Answered step by step

Verified Expert Solution

Question

1 Approved Answer

General Utility Corp. is going to buy a new equipment that falls into the 4-year straight-line depreciation to $150,000. The equipment costs its current

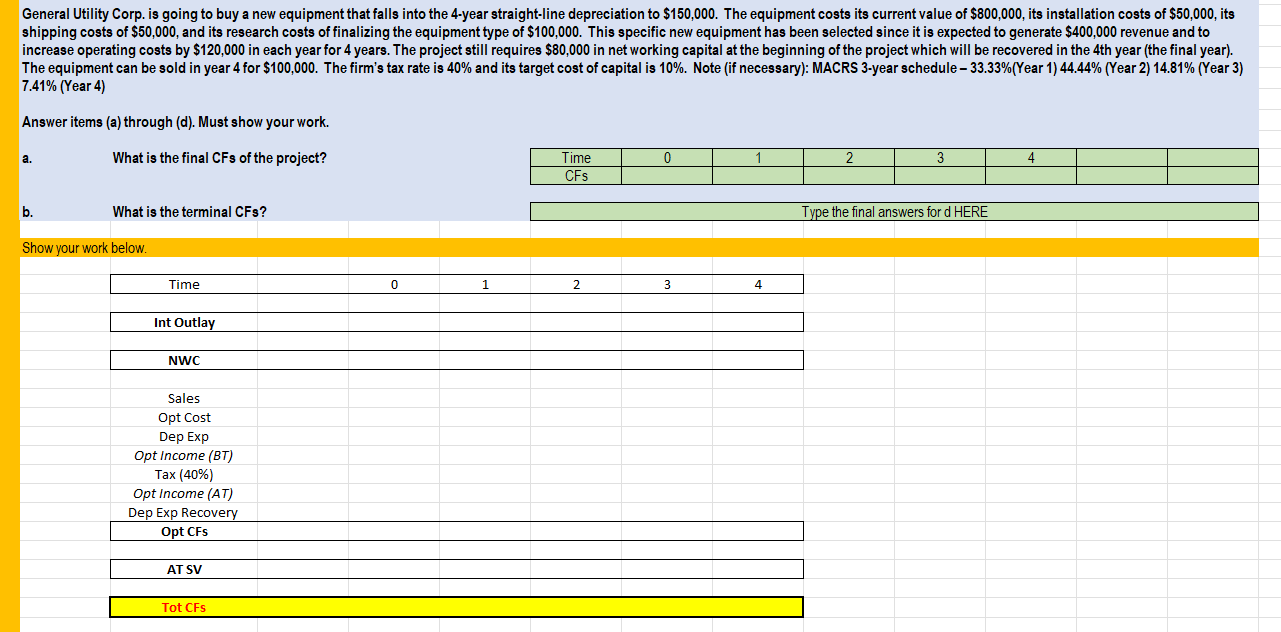

General Utility Corp. is going to buy a new equipment that falls into the 4-year straight-line depreciation to $150,000. The equipment costs its current value of $800,000, its installation costs of $50,000, its shipping costs of $50,000, and its research costs of finalizing the equipment type of $100,000. This specific new equipment has been selected since it is expected to generate $400,000 revenue and to increase operating costs by $120,000 in each year for 4 years. The project still requires $80,000 in net working capital at the beginning of the project which will be recovered in the 4th year (the final year). The equipment can be sold in year 4 for $100,000. The firm's tax rate is 40% and its target cost of capital is 10%. Note (if necessary): MACRS 3-year schedule - 33.33% ( Year 1) 44.44% (Year 2) 14.81% (Year 3) 7.41% (Year 4) Answer items (a) through (d). Must show your work. What is the final CFs of the project? a. b. What is the terminal CFs? Show your work below. Time Int Outlay NWC Sales Opt Cost Dep Exp Opt Income (BT) Tax (40%) Opt Income (AT) Dep Exp Recovery Opt CFs AT SV Tot CFs 0 1 Time CFs 2 0 3 1 4 2 3 Type the final answers for d HERE 4

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the final cash flows CFs of the project including the terminal CFs we need to calculate the relevant cash flows for each year and then discount them to the present value using the firms t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started