Question

George purchased 2 bonds, a 5-year 10% annual coupon Bond X and a 10-year 10% annual coupon Bond Y, both with a par value

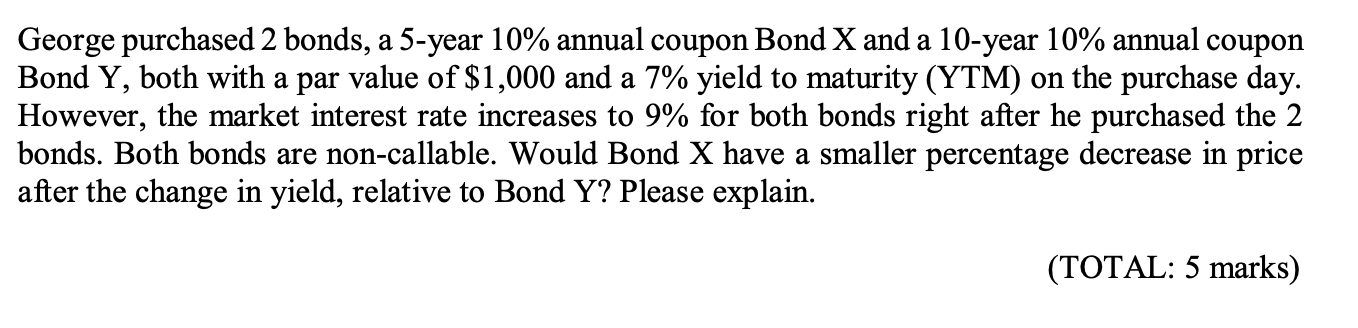

George purchased 2 bonds, a 5-year 10% annual coupon Bond X and a 10-year 10% annual coupon Bond Y, both with a par value of $1,000 and a 7% yield to maturity (YTM) on the purchase day. However, the market interest rate increases to 9% for both bonds right after he purchased the 2 bonds. Both bonds are non-callable. Would Bond X have a smaller percentage decrease in price after the change in yield, relative to Bond Y? Please explain. (TOTAL: 5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether Bond X would have a smaller percentage decrease in price relative to Bond Y aft...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Corporate Finance Value Creation With Currency Derivatives In Global Capital Markets

Authors: Laurent L. Jacque

2nd Edition

1119550467, 978-1119550464

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App