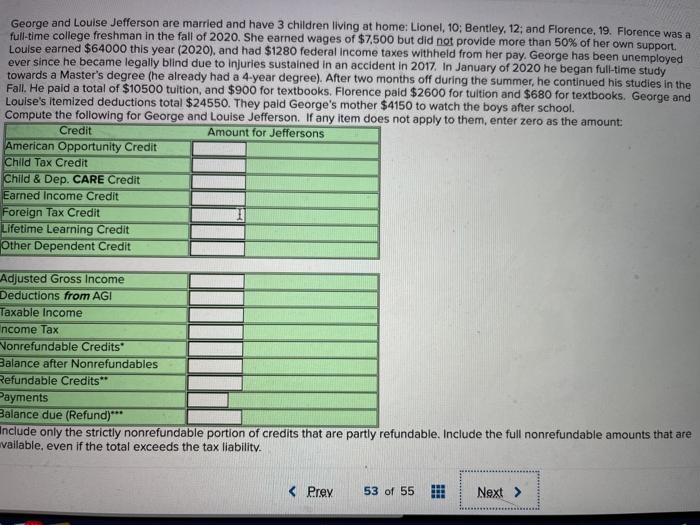

George and Louise Jefferson are married and have 3 children living at home: Lionel, 10; Bentley, 12and Florence, 19. Florence was a full-time college freshman in the fall of 2020. She earned wages of $7,500 but did not provide more than 50% of her own support. Louise earned $64000 this year (2020), and had $1280 federal income taxes withheld from her pay. George has been unemployed ever since he became legally blind due to injuries sustained in an accident in 2017. In January of 2020 he began full-time study towards a Master's degree (he already had a 4-year degree). After two months off during the summer, he continued his studies in the Fall. He paid a total of $10500 tuition, and $900 for textbooks. Florence paid $2600 for tuition and $680 for textbooks. George and Louise's itemized deductions total $24550. They paid George's mother $4150 to watch the boys after school. Compute the following for George and Louise Jefferson. If any item does not apply to them, enter zero as the amount: Credit Amount for Jeffersons American Opportunity Credit Child Tax Credit Child & Dep. CARE Credit Earned Income Credit Foreign Tax Credit Lifetime Learning Credit Other Dependent Credit Adjusted Gross Income Deductions from AGI Taxable income ncome Tax Vonrefundable Credits Balance after Nonrefundables Refundable Credits Payments Balance due (Refund)*** Include only the strictly nonrefundable portion of credits that are partly refundable. Include the full nonrefundable amounts that are vailable, even if the total exceeds the tax liability. George and Louise Jefferson are married and have 3 children living at home: Lionel, 10; Bentley, 12and Florence, 19. Florence was a full-time college freshman in the fall of 2020. She earned wages of $7,500 but did not provide more than 50% of her own support. Louise earned $64000 this year (2020), and had $1280 federal income taxes withheld from her pay. George has been unemployed ever since he became legally blind due to injuries sustained in an accident in 2017. In January of 2020 he began full-time study towards a Master's degree (he already had a 4-year degree). After two months off during the summer, he continued his studies in the Fall. He paid a total of $10500 tuition, and $900 for textbooks. Florence paid $2600 for tuition and $680 for textbooks. George and Louise's itemized deductions total $24550. They paid George's mother $4150 to watch the boys after school. Compute the following for George and Louise Jefferson. If any item does not apply to them, enter zero as the amount: Credit Amount for Jeffersons American Opportunity Credit Child Tax Credit Child & Dep. CARE Credit Earned Income Credit Foreign Tax Credit Lifetime Learning Credit Other Dependent Credit Adjusted Gross Income Deductions from AGI Taxable income ncome Tax Vonrefundable Credits Balance after Nonrefundables Refundable Credits Payments Balance due (Refund)*** Include only the strictly nonrefundable portion of credits that are partly refundable. Include the full nonrefundable amounts that are vailable, even if the total exceeds the tax liability.