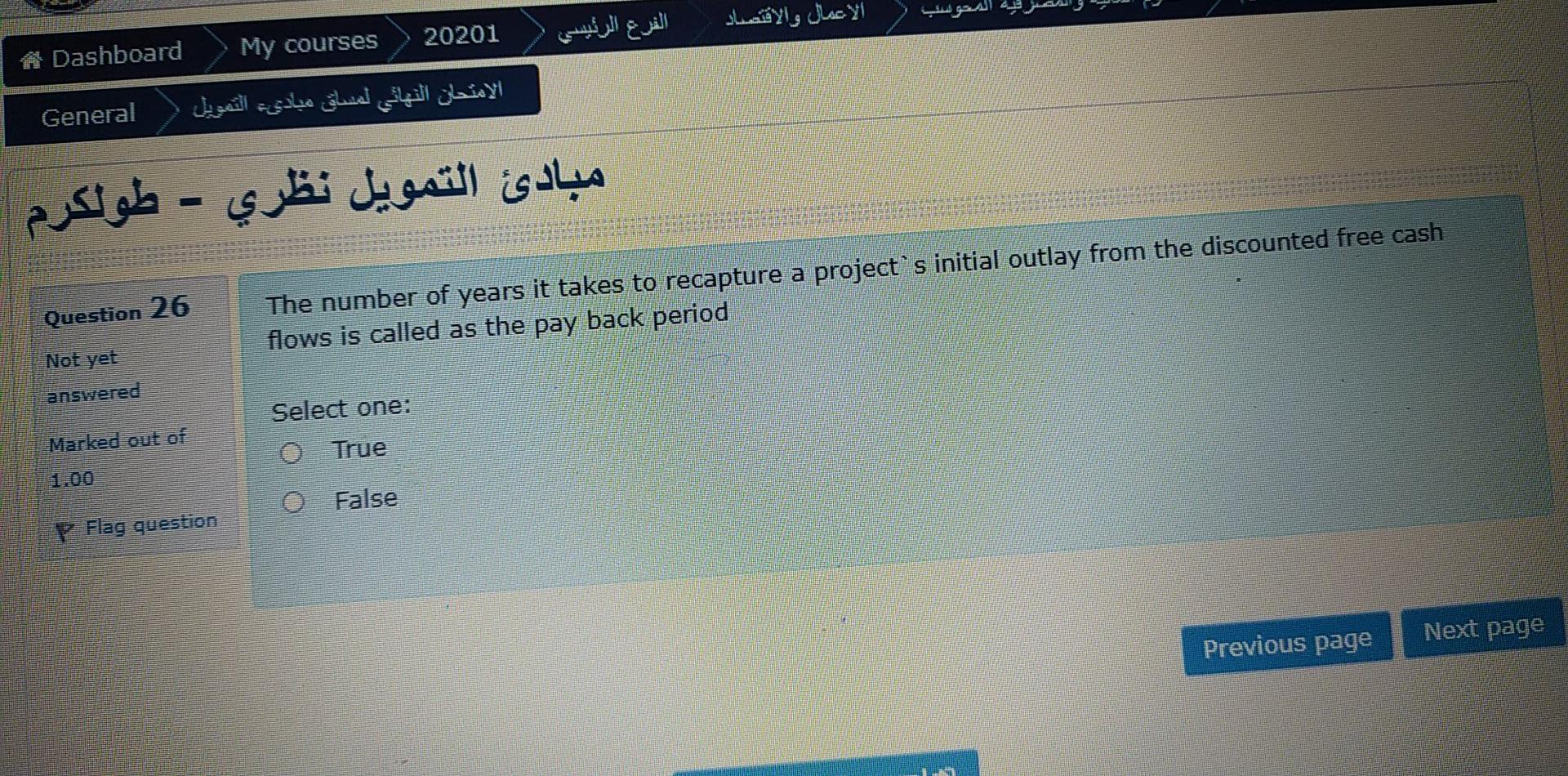

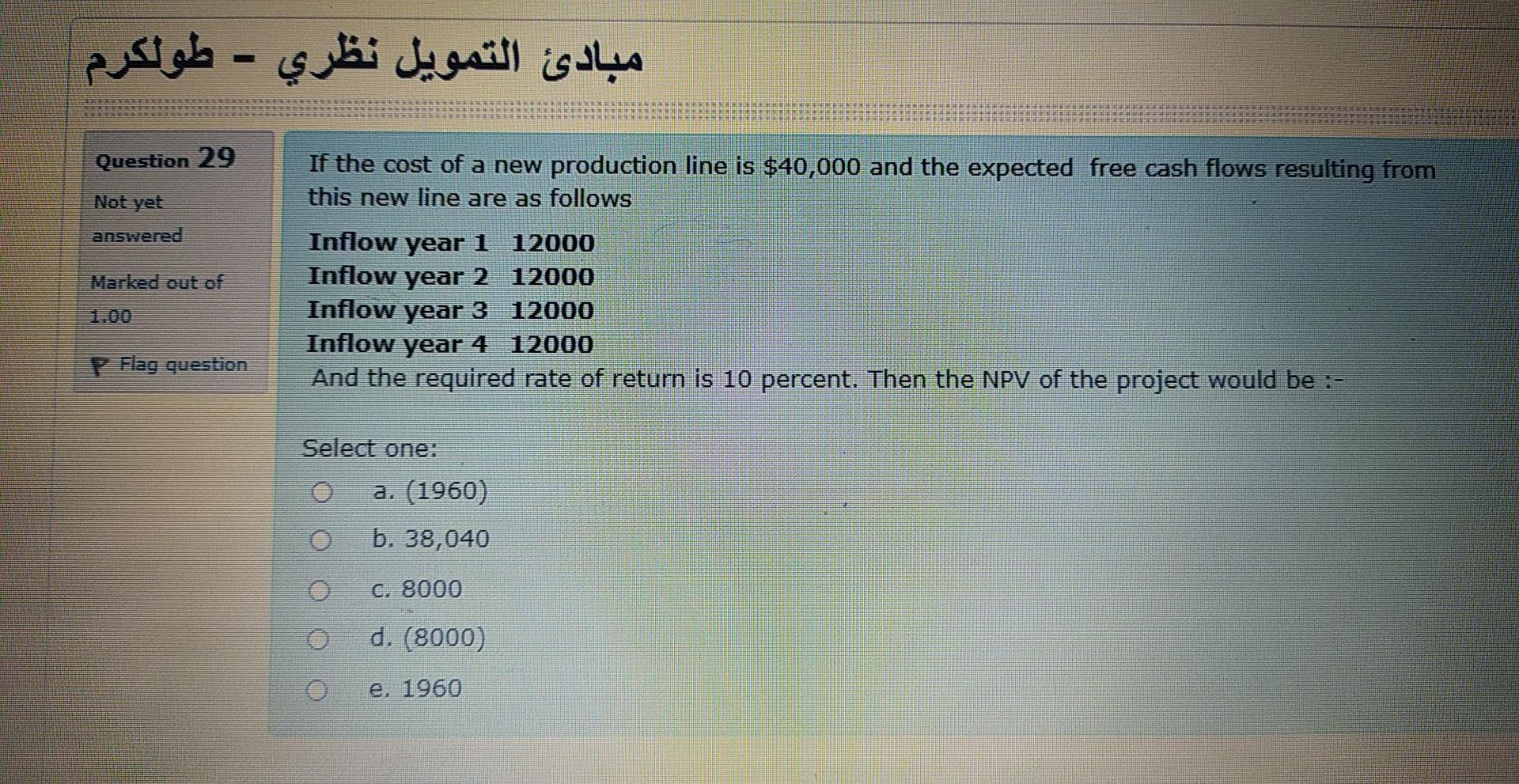

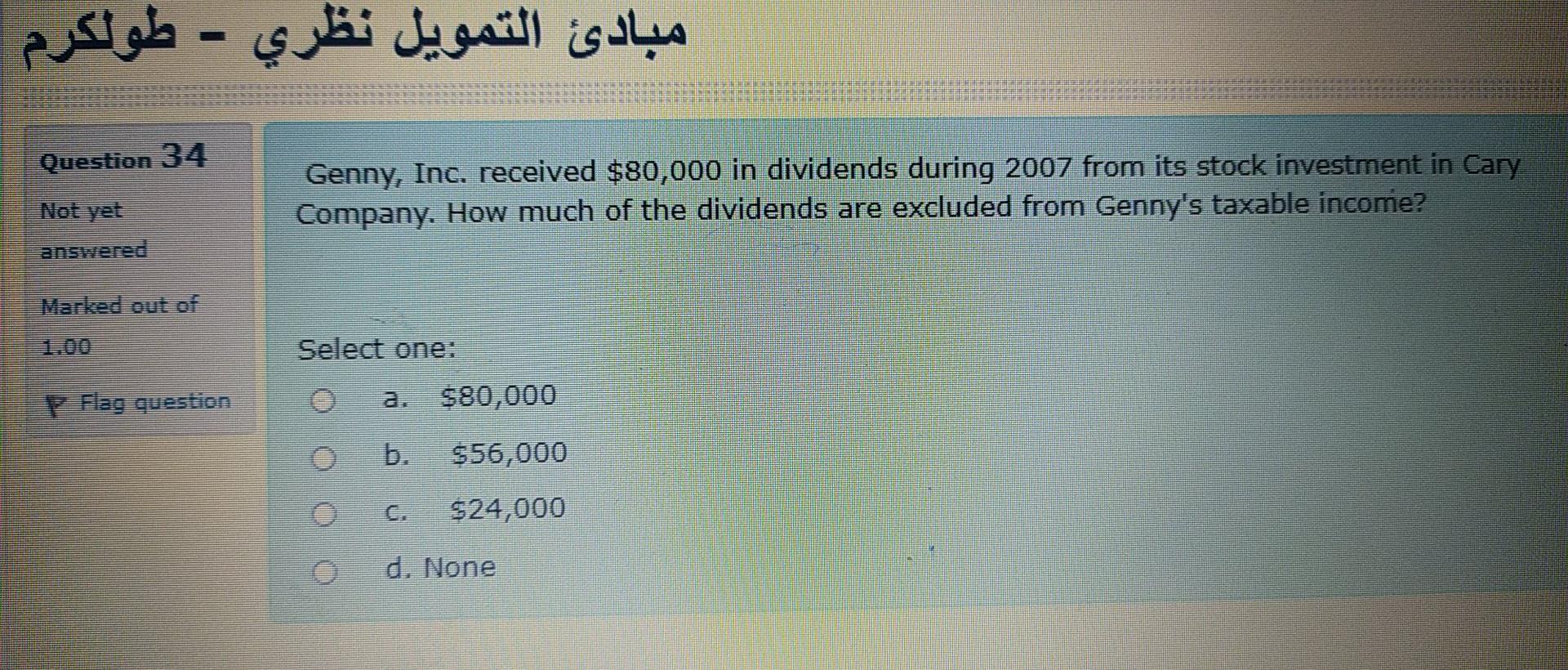

General - Question 28 The A corporation has an operating profit margin of 20%, operating expenses of $500,000, and financing costs of $15,000. Therefore Not yet answered Marked out of Y Flag question Select one: o a. the corporation's gross profit margin is greater than 20%. O b. the corporation's gross profit margin is less than 20%. o c. the corporation's net profit margin is greater than 20%. d.) the corporation's gross profit margin is equal to 20% because gross profit is not affected by operating expenses or financing costs Previous page Next page 20201 A Dashboard My courses General - Question 26 The number of years it takes to recapture a project's initial outlay from the discounted free cash flows is called as the pay back period Not yet answered Select one: O True Marked out of O False Y Flag question Next page Previous page - Question 29 Not yet answered Merked out of If the cost of a new production line is $40,000 and