Answered step by step

Verified Expert Solution

Question

1 Approved Answer

General Telecommunications (GT) is a telecommunications company that wants to position itself as a leading provider of a wide range of telecommunication services. GT

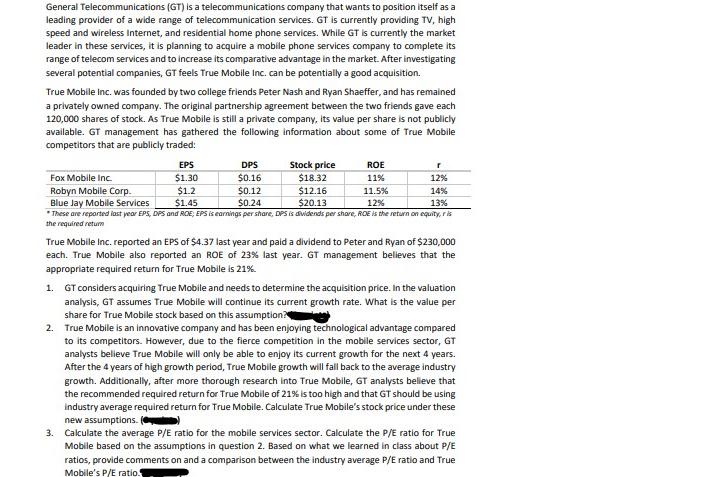

General Telecommunications (GT) is a telecommunications company that wants to position itself as a leading provider of a wide range of telecommunication services. GT is currently providing TV, high speed and wireless Internet, and residential home phone services. While GT is currently the market leader in these services, it is planning to acquire a mobile phone services company to complete its range of telecom services and to increase its comparative advantage in the market. After investigating several potential companies, GT feels True Mobile Inc. can be potentially a good acquisition. True Mobile Inc. was founded by two college friends Peter Nash and Ryan Shaeffer, and has remained a privately owned company. The original partnership agreement between the two friends gave each 120,000 shares of stock. As True Mobile is still a private company, its value per share is not publicly available. GT management has gathered the following information about some of True Mobile competitors that are publicly traded: EPS $1.30 $1.2 $1.45 DPS $0.16 $0.12 $0.24 ROE 11% Fox Mobile Inc. Robyn Mobile Corp. 11.5% 12% Blue Jay Mobile Services *These are reported last year EPS, DPS and ROE, EPS is earnings per share, DPS is dividends per share, ROE is the return on equity, ris the required return Stock price $18.32 $12.16 $20.13 r 12% 14% 13% True Mobile Inc. reported an EPS of $4.37 last year and paid a dividend to Peter and Ryan of $230,000 each. True Mobile also reported an ROE of 23 % last year. GT management believes that the appropriate required return for True Mobile is 21%. 1. GT considers acquiring True Mobile and needs to determine the acquisition price. In the valuation analysis, GT assumes True Mobile will continue its current growth rate. What is the value per share for True Mobile stock based on this assumption? 2. True Mobile is an innovative company and has been enjoying technological advantage compared to its competitors. However, due to the fierce competition in the mobile services sector, GT analysts believe True Mobile will only be able to enjoy its current growth for the next 4 years. After the 4 years of high growth period, True Mobile growth will fall back to the average industry growth. Additionally, after more thorough research into True Mobile, GT analysts believe that the recommended required return for True Mobile of 21% is too high and that GT should be using industry average required return for True Mobile. Calculate True Mobile's stock price under these new assumptions. ( 3. Calculate the average P/E ratio for the mobile services sector. Calculate the P/E ratio for True Mobile based on the assumptions in question 2. Based on what we learned in class about P/E ratios, provide comments on and a comparison between the industry average P/E ratio and True Mobile's P/E ratio. 4. Keeping the assumptions that True Mobile's growth rate will fall back to the industry average growth rate after 4 years, calculate True Mobile's long-term ROE. Assume that True Mobile's retention ratio remains constant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate True Mobiles longterm return on equity ROE we need to use the sustainable growth rate f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started