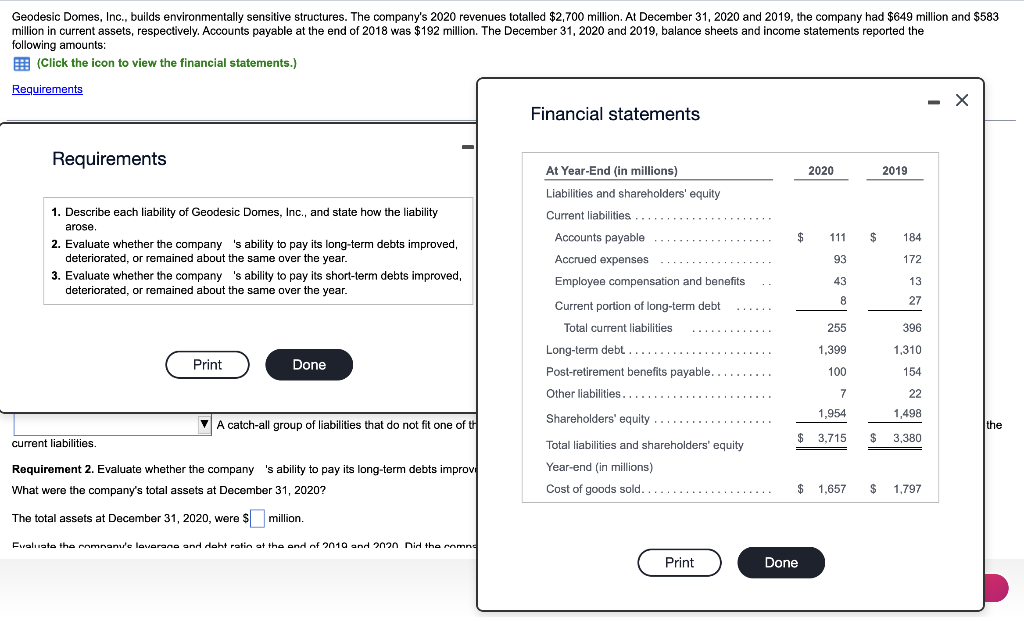

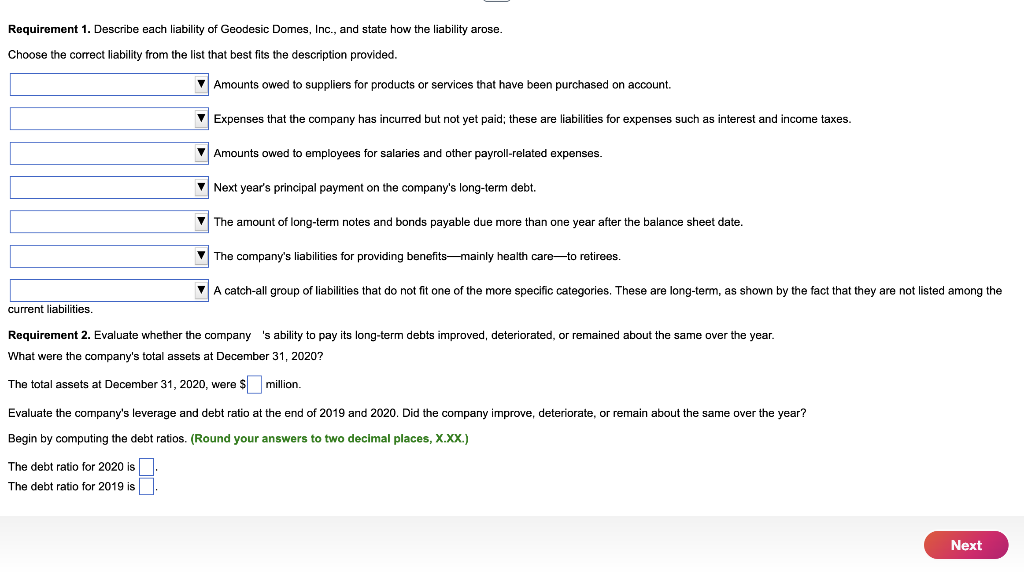

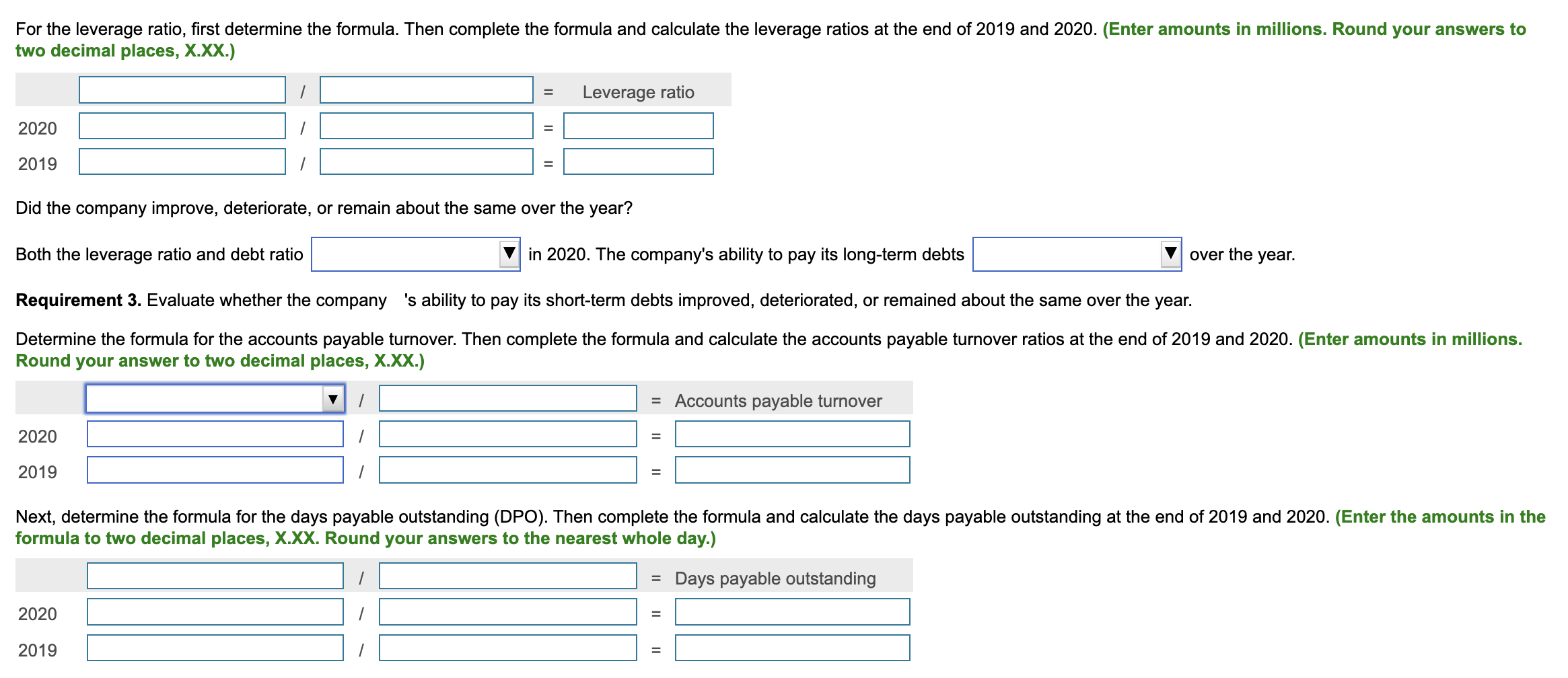

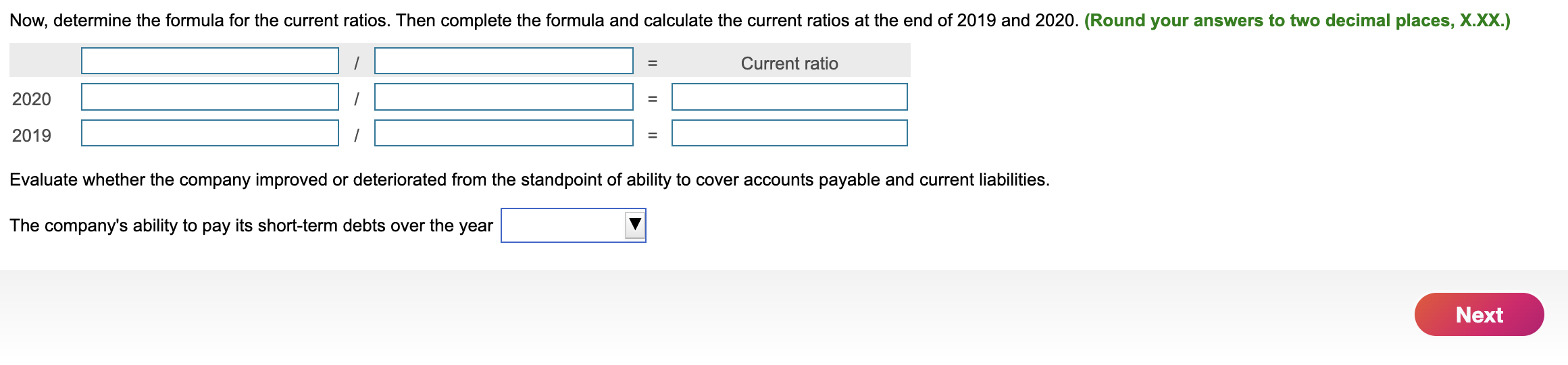

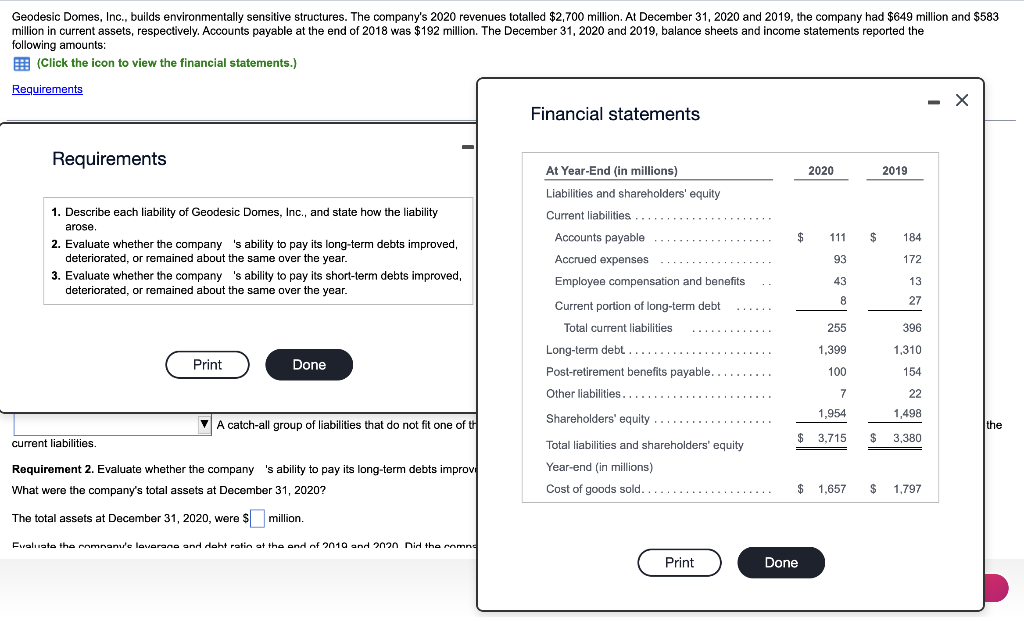

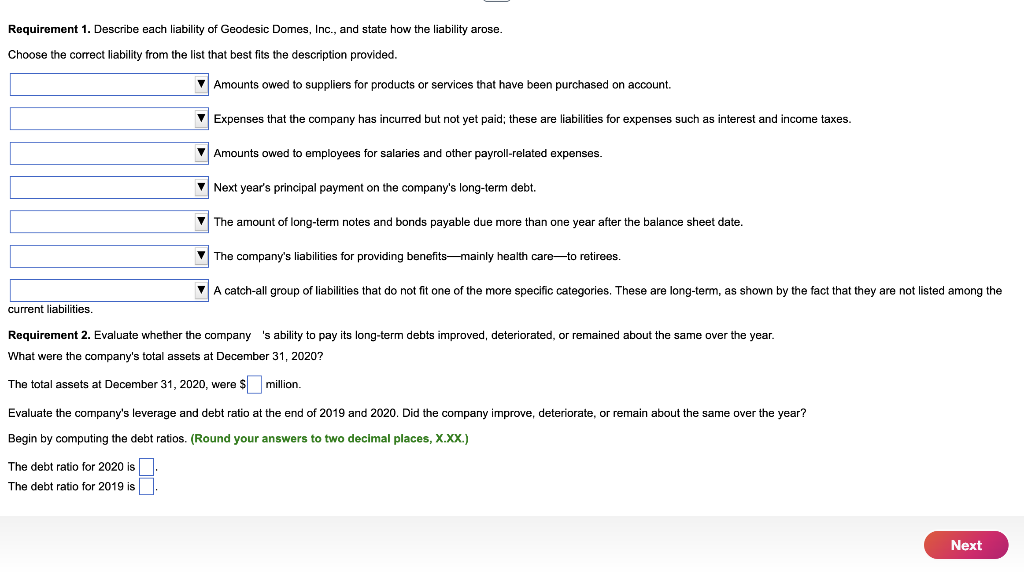

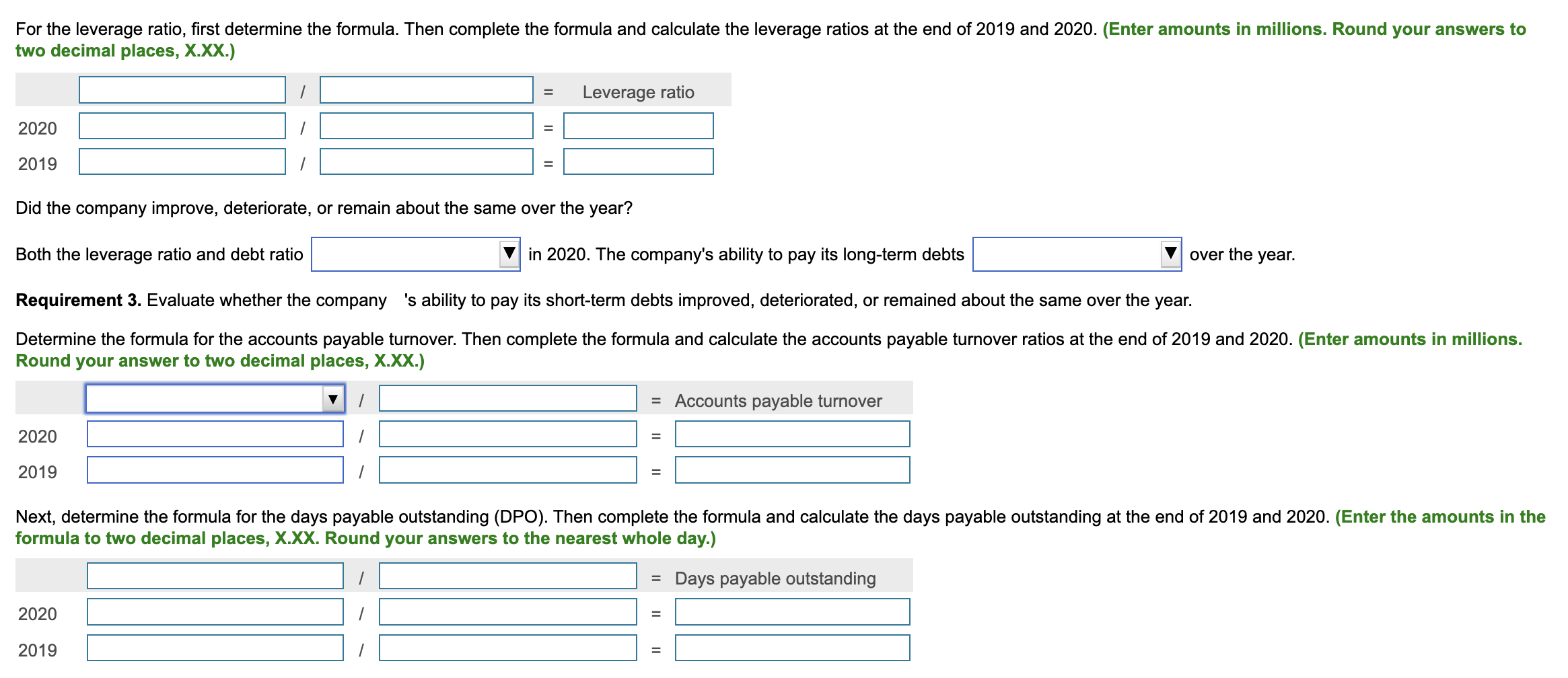

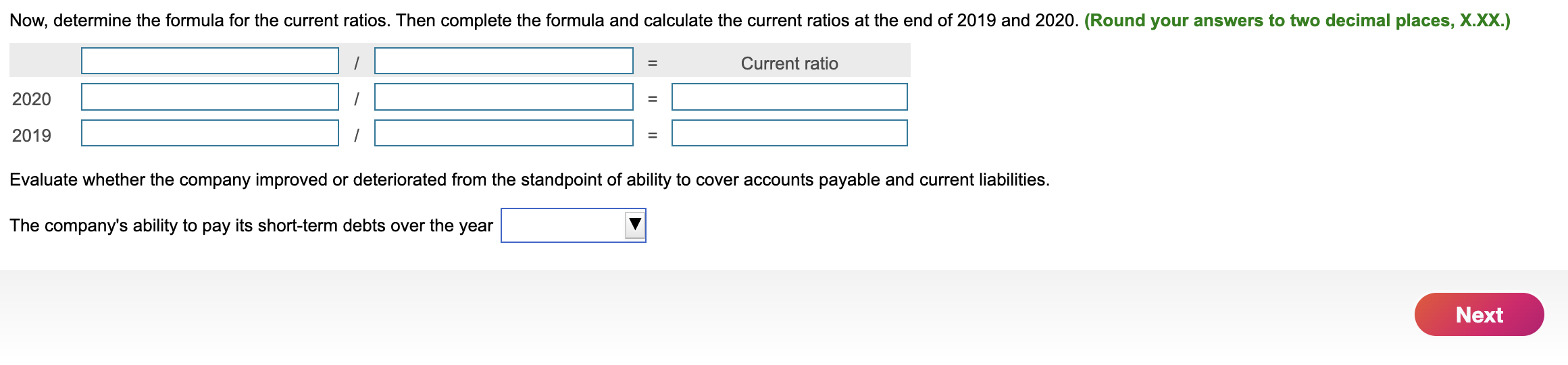

Geodesic Domes, Inc., builds environmentally sensitive structures. The company's 2020 revenues totalled $2,700 million. At December 31,2020 and 2019 , the company had $649 million and $583 million in current assets, respectively. Accounts payable at the end of 2018 was $192 million. The December 31,2020 and 2019 , balance sheets and income statements reported the following amounts: (Click the icon to view the financial statements.) Financial statements Requirements 1. Describe each liability of Geodesic Domes, Inc., and state how the liability arose. 2. Evaluate whether the company 's ability to pay its long-term debts improved, deteriorated, or remained about the same over the year. 3. Evaluate whether the company 's ability to pay its short-term debts improved, deteriorated, or remained about the same over the year. current liabilities. Requirement 2. Evaluate whether the company 's ability to pay its long-term debts improvi What were the company's total assets at December 31, 2020? The total assets at December 31,2020 , were $ million. Fialiote the momnanu'e lavarame and Haht ratin at the and af 2010 and onon hid the momne Requirement 1. Describe each liability of Geodesic Domes, Inc., and state how the liability arose. Choose the correct liability from the list that best fits the description provided. Amounts owed to suppliers for products or services that have been purchased on account. Expenses that the company has incurred but not yet paid; these are liabilities for expenses such as interest and income taxes. Amounts owed to employees for salaries and other payroll-related expenses. Next year's principal payment on the company's long-term debt. The amount of long-term notes and bonds payable due more than one year after the balance sheet date. The company's liabilities for providing benefits-mainly health care-to retirees. A catch-all group of liabilities that do not fit one of the more specific categories. These are long-term, as shown by the fact that they are not listed among the current liabilities. Requirement 2. Evaluate whether the company 's ability to pay its long-term debts improved, deteriorated, or remained about the same over the year. What were the company's total assets at December 31,2020? The total assets at December 31,2020 , were $ million. Evaluate the company's leverage and debt ratio at the end of 2019 and 2020 . Did the company improve, deteriorate, or remain about the same over the year? Begin by computing the debt ratios. (Round your answers to two declmal places, X.X.) The debt ratio for 2020 is The debt ratio for 2019 is For the leverage ratio, first determine the formula. Then complete the formula and calculate the leverage ratios at the end of 2019 and 2020 . (Enter amounts in millions. Round your answers to two decimal places, X.XX.) Did the company improve, deteriorate, or remain about the same over the year? Both the leverage ratio and debt ratio in 2020. The company's ability to pay its long-term debts over the year. Requirement 3. Evaluate whether the company 's ability to pay its short-term debts improved, deteriorated, or remained about the same over the year. Determine the formula for the accounts payable turnover. Then complete the formula and calculate the accounts payable turnover ratios at the end of 2019 and 2020 . (Enter amounts in millions. Round your answer to two decimal places, X.XX.) Next, determine the formula for the days payable outstanding (DPO). Then complete the formula and calculate the days payable outstanding at the end of 2019 and 2020 . (Enter the amounts in the formula to two decimal places, X.XX. Round your answers to the nearest whole day.) \begin{tabular}{l|ll} & 1 & = Days payable outstanding \\ 2020 & 1 & = \\ 2019 & 1 & = \end{tabular} 20202019111===Currentratio Evaluate whether the company