Answered step by step

Verified Expert Solution

Question

1 Approved Answer

George is the owner of numerous classic automobiles. His intention is to hold the automobiles until they increase in value and then sell them.

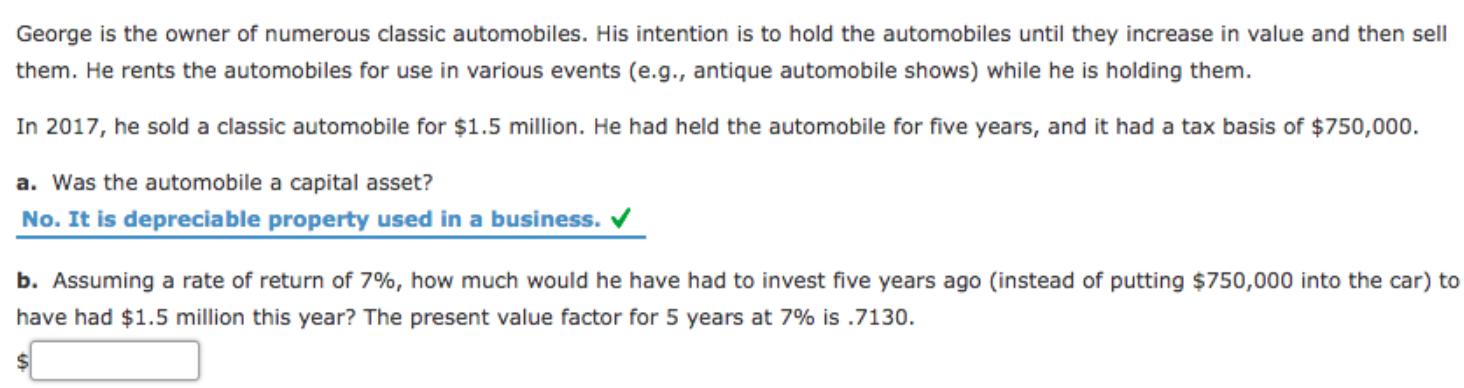

George is the owner of numerous classic automobiles. His intention is to hold the automobiles until they increase in value and then sell them. He rents the automobiles for use in various events (e.g., antique automobile shows) while he is holding them. In 2017, he sold a classic automobile for $1.5 million. He had held the automobile for five years, and it had a tax basis of $750,000. a. Was the automobile a capital asset? No. It is depreciable property used in a business. b. Assuming a rate of return of 7%, how much would he have had to invest five years ago (instead of putting $750,000 into the car) to have had $1.5 million this year? The present value factor for 5 years at 7% is .7130.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Capital assets Assets used for gains not used for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started