Question

Geri Rae is the CEO of TRX Training, a company that currently owns two fitness studios. TRX Sky is the original TRX Training studio that

Geri Rae is the CEO of TRX Training, a company that currently owns two fitness studios. TRX Sky is the original TRX Training studio that started in year 2010. Just 2 years ago (in the beginning of 2018), TRX Training opened a brand new studio - TRX Absolute. Both studios offer a variety of fitness classes and personal training. There are 20 fitness instructors that work for TRX Training. 10 instructors permanently teach at each studio. Staff rotation, however, is possible. Carrie Baptiste is the business manager for TRX Sky, while Iduma Swenson is the business manager for TRX Absolute. Both studios are evaluated as investment centres. Part of Carrie and Iduma’s responsibilities (as investment centre managers) are supervising and evaluating the performance of the fitness instructors in their studios. Both business managers report directly to Geri.

Geri Rae is the CEO of TRX Training, a company that currently owns two fitness studios. TRX Sky is the original TRX Training studio that started in year 2010. Just 2 years ago (in the beginning of 2018), TRX Training opened a brand new studio - TRX Absolute. Both studios offer a variety of fitness classes and personal training. There are 20 fitness instructors that work for TRX Training. 10 instructors permanently teach at each studio. Staff rotation, however, is possible. Carrie Baptiste is the business manager for TRX Sky, while Iduma Swenson is the business manager for TRX Absolute. Both studios are evaluated as investment centres. Part of Carrie and Iduma’s responsibilities (as investment centre managers) are supervising and evaluating the performance of the fitness instructors in their studios. Both business managers report directly to Geri.

The initial investment cost for TRX Sky is $3,000,000 ten years ago. Carrie expected the useful life of this investment to be 15 years and projected annual after-tax cash flows of $525,000. The projected rate of return of slightly more than 15% is above TRX Training’s cost of capital. During the past 10 years, price level had risen (due to inflation), and the after-tax cash flows from TRX Sky have now increased to an annual level of $800,000.

TRX Absolute required similar investment as TRX Sky, but this investment was made just 2 years ago. Because of the increase in costs (due to inflation), Iduma had to make $4,500,000 investment in TRX Absolute. The expected life of this investment is 10 years, and the projected annual after-tax cash flows is $900,000. This investment also had a projected yield slightly in excess of 15%.

Geri’s evaluation system for the fitness instructors has been in place for 10 years (since TRX Sky first started). Currently, the instructors are awarded grades from one of four categories, where 4.0 is the highest grade. The instructors in TRX Sky are evaluated and graded by Carrie, while the instructors in TRX Absolute are evaluated and graded by Iduma. This is because the instructors in TRX Sky report directly to Carrie, and hence, Carrie is in the best position to evaluate and observe their performance. Similarly, this is the case for the instructors in TRX Absolute reporting to Iduma. Geri decides on a common bonus pool for the instructors based on TRX Training’s overall profitability for the period. The allocation of this bonus pool to the individual instructors is then decided based on the performance grading. Geri has noticed that grade inflation is becoming rampant as both Carrie and Iduma want the fitness instructors they supervise to be evaluated more favourably than the instructors in the other studio. As such, this grading system has become fairly ineffective. The result is that the bonus pool is divided fairly equally among the 20 fitness instructors.

Required:

(a) Geri evaluates the performance of TRX Sky and TRX Absolute using Return on Investment (ROI) as a performance measure. She calculates ROI as the rate at which average investment net book value generates net income. For 2019, which studio will she evaluate more favourably?

(b) Would Carrie and Iduma view Geri’s method of calculating ROI as a fair way to evaluate the studios’ performance? Why or why not? Can you suggest a better way to calculate the two studios’ ROI? Explain.

(c) What are the problems associated with the current fitness instructor evaluation scheme that Geri has been using?

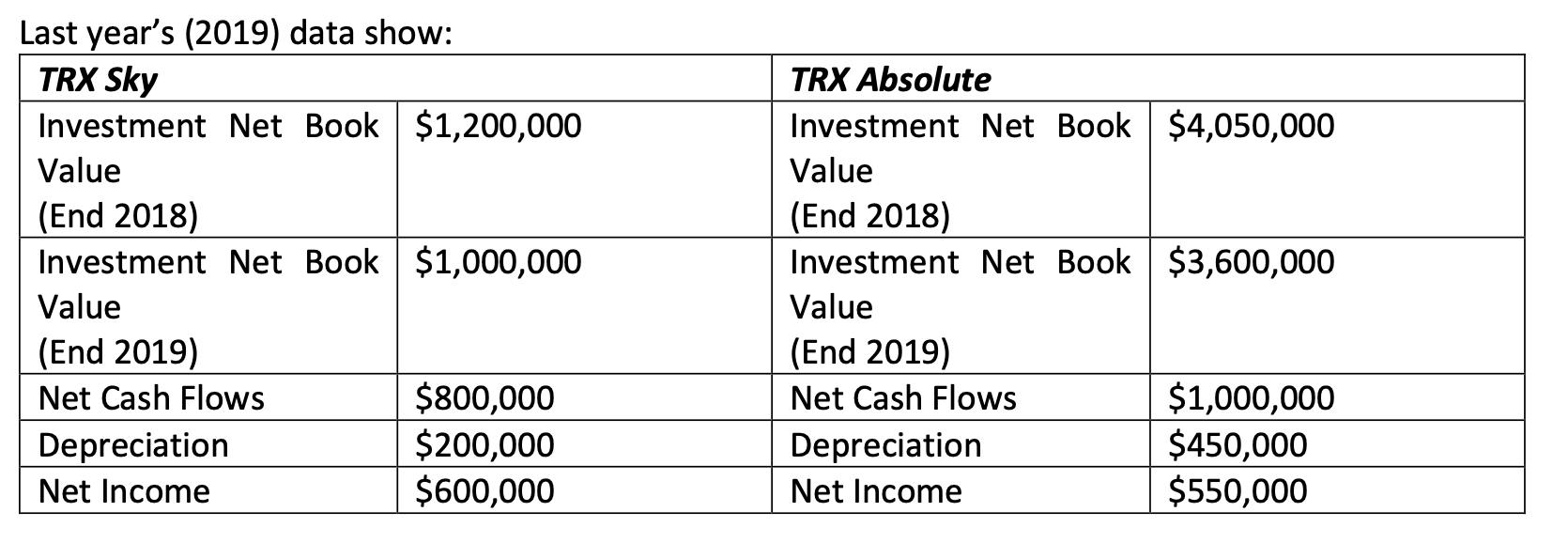

Last year's (2019) data show: TRX Sky Investment Net Book $1,200,000 Value (End 2018) Investment Net Book $1,000,000 Value (End 2019) Net Cash Flows Depreciation Net Income $800,000 $200,000 $600,000 TRX Absolute Investment Net Book $4,050,000 Value (End 2018) Investment Net Book $3,600,000 Value (End 2019) Net Cash Flows Depreciation Net Income $1,000,000 $450,000 $550,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER A The most common is net income divided by the total cost of the investment or ROI Net income Cost of investment x 100 ROI is calculated by sub...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started