improved or deteriorated from the standpoint of ability to cover accounts payable and current liabilities. The company's ability to pay its short-term debts over the year Geodesic Domes, Inc., builds environmentally sensitive structures. The company's 2020 revenues totalled $2,700 million. At December 31,2020 and 2019 , the company had $649 million and $583 million in current assets, respectively. Accounts payable at the end of 2018 was $192 million. The December 31,2020 and 2019 , balance sheets and income statements reported the following amounts: (Click the icon to view the financial statements.) Financial statements Requirements 1. Describe each liability of Geodesic Domes, Inc., and state how the liability arose. 2. Evaluate whether the company 's ability to pay its long-term debts improved, deteriorated, or remained about the same over the year. 3. Evaluate whether the company 's ability to pay its short-term debts improved, deteriorated, or remained about the same over the year. current liabilities. Requirement 2. Evaluate whether the company 's ability to pay its long-term debts improvi What were the company's total assets at December 31, 2020? The total assets at December 31,2020 , were $ million. Fialiote the momnanu'e lavarame and Haht ratin at the and af 2010 and onon hid the momne Requirement 1. Describe each liability of Geodesic Domes, Inc., and state how the liability arose. Choose the correct liability from the list that best fits the description provided. Amounts owed to suppliers for products or services that have been purchased on account. Expenses that the company has incurred but not yet paid; these are liabilities for expenses such as interest and income taxes. Amounts owed to employees for salaries and other payroll-related expenses. Next year's principal payment on the company's long-term debt. The amount of long-term notes and bonds payable due more than one year after the balance sheet date. The company's liabilities for providing benefits-mainly health care-to retirees. A catch-all group of liabilities that do not fit one of the more specific categories. These are long-term, as shown by the fact that they are not listed among the current liabilities. Requirement 2. Evaluate whether the company 's ability to pay its long-term debts improved, deteriorated, or remained about the same over the year. What were the company's total assets at December 31,2020? The total assets at December 31,2020 , were $ million. Evaluate the company's leverage and debt ratio at the end of 2019 and 2020 . Did the company improve, deteriorate, or remain about the same over the year? Begin by computing the debt ratios. (Round your answers to two declmal places, X.X.) The debt ratio for 2020 is The debt ratio for 2019 is For the leverage ratio, first determine the formula. Then complete the formula and calculate the leverage ratios at the end of 2019 and 2020 . (Enter amounts in millions. Round your answers to two decimal places, X.XX.) Did the company improve, deteriorate, or remain about the same over the year? Both the leverage ratio and debt ratio in 2020. The company's ability to pay its long-term debts over the year. Requirement 3. Evaluate whether the company 's ability to pay its short-term debts improved, deteriorated, or remained about the same over the year. Determine the formula for the accounts payable turnover. Then complete the formula and calculate the accounts payable turnover ratios at the end of 2019 and 2020 . (Enter amounts in millions. Round your answer to two decimal places, X.XX.) Next, determine the formula for the days payable outstanding (DPO). Then complete the formula and calculate the days payable outstanding at the end of 2019 and 2020 . (Enter the amounts in the formula to two decimal places, X.XX. Round your answers to the nearest whole day.) \begin{tabular}{l|ll} & 1 & = Days payable outstanding \\ 2020 & 1 & = \\ 2019 & 1 & = \end{tabular} 20202019111===Currentratio Evaluate whether the company improved or deteriorated from the standpoint of ability to cover accounts payable and current liabilities. The company's ability to pay its short-term debts over the year