Answered step by step

Verified Expert Solution

Question

1 Approved Answer

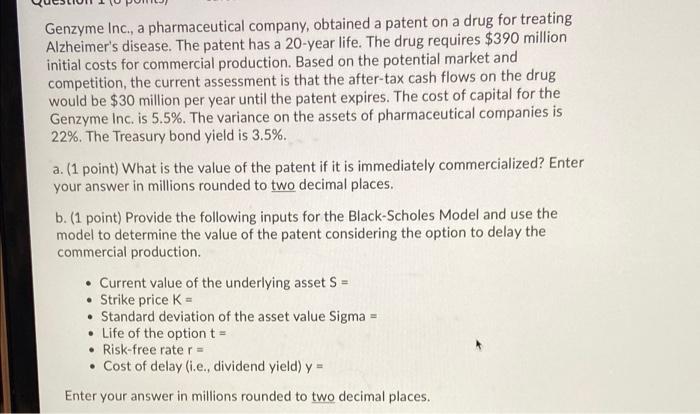

Genzyme Inc., a pharmaceutical company, obtained a patent on a drug for treating Alzheimer's disease. The patent has a 20-year life. The drug requires

Genzyme Inc., a pharmaceutical company, obtained a patent on a drug for treating Alzheimer's disease. The patent has a 20-year life. The drug requires $390 million initial costs for commercial production. Based on the potential market and competition, the current assessment is that the after-tax cash flows on the drug would be $30 million per year until the patent expires. The cost of capital for the Genzyme Inc. is 5.5%. The variance on the assets of pharmaceutical companies is 22%. The Treasury bond yield is 3.5%. a. (1 point) What is the value of the patent if it is immediately commercialized? Enter your answer in millions rounded to two decimal places. b. (1 point) Provide the following inputs for the Black-Scholes Model and use the model to determine the value of the patent considering the option to delay the commercial production. Current value of the underlying asset S = . Strike price K = Standard deviation of the asset value Sigma = Life of the option t = Risk-free rate r = Cost of delay (i.e., dividend yield) y = Enter your answer in millions rounded to two decimal places.

Step by Step Solution

★★★★★

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started