Answered step by step

Verified Expert Solution

Question

1 Approved Answer

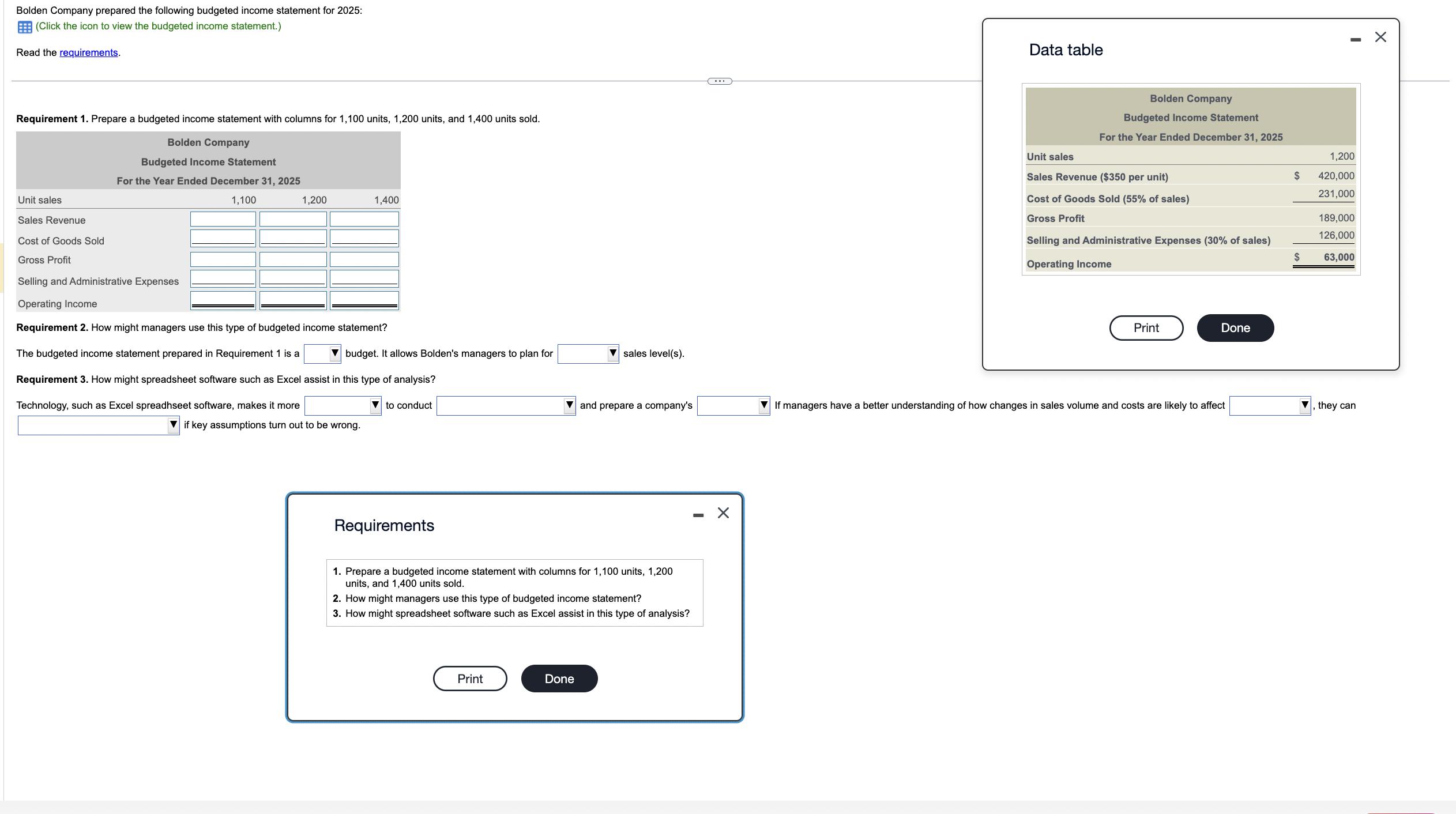

Bolden Company prepared the following budgeted income statement for 2025: (Click the icon to view the budgeted income statement.) Read the requirements. Requirement 1.

Bolden Company prepared the following budgeted income statement for 2025: (Click the icon to view the budgeted income statement.) Read the requirements. Requirement 1. Prepare a budgeted income statement with columns for 1,100 units, 1,200 units, and 1,400 units sold. Bolden Company Budgeted Income Statement For the Year Ended December 31, 2025 1,100 Unit sales Sales Revenue Cost of Goods Sold Gross Profit Selling and Administrative Expenses Operating Income Requirement 2. How might managers use this type of budgeted income statement? The budgeted income statement prepared in Requirement 1 is a budget. It allows Bolden's managers to plan for Requirement 3. How might spreadsheet software such as Excel assist in this type of analysis? Technology, such as Excel spreadhseet software, makes it more if key assumptions turn out to be wrong. 1,200 1,400 to conduct Requirements sales level(s). 1. Prepare a budgeted income statement with columns for 1,100 units, 1,200 units, and 1,400 units sold. Print and prepare a company's 2. How might managers use this type of budgeted income statement? 3. How might spreadsheet software such as Excel assist in this type of analysis? Done X Data table Bolden Company Budgeted Income Statement For the Year Ended December 31, 2025 Unit sales Sales Revenue ($350 per unit) Cost of Goods Sold (55% of sales) Gross Profit Selling and Administrative Expenses (30% of sales) Operating Income Print Done If managers have a better understanding of how changes in sales volume and costs are likely to affect $ $ 1,200 420,000 231,000 189,000 126,000 63,000 they can X

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Bolden Company Budgeted Income Statement For the year ended December 31 2025 Unit Sale...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started