Answered step by step

Verified Expert Solution

Question

1 Approved Answer

genow com/im/takeAssignment takeAssignment Main doinvoker=assignments&takeAssignmentSessionLocator-assignment take&Inpro ota State Uni D2L Brightspace Loo e e w E-services- Minnesc ahn.mnsu.edu/hp/sy Watch TV and movie -Verizon Messages eBook

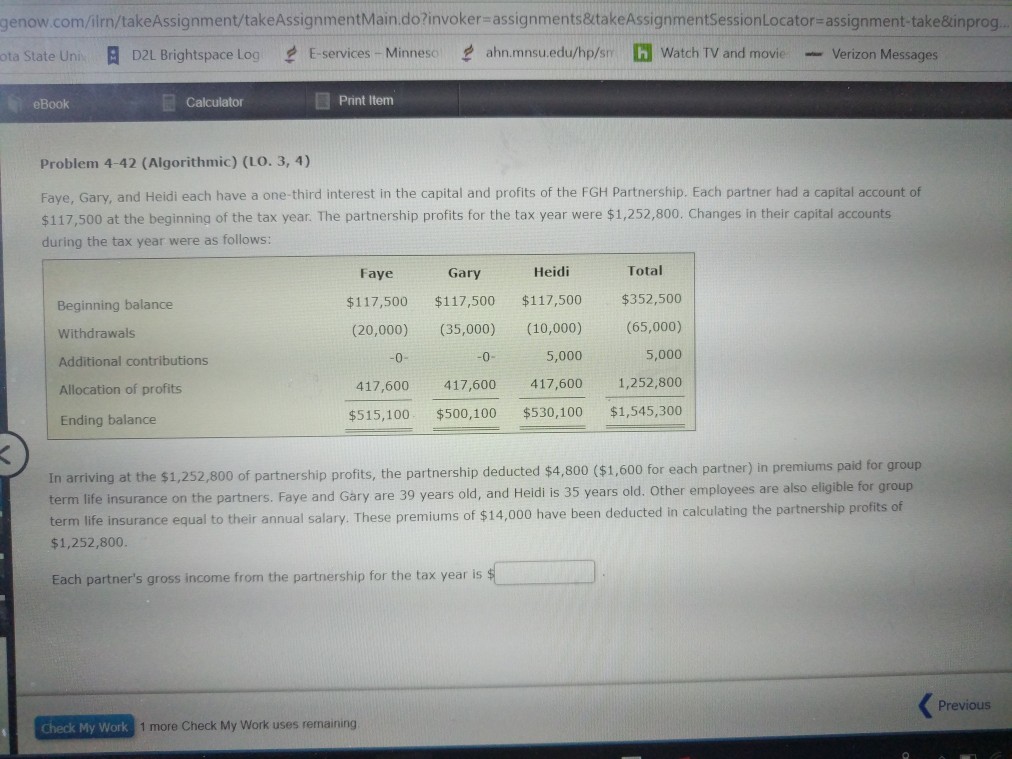

genow com/im/takeAssignment takeAssignment Main doinvoker=assignments&takeAssignmentSessionLocator-assignment take&Inpro ota State Uni D2L Brightspace Loo e e w E-services- Minnesc ahn.mnsu.edu/hp/sy Watch TV and movie -Verizon Messages eBook Print Item Problem 4-42 (Algorithmic) (Lo. 3, 4) Faye, Gary, and Heidi each have a one-third interest in the capital and profits of the FGH Partnership. Each partner had a capital account of $117,500 at the beginning of the tax year. The partnership profits for the tax year were $1,252,800. Changes in their capital accounts during the tax year were as follows: Faye Gary Heidi Total Beginning balance Withdrawals Additional contributions Allocation of profits Ending balance $117,500 $117,500 $117,500 $352,500 (20,000) (35,000) (10,000) (65,000) 5,000 417,600 417,600 417,600 1,252,800 $515,100 $500,100 $530,100 $1,545,300 5,000 In arriving at the $1,252,800 of partnership profits, the partnership deducted $4,800 ($1,600 for each partner) in premiums paid for group term life insurance on the partners. Fay term life insurance equal to their annual salary $1,252,800 e and Gary are 39 years old, and Heidi is 35 years old. other employees are also eligible for group erm ifeInsurance equal to theiranual salary, These premiums of $14,0 have been decducted in calculating the partnership These premium Each partner's gross income from the partnership for the tax year is Previous Check My Work 1 more Check My Work uses temaining 1 more Check My Work uses remaining

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started