the expected free cash flows resulting from this new line are as follows Inflow year 1 12000 Inflow year 2 12000 Inflow year 3 12000 Inflow year 4 12000 And the required rate of return is 10 percent. Then the NPV of the project would be :- Flag question Select one: a (1960) b. 28040 C, 2000 d. (2000) = 1960 General - Question 9 The difference between the market value of the firm and the amount of laiabilities in the firm is known as market value added. Not yet answered Select one: Marked out of O True O False P Flag question Previous page Next page - Question 10 Which of the following categories of owners have unlimited liability? Not yet answered Marked out of Select one: both A and B P Flag question b. general partners in a limited partnership sole proprietors d. shareholders of a corporation - | | | | Question 30 Which of the following best describes cash flow from financing activities? Not yet answered Marked out of 100 P Flag question Select one: : a. Interest paid, plus dividends paid, plus increase (or minus decrease) in stock, plus increase (or minus decrease) in debt b. Interest income, plus dividend income, minus kes c. Increase (or minus decrease) in stock, plus increase (or minus decrease) in debt, minus interest paid, minus dividends paid d. Interest expense, minus dividends paid Previous page Next page - 3. Question 31 All of the following are income statement items EXCEPT Not yet answered Select one: a. accrued expenses Marked out of b. interest expense V Flag question c. depreciation expense d. cost of goods sold General - Question 32 If the Profitability Index of a project is 0.7 and the initial outlay = 5000. Then the present value of the project equals :- Not yet answered Select one: Marked out of = 142 3500 Flag question C. None of the above 4500 Dravious page Next pa - Question 34 Genny, Inc. received $80,000 in dividends during 2007 from its stock investment in Cary Company. How much of the dividends are excluded from Genny's taxable income? Not yet answered Select one: $80,000 y Flag question $56,000 $24,000 d. None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started