Question

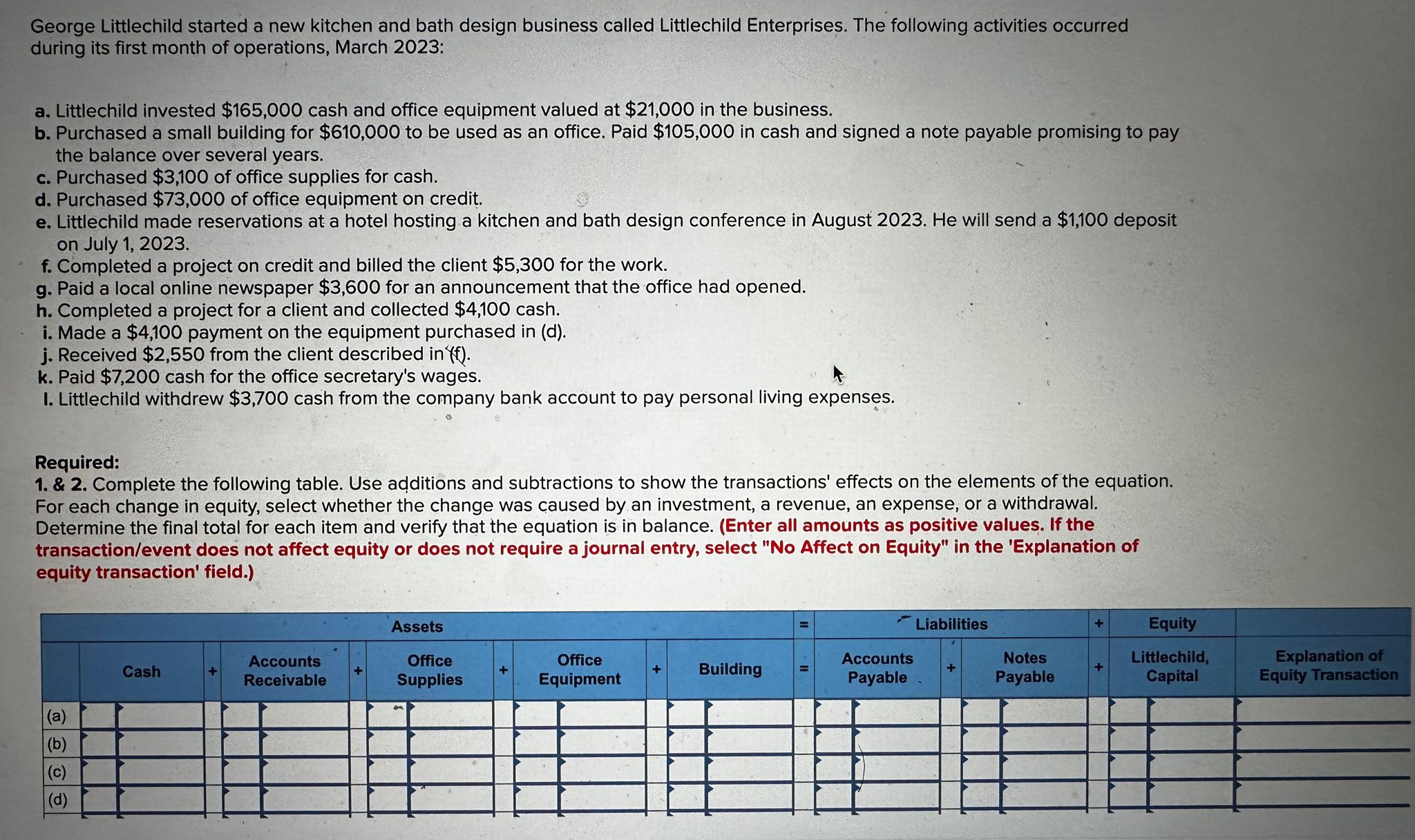

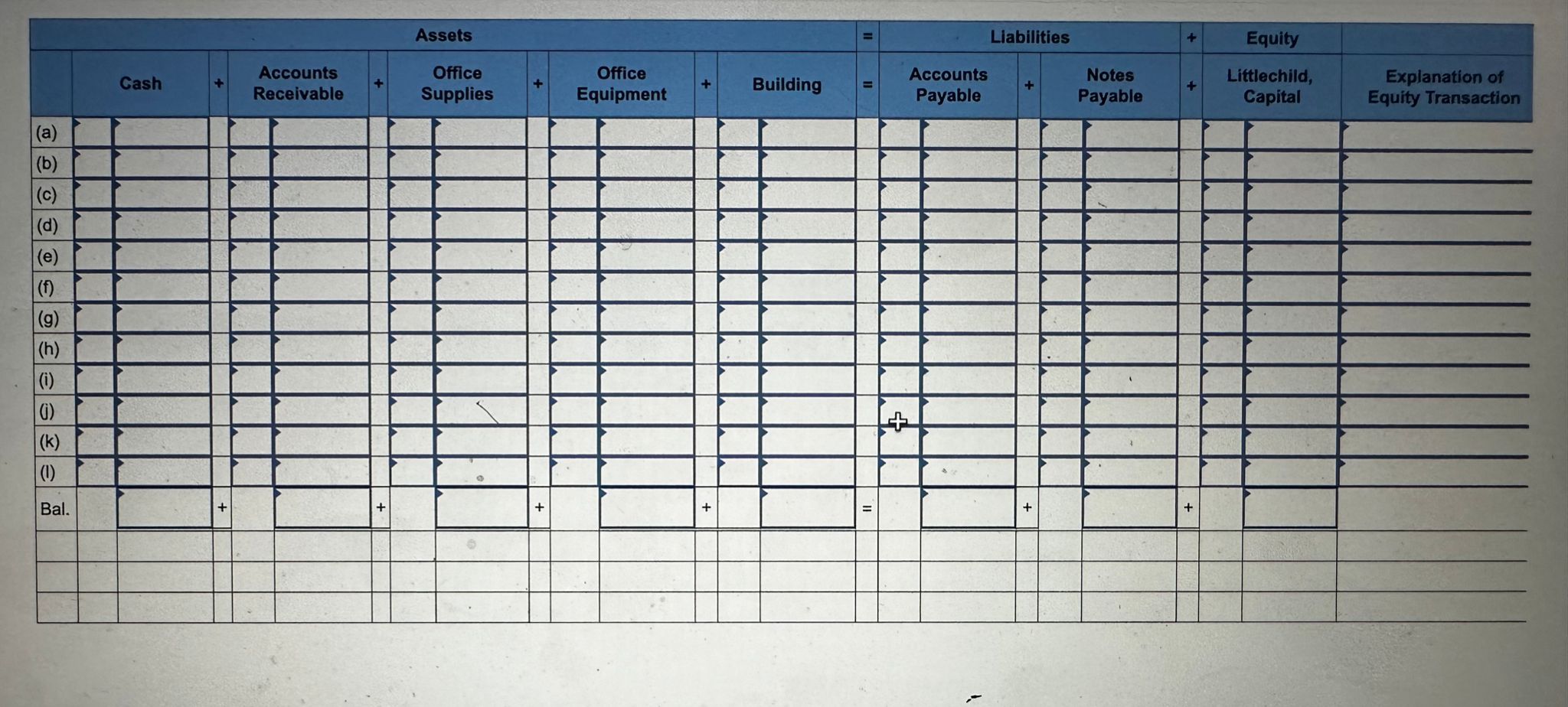

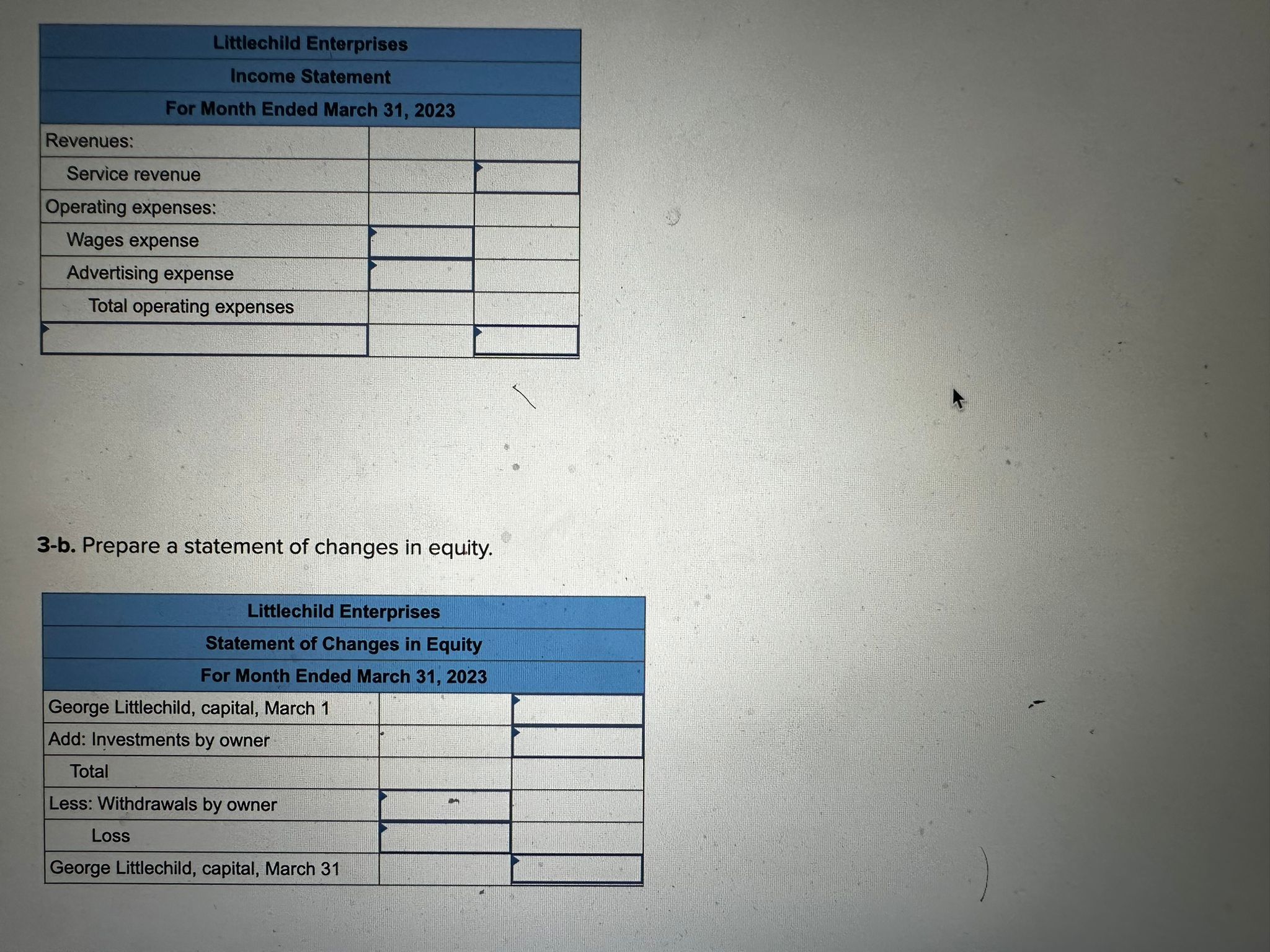

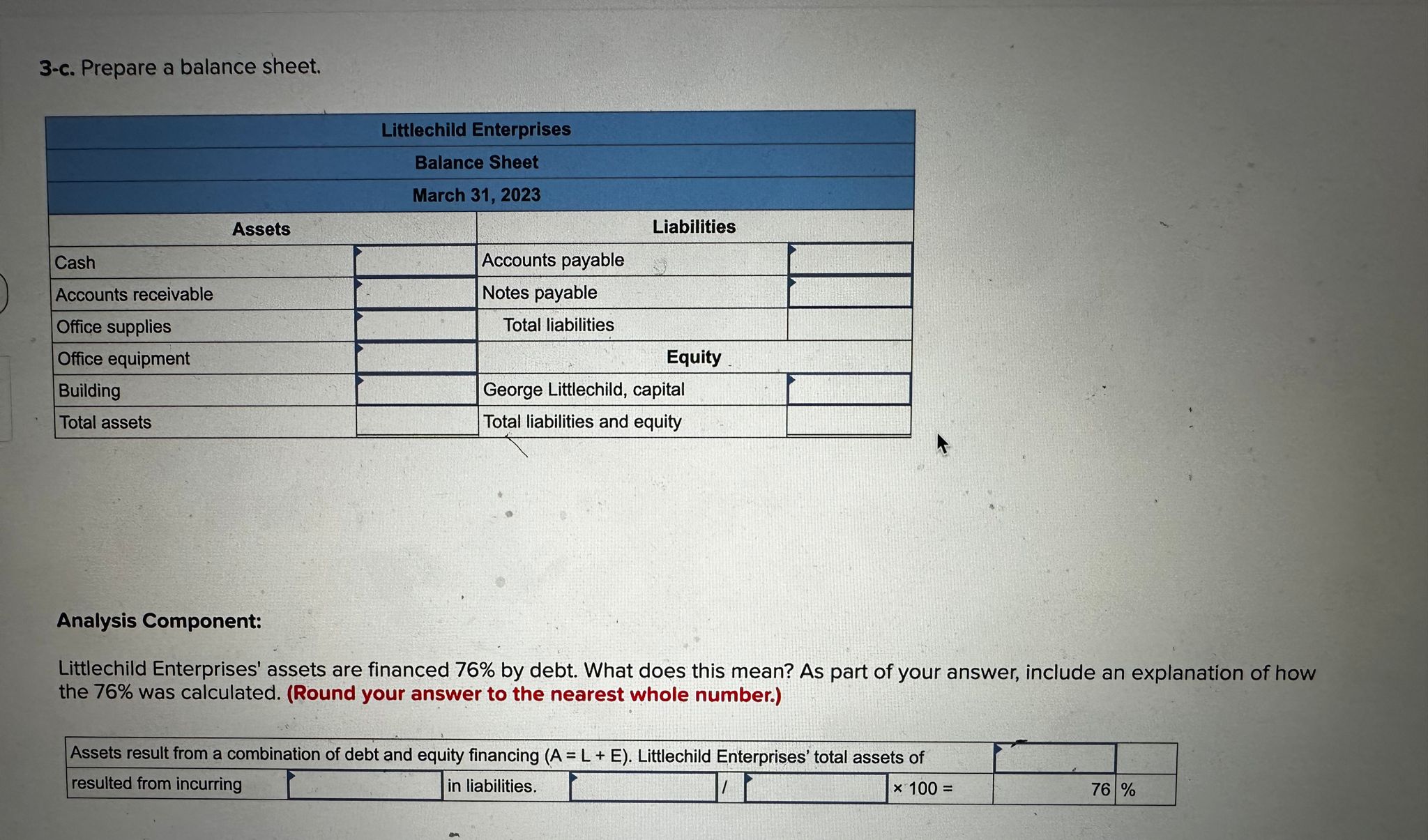

George Littlechild started a new kitchen and bath design business called Littlechild Enterprises. The following activities occurred during its first month of operations, March 2023:

George Littlechild started a new kitchen and bath design business called Littlechild Enterprises. The following activities occurred during its first month of operations, March 2023: Littlechild invested $165,000 cash and office equipment valued at $21,000 in the business. Purchased a small building for $610,000 to be used as an office. Paid $105,000 in cash and signed a note payable promising to pay the balance over several years. Purchased $3,100 of office supplies for cash. Purchased $73,000 of office equipment on credit. Littlechild made reservations at a hotel hosting a kitchen and bath design conference in August 2023. He will send a $1,100 deposit on July 1, 2023. Completed a project on credit and billed the client $5,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started