Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GEO Labs is evaluating the acquisition of a light truck that will increase the speed and amount of area serving. The acquisition of this

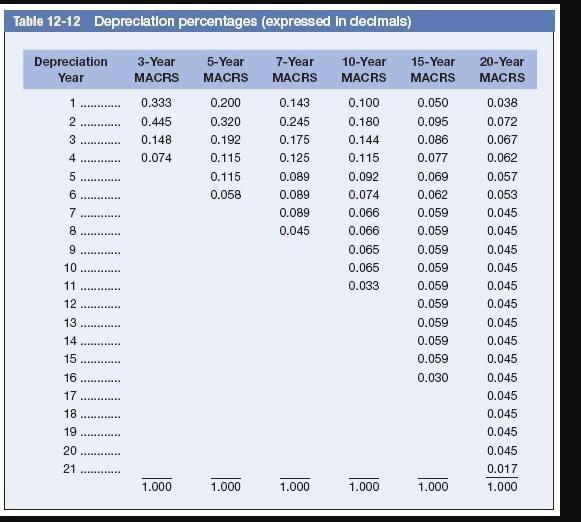

GEO Labs is evaluating the acquisition of a light truck that will increase the speed and amount of area serving. The acquisition of this light truck at a cost of $100,000 will result in earnings before depreciation and taxes of $34,000 in years 1 to 3, and $14,500 in years 4 to 6. The company tax rate is 30% and cost of capital is 10% (REMEMBER TO USE TABLES 12-11 AND 12-12) PRESENT YOUR ANSWER ROUNDED TO ZERO DECIMAL PLACES AND DON'T USE COMMA SEPARATORS HOW MUCH ARE THE CASH FLOWS IN YEAR 2 Table 12-12 Depreciation percentages (expressed in decimals) Depreciation 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year MACRS MACRS MACRS MACRS CRS MACRS 0.333 0.200 0.143 0.100 0.050 0.038 2 0.445 0.320 0.245 0.180 0.095 0.072 3 0.148 0.192 0.175 0.144 0.086 0.067 ........... 4 0.074 0.115 0.125 0.115 0.077 0.062 0.115 0.089 0.092 0.069 0.057 ........... 6. 0.058 0.089 0.074 0.062 0.053 ........... 7 0.089 0.066 0.059 0.045 8. 0.045 0.066 0.059 0.045 9 0.065 0.059 0.045 ........ 10 0.065 0.059 0.045 11 0.033 0.059 0.045 12 0.059 0.045 13 0.059 0.045 14 0.059 0.045 15 0.059 0.045 16 0.030 0.045 ............ 17 0.045 18 0.045 19 0.045 ............. 20 0.045 ............ 21 0.017 ........... 1.000 1.000 1.000 1.000 1.000 1.000 Appendix B Present value of $1, PV PV = FV Percent Period 1% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0,794 0.772 0.751 0.731 0.712 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 7. 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.914 0.837 0.766 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 11 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 13 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 14 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 15 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 16 0.853 0.728 0.623 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 17 0.844 0.714 0.605 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 18 0.836 0.700 0.587 0.494 0416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 19 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 20 0.820 0.673 0.554 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 25 0.780 0.610 0.478 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 50 0.608 0.372 0.228 0.141 0.087 0.054 0.034 0.021 0.013 0.009 0.005 0.003

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Net Present Value of the Project 11645 In years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started