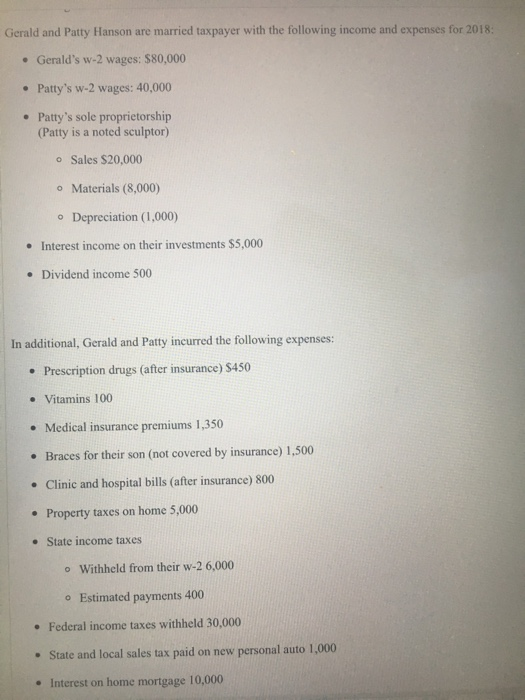

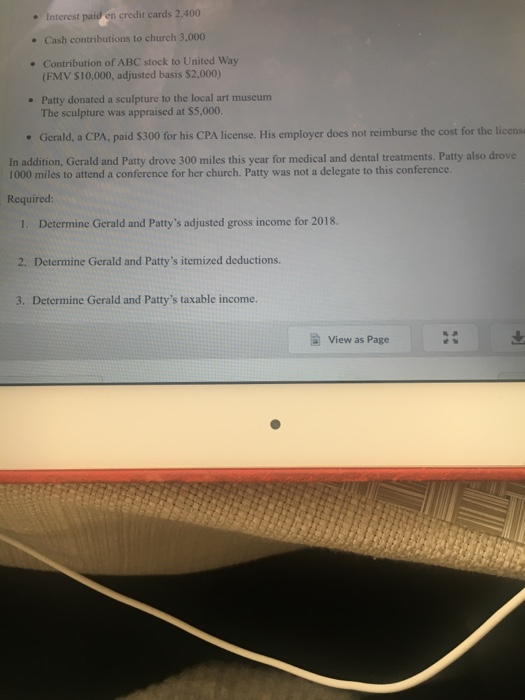

Gerald and Patty Hanson are married taxpayer with the following income and expenses for 2018: . Gerald's w-2 wages: $80,000 e Patty's w-2 wages: 40,000 Patty's sole proprietorship (Patty is a noted sculptor) o Sales $20,000 o Materials (8,000) o Depreciation (1,000) Interest income on their investments $5,000 . Dividend income 500 In additional, Gerald and Patty incurred the following expenses: . Prescription drugs (after insurance) $450 . Vitamins 100 . Medical insurance premiums 1,350 Braces for their son (not covered by insurance) 1,500 . Clinic and hospital bills (after insurance) 800 . Property taxes on home 5,000 State income taxes withheld from their w-2 6,000 o Estimated payments 400 Federal income taxes withheld 30,000 State and local sales tax paid on new personal auto 1,000 . . Interest on home mortgage 10,000 e Interest paid en credit cards 2,400 . Cash contributions to church 3,000 Contribution of ABC stock to United Way (FMV $10,000, adjusted basis $2,000) The sculpture was appraised at $5,000. Gerald, a CPA, paid $300 for his CPA license. His employer does not reimburse the cost for the licens . Patty donated a sculpture to the local art museum In addition, Gerald and Patty drove 300 miles this year for medical and dental treatments. Patty also drove 1000 miles to attend a conference for her church. Patty was not a delegate to this conference. Required: I. Determine Gerald and Patty's adjusted gross income for 2018. 2. Determine Gerald and Patty's itemized deductions. 3. Determine Gerald and Patty's taxable income. a View as Page Gerald and Patty Hanson are married taxpayer with the following income and expenses for 2018: . Gerald's w-2 wages: $80,000 e Patty's w-2 wages: 40,000 Patty's sole proprietorship (Patty is a noted sculptor) o Sales $20,000 o Materials (8,000) o Depreciation (1,000) Interest income on their investments $5,000 . Dividend income 500 In additional, Gerald and Patty incurred the following expenses: . Prescription drugs (after insurance) $450 . Vitamins 100 . Medical insurance premiums 1,350 Braces for their son (not covered by insurance) 1,500 . Clinic and hospital bills (after insurance) 800 . Property taxes on home 5,000 State income taxes withheld from their w-2 6,000 o Estimated payments 400 Federal income taxes withheld 30,000 State and local sales tax paid on new personal auto 1,000 . . Interest on home mortgage 10,000 e Interest paid en credit cards 2,400 . Cash contributions to church 3,000 Contribution of ABC stock to United Way (FMV $10,000, adjusted basis $2,000) The sculpture was appraised at $5,000. Gerald, a CPA, paid $300 for his CPA license. His employer does not reimburse the cost for the licens . Patty donated a sculpture to the local art museum In addition, Gerald and Patty drove 300 miles this year for medical and dental treatments. Patty also drove 1000 miles to attend a conference for her church. Patty was not a delegate to this conference. Required: I. Determine Gerald and Patty's adjusted gross income for 2018. 2. Determine Gerald and Patty's itemized deductions. 3. Determine Gerald and Patty's taxable income. a View as Page