Answered step by step

Verified Expert Solution

Question

1 Approved Answer

George Corporation paid $240,000 for 45% of Washington Corporation's outstanding voting common stock on July 1, 2021. Washington's stockholders' equity on January 1, 2021

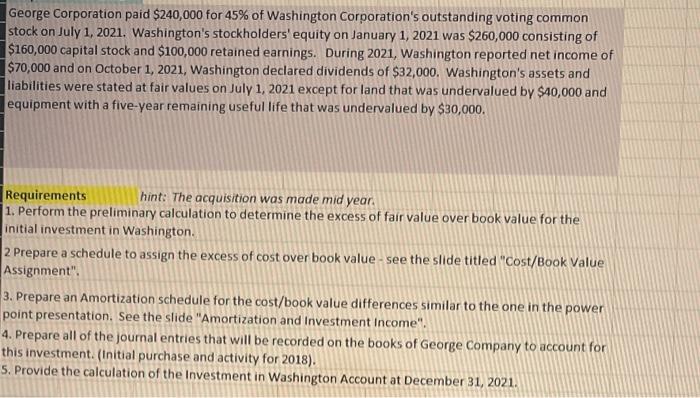

George Corporation paid $240,000 for 45% of Washington Corporation's outstanding voting common stock on July 1, 2021. Washington's stockholders' equity on January 1, 2021 was $260,000 consisting of $160,000 capital stock and $100,000 retained earnings. During 2021, Washington reported net income of $70,000 and on October 1, 2021, Washington declared dividends of $32,000. Washington's assets and liabilities were stated at fair values on July 1, 2021 except for land that was undervalued by $40,000 and equipment with a five-year remaining useful life that was undervalued by $30,000. Requirements hint: The acquisition was made mid year. 1. Perform the preliminary calculation to determine the excess of fair value over book value for the initial investment in Washington. 2 Prepare a schedule to assign the excess of cost over book value - see the slide titled "Cost/Book Value Assignment". 3. Prepare an Amortization schedule for the cost/book value differences similar to the one in the power point presentation. See the slide "Amortization and Investment Income". 4. Prepare all of the journal entries that will be recorded on the books of George Company to account for this investment. (Initial purchase and activity for 2018). 5. Provide the calculation of the Investment in Washington Account at December 31, 2021.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Excess of fair value over book value 240000 160000 100000 40000 2 Assignment of excess of cost ove...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started